It is likely we will see higher than average vehicle sales in July this year as more supply arrives to Irish shores, says head of Motor at Bank of Ireland Stephen Healy.

Sector update

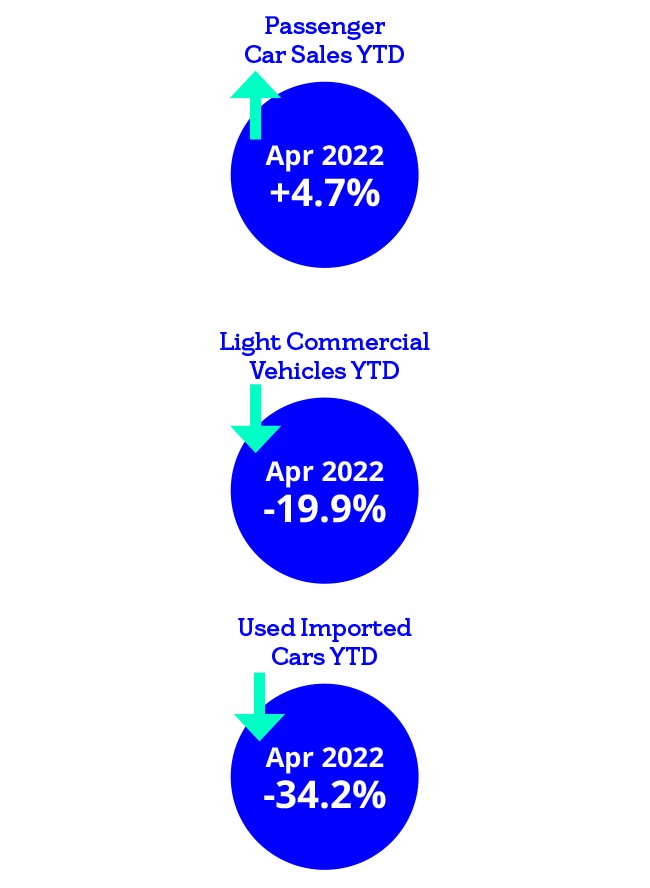

In the month of April, new passenger car (PC) sales increased 10.3% year-on-year (y-o-y) to 7,886 units, Light Commercial Vehicle (LCV) sales declined 31.8%y-o-y to 1,626 units and used imports declined 25.6% y-o-y to 4,223 units.

Passenger Car Registrations

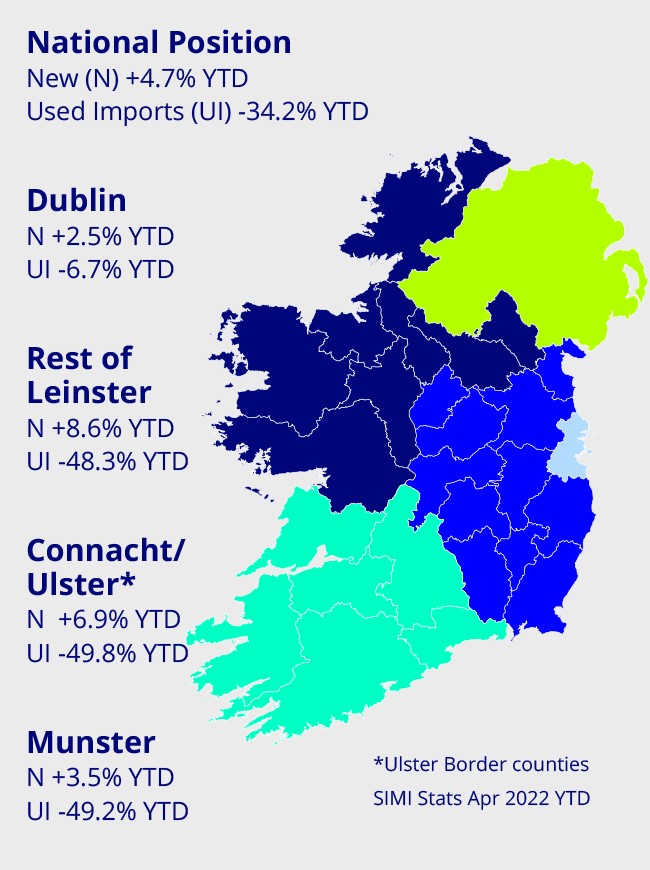

In the first four months, new passenger car registrations increased 4.7% year on year to 57,776 units.

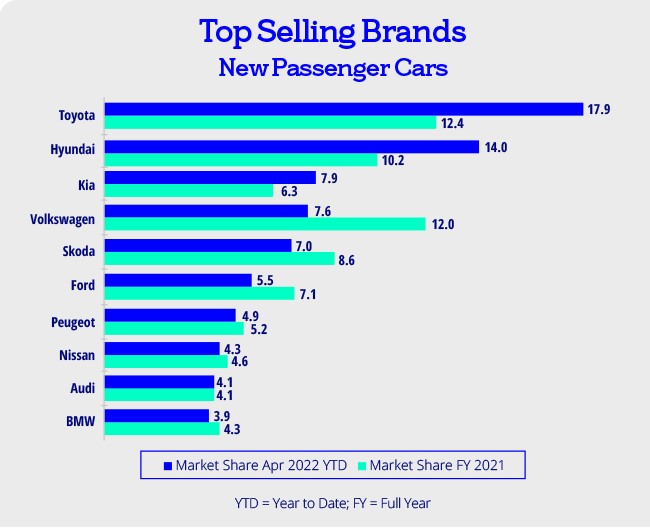

Toyota holds the #1 position with 17.9% market share, followed by Hyundai with 14.0% in #2, Kia with 7.9% in #3, Volkswagen with 7.6% in #4 and Skoda with 7.0% in #5.

Light Commercial Vehicle Registrations

In the first four months, new light commercial vehicle registrations declined 19.9% year on year to 10,992 units. Ford holds the #1 position with 28.2% market share, followed by Volkswagen with 14.7% in #2, Toyota with 11.1% in #3, Opel with 10.3% in #4 and Peugeot with 8.2% in #5.

Used Imports YTD

Registrations of used imports declined 34.2% year on year to 15,864 units in the first four months.

Market News

The European Automobile Manufacturers’ Association (ACEA) recently released sales statistics for new vehicles in quarter one.

Sales of new cars declined 12.3% across the EU in Q1 2022, however Ireland compared favourably increasing by 4.0% in the same period. New car sales in April also continued to be strong here.

The ACEA cite continuing supply constraints, largely due to semiconductor supply shortages, as holding back the EU market. Irish motor dealers are also impacted by supply shortages with some popular models “sold out” for 2022.

Market seasonalisation will be different this year as a result of these supply chain disruptions. In 2021, more new cars were sold in July than in January for the first time ever. Ireland exited 4.5 months of L5 restrictions in May 2021 and therewas clear pent up demand.

Bank of Ireland’s Business Pulse survey shows sentiment fell back in April but the index at 88.7 is still ahead of the January reading of 87.1. Nonetheless, 55% of firms surveyed indicated that they plan to expand their business over the next 1-3 years. Notably, the share of businesses planning to scale down has not increased.

The Consumer Pulse survey also fell in April and the index at 51.3 is now well down on the January reading of 74.1.

Cost of living increases is starting to bite households.

The war in Ukraine is likely generating additional uncertainty and has the potential to soften overall buying sentiment, however macro fundamentals remain robust.

The labour market is strong with c.2.5m people in employment. Deposit balances increased materially during the pandemic some of which will be released over the course of the year.

GDP forecasts are also very healthy.

Pent up demand carried over into 2022 and motor franchises and dealers here continue to report busy order books.

It is likely we will see higher than average vehicle sales in July this year as more supply arrives to Irish shores.

So, although there are challenges on the horizon the motor outlook for 2022 remains positive.