Podcast Ep 122: Want a car with all the new bells and whistles? You may be waiting. We talk to Bank of Ireland head of Motor Stephen Healy about the industry’s ongoing supply challenges.

Last month (July) the Irish motor sector commenced the second peak for new car sales, a typical time of growth for the sector as keen buyers snap coveted ‘222’ numberplates.

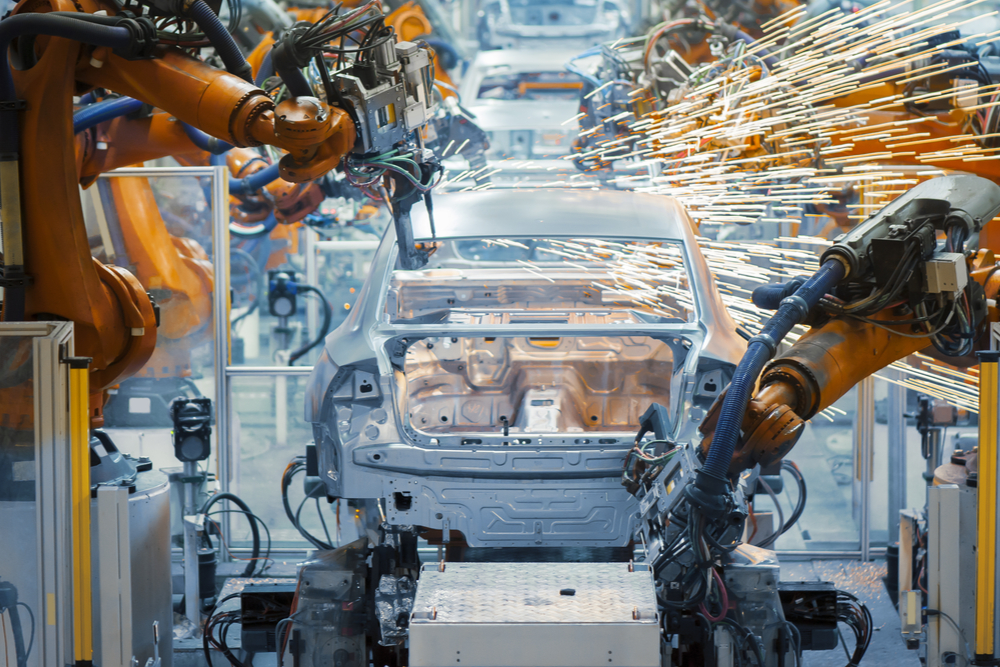

While most motorists will no doubt drive home their new pride and joy, the supply chain limitations caused by both Covid-19 and the war in Ukraine could mean some will be missing some state-of-the-art features. Perhaps a few sensors or those fancy folding wing mirrors.

“It is critically important that the Irish Government continues its BEV grants to support the transition”

Speaking to head of Motor Sector at Bank of Ireland Stephen Healy, pent up demand means motorists may overlook the lack of a few features in favour of a new pride and joy.

“Pent up demand carried over into 2022, but supply shortages have impacted the true market potential. This is due to global supply chain challenges and microchip shortages, this impacts manufacturing output.

“Deposit balances increased during Covid … those with the means are buying cars.”

According to the latest Motor Sector News from Healy, in the month of July new passenger car (PC) sales declined 17.3% year-on-year (y-o-y) to 21,902 units, Light Commercial Vehicle (LCV) sales declined 14.8% y-o-y to 4,039 units and used imports declined 21.3% y-o-y to 4,206 units. In the first seven months of 2022, new passenger car registrations declined 3.6% year on year to 87,075 units. Toyota holds the #1 position with 16.9% market share, followed by Hyundai with 13.3% in #2, Volkswagen with 10.2% in #3, Kia with 7.5% in #4 and Skoda with 7.2% in #5.

“It takes time to recover from a pandemic,” Healy said, pointing out that van sales will be well down on last year, possibly in the region of 25%. “The demand is there, the supply is not.”

Flat market for 2022

Supply problems he believes will persist well into H2 and the expectation now is a flat new car market in 2022.

“Despite the impact of the war in Ukraine, increased microchip supply is baked into H2 supply improvement, so that means improved supply for 2023, but lead times are still likely to be longer than the average. So now is the time to talk to your dealer about a new car for the New Year.”

The ongoing war in Ukraine will continue to disrupt supply chains, but even still the global automotive industry has extensive supply chains so will adapt and shift production globally.

Healy cited major wiring harness maker Leoni which has two plants in western Ukraine and is now back operating at pre-war capacity despite the ongoing risks.

But it is Russia where the supply issue will cut deepest because manufacturers have halted exports to Russia and production within the country in support of sanctions.

“The car market has crashed in Russia, the market is down 80% in April and May while prices are up 50%. 18 out of 20 plants have closed. Only two remain open, one Russian and the other Chinese. The Russians are now looking at restarting brands that are decades off the market, such as the Moskovich.”

But still the war bites into global supply. Russia is the world’s largest producer of palladium, a material critical to the manufacture of catalytic converters. Ukraine is a major producer of neon gas, which is used in the production of microchips.

“We are seeing rising input costs, including metals and other commodities which may lead to increased prices as we’ve seen with Tesla. We will see more onshoring of production back into Europe, leading to a reduction in globalisation. The disruption will continue but component shortages will improve next year, particularly if consumer electronic demand slows down. As the transition to electric cars gains pace, the sector will need even more supply of chips to power these cars.”

Notwithstanding the supply chain issues, the arrival of electric cars onto Ireland’s roads continues at a steady pace.

“Consumers are accelerating demand for electrically chargeable cars,” Healy said. “In 2022 20.6% of new cars will be electrically chargeable vehicles (ECVs), which compares favourably with 18.6% in the EU.”

According to Healy’s figures 13% of cars sold in Ireland were battery electric vehicles (BEVs) compared with the UK at 14% and the EU average of 10%. “Eastern European countries have the lowest adoption due to cost.”

Already there are 50,000 BEVs now on Irish roads, around 2% of the nation’s fleet.

“In fact, ECVs plus hybrid (non-plugged) represent 44% of all new cars sold in the first six months.”

But he says, there’s a long way to go before the Irish Government’s Climate Action Plan target of 845,000 cars by 2030 can be reached.

“Manufacturers are building more ECVs and petrol and diesel cars to strict EU emissions standards. The 2023 outlook is that ECV sales will be down slightly to less than 20% but will continue to grow again in 2023.”

As we navigate a changing inflationary environment Healy advised: “It is critically important that the Irish Government continues its BEV grants to support the transition.”