Bank of Ireland’s head of Motor Sector Stephen Healy looks back on 2021 sales figures and forecasts new car sales growth in 2022.

“The sector is predicting

growth in new car sales, potentially back to pre-pandemic levels,

to circa 120,000 new cars in 2022”

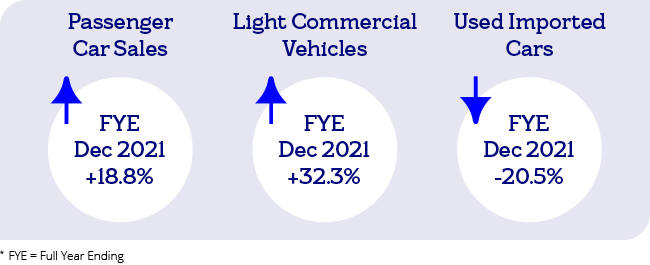

Highlights: FYE December 2021

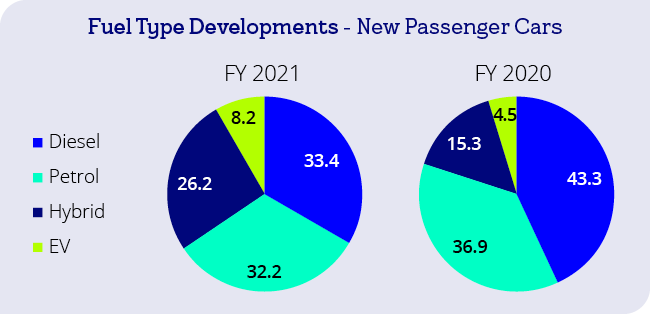

New Passenger Cars:

- In 2021, new passenger car registrations increased 18.8% year on year to 105k units. Compared to pre-pandemic levels, new car sales were 10.4% lower than sales in 2019 (117k units). When hire drive sales are excluded, new car sales were just 2% behind 2019.

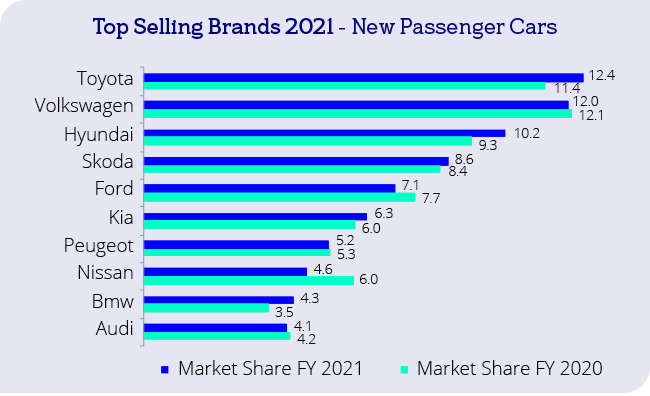

- Toyota took the #1 position with 12.4% market share, followed by Volkswagen with 12.0% in #2, Hyundai with 10.2% in #3, Skoda with 8.6% in #4 and Ford with 7.1% in #5.

Light Commercial Vehicles:

In 2021, light commercial vehicle registrations (LCV) increased by 32.3% year on year. Compared to pre-pandemic levels, new van sales were 13.4% higher when compared to 2019.

LCV sales peaked in 2016 at 28.2k units. In 2021, sales exceeded the peak year by c. 2% (28.7k units) and highlights strong demand for commercial vehicles throughout the pandemic.

Ford held the #1 position with 24.4% market share, followed by Renault with 12.7% in #2, Volkswagen with 11.4% in #3, Peugeot with 9.9% in #4 and Toyota with 7.6% in #5.

Used Car Imports:

- In 2021, used car imports declined 20.5% year on year to 63.6k units. Registrations of used imported cars declined 44% compared to peak levels in 2019 (114k units). This reflects the impact of Brexit, changes to VRT for used imports and tightened supply in the UK.

- Historically 95% of used imported cars were sourced from the UK, however the share imported from the UK fell to 74% in 2021.

- Used cars sourced from Japan has increased to c. 15% of total used car imports in 2021. The run rate has increased to c. 30% in the last 3 months of 2021 as dealers seek alternative sources for used vehicle supply.

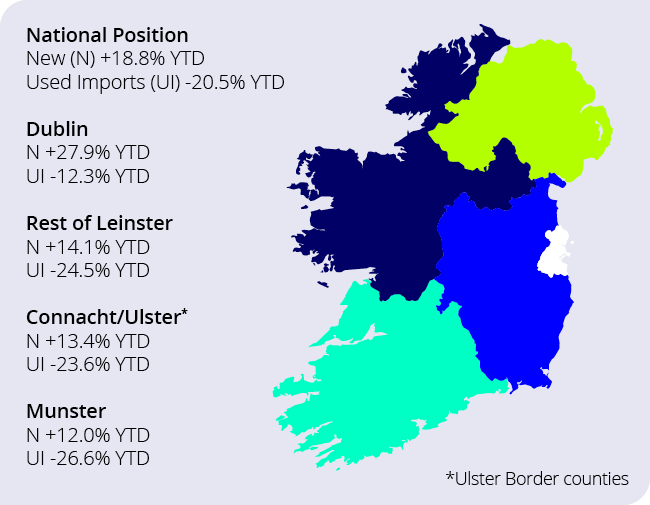

PROVINCIAL PICTURE

Outlook as we drive into 2022

The car market is expected to continue its recovery in 2022 as new and used vehicle demand remains strong. The sector is predicting growth in new car sales, potentially back to pre-pandemic levels, to circa 120,000 new cars in 2022.

Vehicle supply is likely to be a challenge in Q1 due to global production constraints, however new vehicle supply is predicted to improve from Q2 onwards. New car sales have a second peak in July each year, and improved supply in Q2 could bring about a stronger Q3 and second half than seen in recent years.

We will cover motor trends and outlook in more detail in our “Insights and Outlook” publication due for release in early February 2022.