New car sales are ahead 3% this year to date, writes Stephen Healy, head of Motor Sector at Bank of Ireland.

May lookback

“The sector expects above average sales in H2 this year when the second sales peak commences in July with the “222” plate”

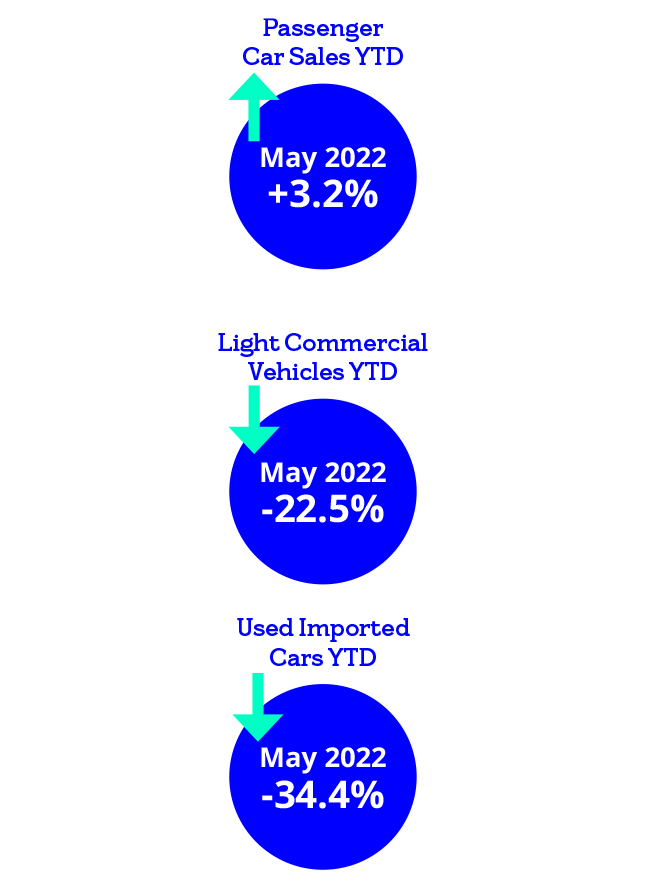

In the month of May, new passenger car (PC) sales declined 10.3% year-on-year (y-o-y) to 5,303 units, Light Commercial Vehicle (LCV) sales declined 37.4% y-o-y to 1,449 units and used imports declined 35.2% y-o-y to 3,905 units.

Passenger car Registrations

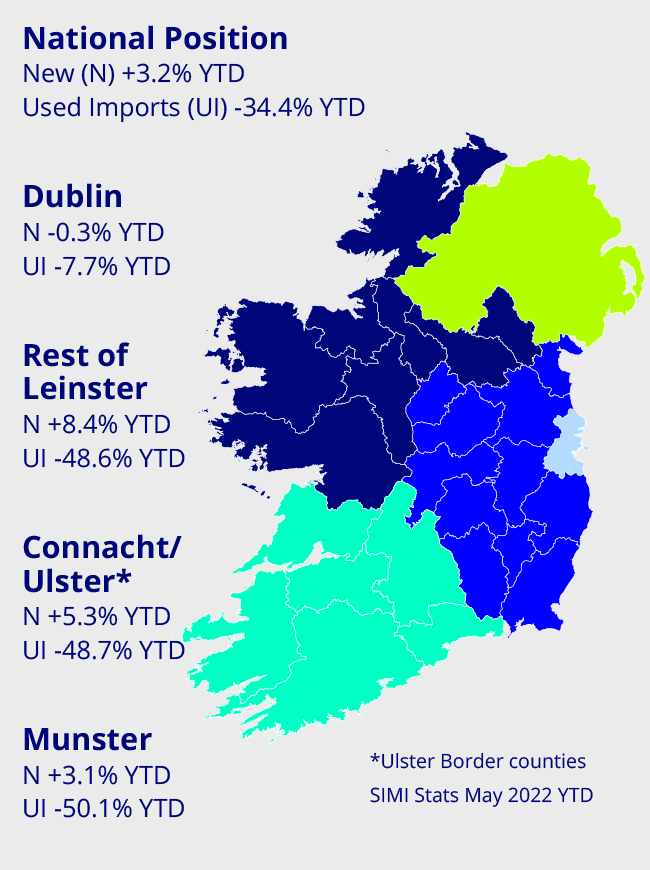

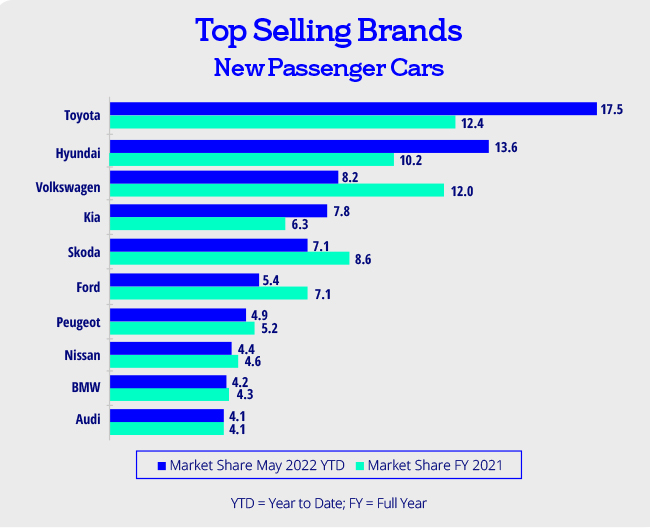

In the first five months, new passenger car registrations increased 3.2% year on year to 63,045 units. Toyota holds the #1 position with 17.5% market share, followed by Hyundai with 13.6% in #2, Volkswagen with 8.2% in #3, Kia with 7.8% in #4 and Skoda with 7.1% in #5.

Light commercial vehicle Registrations

In the first five months, new light commercial vehicle registrations declined 22.5% year on year to 12,431 units. Ford holds the #1 position with 27.4% market share, followed by Volkswagen with 14.2% in #2, Toyota with 11.6% in #3, Opel with 10.3% in #4 and Peugeot with 8.2% in #5.

Used Imports YTD

Registrations of used imports declined 34.4% year on year to 19,769 units in the first five months.

Market News

Microchip shortages and global supply chain issues continue to hamper recovery from the pandemic in the automotive sector.

In the first four months this year, sales of new cars in Europe are down 14.4% according to the European Automobile Manufacturers’ Association (ACEA).

Comparatively, sales in Ireland were ahead almost 5% in the same period.

The ACEA also reported that sales in the month of April this year were the weakest on record, with the exception of 2020 when the arrival of COVID closed down motor dealer sales operations across Europe.

New vehicle sales slipped back here in the month of May and we are likely to see monthly sales variances ebb and flow this year as inventories wane and supply gets replenished.

As previously reported, the sector expects above average sales in H2 this year when the second sales peak commences in July with the “222” plate.

Indeed, the new number plate may attract some consumers to change their car this summer.

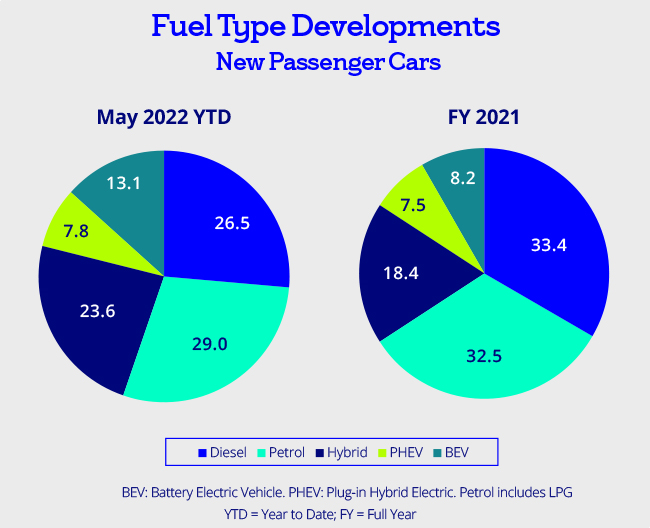

The ACEA recently released statistics for sales of new cars by engine type in Q1 2022. Battery electric vehicle (BEV) demand continues to rise across Europe.

Circa 13% of Irish consumers bought fully electric cars in the period. This puts Ireland ahead of the EU average of 10% however, we lag our nearest neighbour in the UK at 15%.

Norway continues to lead the transition to BEV’s. In quarter one this year, almost 83% of consumers who purchased a new car there opted for a fully electric vehicle.

Sweden is the next largest with a BEV share of c. 28%, followed by Denmark at c. 17%.

In terms of volume, Germany recorded the most BEV sales in Q1 with c. 84,000 sold (13% share) followed by France with c. 43,500 (12% share) and Sweden with c. 20,000 (28% share). In the same period in Ireland, almost 6,250 new BEVs were sold – more than double compared with Q1 2021.

Despite higher retail prices, demand for BEV’s is increasing. Higher prices at the pumps is likely to fuel even greater BEV demand with inflated fuel prices expected to continue for the foreseeable.

Government BEV supports are therefore vital to help bridge the price gap for Irish consumers. Supply shortages, however, will constrain growth potential for BEV sales this year.