Bank of Ireland’s head of Motor Stephen Healy looks back on how 2021 impacted the sector and looks at the trends for 2022.

In the month of November, new passenger car (PC) sales increased 23.9% year-on-year (y-o-y) to 1,131 units, Light Commercial Vehicle (LCV) sales declined 7.5% year-on-year to 767 units and used imports declined 48.6% y-o-y to 4,445 units.

PC Registrations YTD

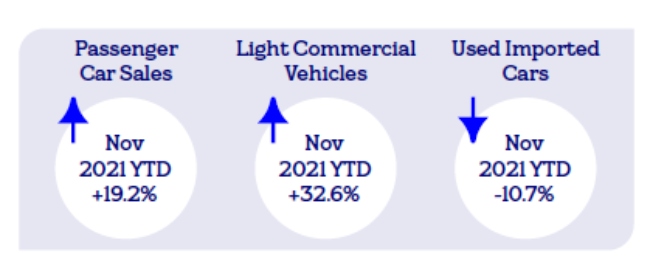

In the first 11 months, new passenger car registrations increased 19.2% y-o-y (to 104,563 units). Toyota holds the #1 position with 12.4% market share, followed by Volkswagen with 12.0% in #2, Hyundai with 10.3% in #3, Skoda with 8.6% in #4 and Ford with 7.1% in #5.

LCV Registrations YTD

In the first 11 months, new light commercial vehicle registrations increased 32.6% year on year (to 28,424 units). Ford holds the #1 position with 24.3% market share, followed by Renault with 12.8% in #2, Volkswagen with 11.5% in #3, Peugeot with 9.9% in #4 and Toyota with 7.6% in #5.

Used Imports

Registrations of used imports declined 10.7% year on year (to 59,982 units) in the first 11 months of 2021.

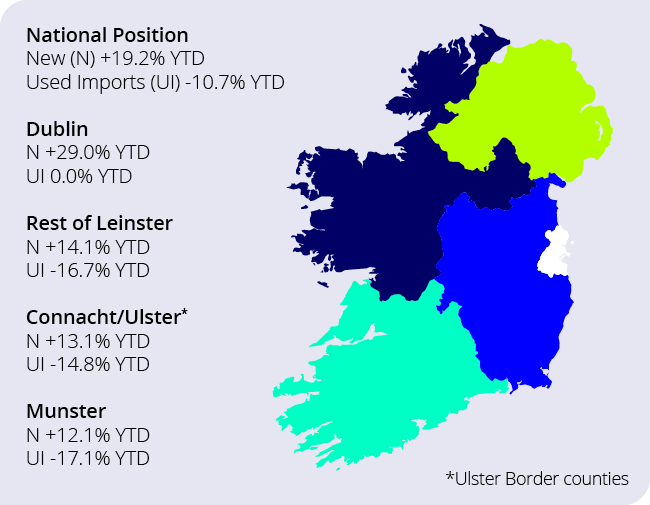

Provincial developments November 2021 YTD

2021 … looking back

As another year draws to a close and we issue our last newsletter of 2021, the motor sector has proved to be resilient to the challenges it has faced. Dealers tackled 4.5 months of Covid L5 restrictions, serving its customers brilliantly by fully operating vehicle aftersales facilities while dealing with vehicle sales customers remotely and delivering sold vehicles nationwide.

“We know supply chains have been damaged worldwide due to the impact of Covid, extreme weather events and the blockage of the Suez Canal. Add to this a devastating fire at a major supplier of semiconductor chips to the automotive sector and you have the perfect storm”

This was in the same year that saw the trading environment challenged by an overhaul of vehicle registration tax (VRT) effective from the 1st January 2021. The overhaul brought with it retail price increases for consumers, partially offset by a temporary reduction in VAT in place for the first two months of the year. Then there was Brexit.

Brexit reduced the inflow of privately imported used cars from the UK and used supply here has tightened. Used car supply here is also tight due to lower volumes of new car sales, particularly in 2020 and 2021, and less trade-ins generated (along with tax policy that limits market size). Used vehicle prices have increased notably in both the UK and Ireland this year.

We know supply chains have been damaged worldwide due to the impact of Covid, extreme weather events and the blockage of the Suez Canal. Add to this a devastating fire at a major supplier of semiconductor chips to the automotive sector and you have the perfect storm that continues to impact new vehicle supply.

Motor dealers have had no choice but to adapt to each of these challenges and have done so superbly, and delivered an increase of c. 22% in combined new car and van sales in the first 11 months of 2021.

2022 … looking forward

The government revised VRT again in Budget 2022 with changes that take effect from 1st January 2022. New cars in VRT bands 9-20 will incur higher VRT and consumers will ultimately foot the bill. VRT bands 1-8 will, however, be unchanged. More detail on this can be found in our October newsletter.

“The sector is predicting new car and van sales of c. 120-130k and 27-30k respectively in 2022”

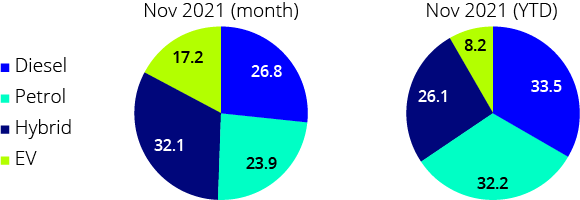

We welcome the extension of VRT relief for battery electric vehicles (BEV) in 2022. BEVs account for c. 8% of new car sales year to date and demand continues to rise. 2022 will bring greater levels of choice for consumers seeking to buy a new electric vehicle, alongside other new low emission vehicles, and we expect to see further growth in the BEV market next year.

We expect that the new car market will continue its recovery next year, back to pre-pandemic levels. New vehicle supply is likely to a challenge in Q1, however supply is predicted to improve from Q2 onwards. New car sales have a second peak in July each year, so improved supply in Q2 could bring about a stronger Q3 and second half than seen in recent years.

Fuel type developments: New passenger cars

Source: Society of the Motor Industry (SIMI), 30 November 2021

The sector is predicting new car and van sales of c. 120-130k and 27-30k respectively in 2022. We will examine market developments in more detail in our motor Insights and Outlook publication due out in February 2022.