New car sales dipped in July as supply shortages continue to impact the sector, writes Stephen Healy, head of Motor Sector at Bank of Ireland.

“New car sales from August to December typically account for about 10% of the market”

July lookback

In the month of July, new passenger car (PC) sales declined 17.3% year-on-year (y-o-y) to 21,902 units, Light Commercial Vehicle (LCV) sales declined 14.8% y-o-y to 4,039 units and used imports declined 21.3% y-o-y to 4,206 units.

Passenger car registrations

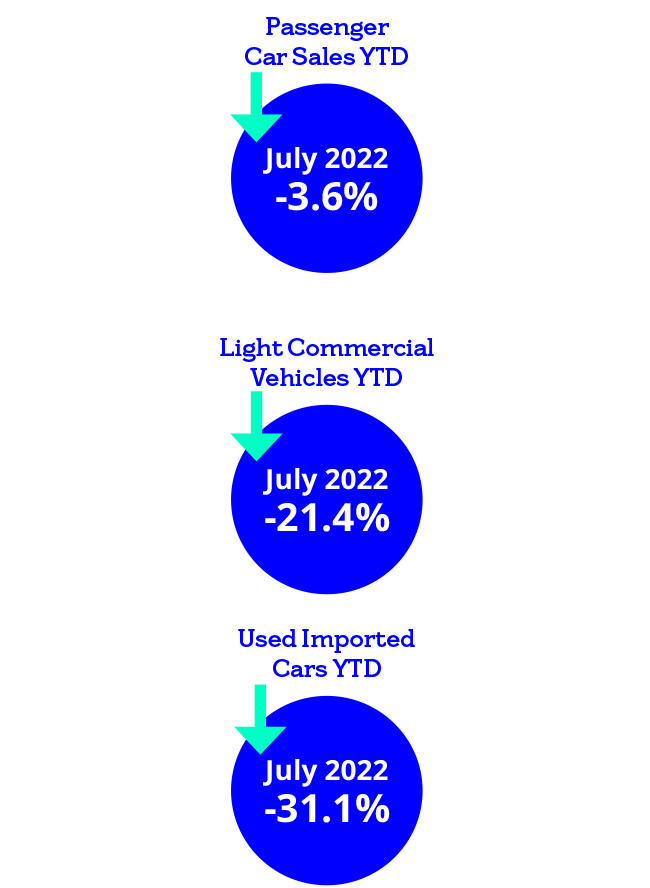

In the first seven months of 2022, new passenger car registrations declined 3.6% year on year to 87,075 units. Toyota holds the #1 position with 16.9% market share, followed by Hyundai with 13.3% in #2, Volkswagen with 10.2% in #3, Kia with 7.5% in #4 and Skoda with 7.2% in #5.

Light commercial vehicle registrations

In the first seven months of 2022, new light commercial vehicle registrations declined 21.4% year on year to 17,100 units. Ford holds the #1 position with 24.8% market share, followed by Volkswagen with 13.8% in #2, Toyota with 13.1% in #3, Opel with 10.7% in #4 and Peugeot with 7.8% in #5.

Used imports YTD

Registrations of used imports declined 31.1% year on year to 28,316 units in the first 7 months this year.

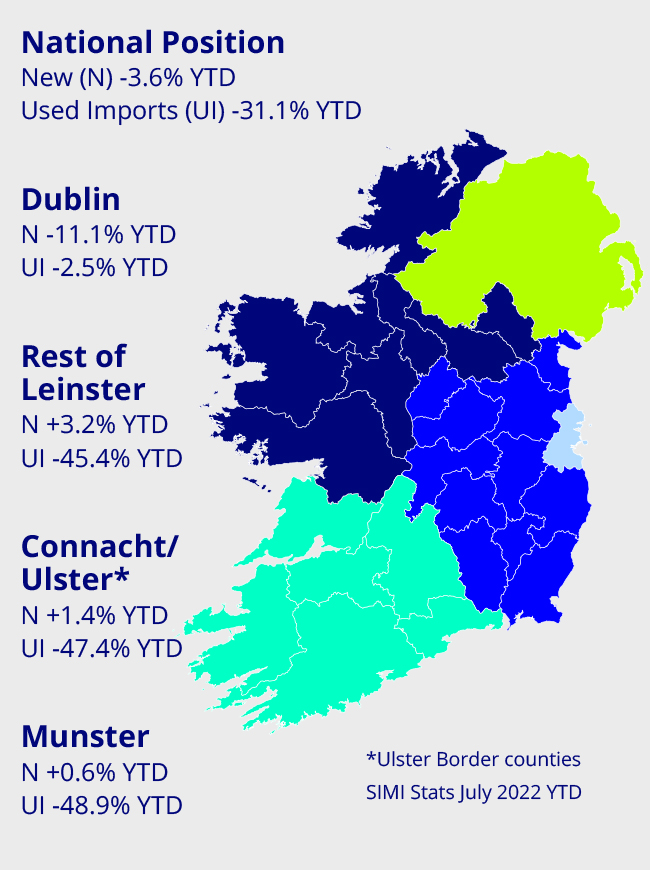

Provincial developments

Market news

Sales of new cars dipped again in July as supply shortages continue to burden the market.

New car sales increased by 2.1% in the first half however the dip in sales last month has led to new car sales declining by 3.6% in the first 7 months. Combined new car and van sales have declined 7.1% in the same period.

The decline in new car sales is heavily impacted by a decline in new car rental registrations which fell c. 49% this year to date. When car rentals are removed from total new car sales (predominantly registered in Dublin), new retail car sales actually increased 0.5% in the first 7 months.

New car sales from August to December typically account for about 10% of the market. In this period, motor dealers will focus on delivering their remaining 2022 orders, pre-selling vehicles for delivery in 2023, selling used cars and operating aftersales departments.

Although vehicle sales are down year on year, average selling prices have increased and motor dealers are achieving higher vehicle margins both for new and used cars. This has been a significant mitigant to lower volumes this year.

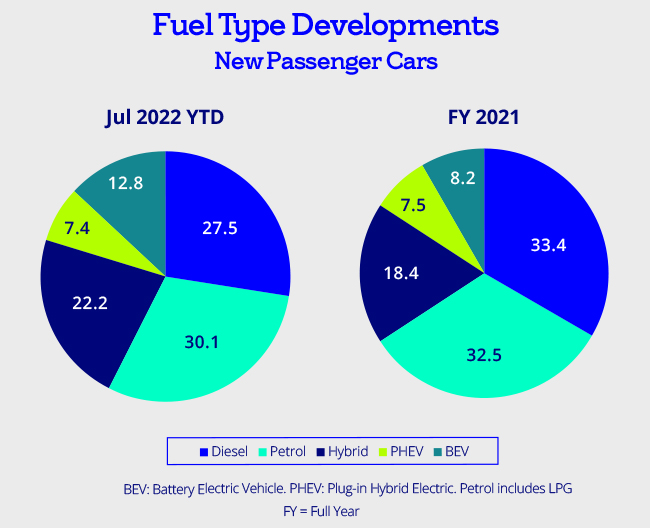

ZEVI Launch

The Zero Emission Vehicles Ireland office (ZEVI), part of the Department of Transport, launched in July. At the launch, they announced new initiatives and grants.

ZEVI will be led by Aoife O’Grady and we wish Aoife and her team success in supporting the uptake of zero emission vehicles and the development of charging infrastructure in Ireland.

Pulse surveys

Bank of Ireland’s Consumer and Business Pulse surveys note declining sentiment in July with inflationary concerns weighing on results. (click the link for more detail)

H2 Outlook

We will release our bi-annual Insights and Outlook report later this month. In it, we will cover the supply story, Ukraine impact, accelerating EV sales and more.