Bank of Ireland head of Motor Sector Stephen Healy on how car sales sprung to life in March.

March look back

In the month of March, new passenger car (PC) sales increased 40.7% year-on-year (y-o-y) to 12,935 units, Light Commercial Vehicle (LCV) sales declined 32.2% y-o-y to 2,032 units and used imports declined 35.1% y-o-y to 3,793 units.

Passenger car registrations

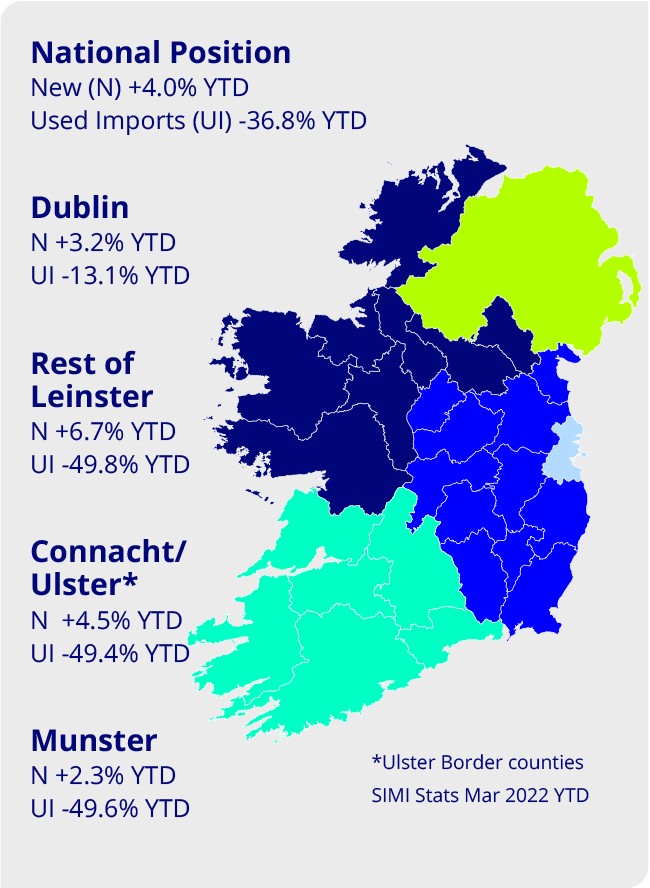

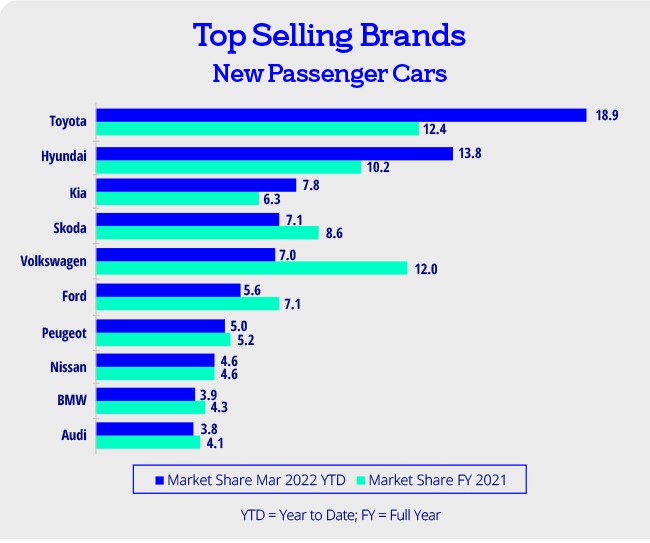

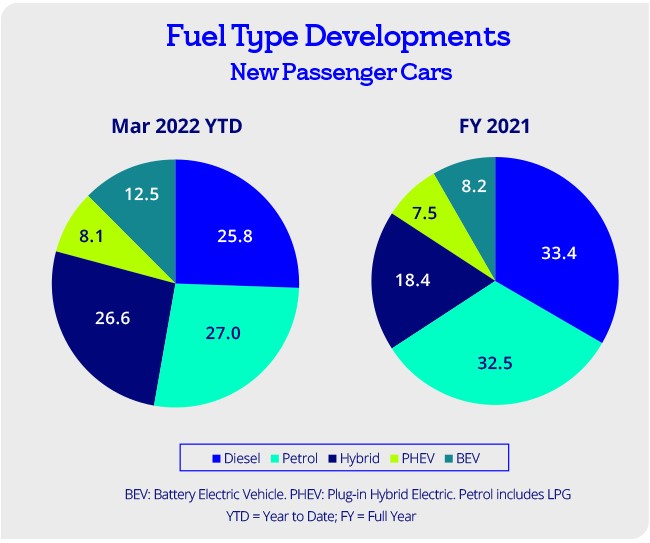

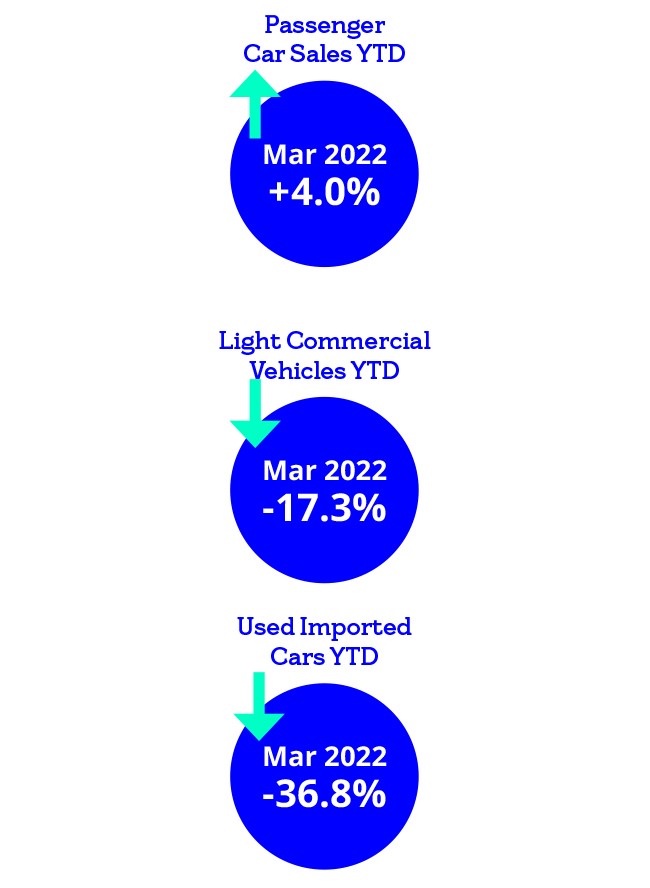

In the first quarter, new passenger car registrations increased 4.0% year on year to 49,928 units. Toyota holds the #1 position with 18.9% market share, followed by Hyundai with 13.8% in #2, Kia with 7.8% in #3, Skoda with 7.1% in #4 and Volkswagen with 7.0% in #5.

LCV registrations

In the first quarter, new light commercial vehicle registrations declined 17.3% year on year to 9,372 units. Ford holds the #1 position with 28.1% market share, followed by Volkswagen with 15.8% in #2, Toyota with 11.2% in #3, Opel with 10.5% in #4 and Citroen with 8.3% in #5.

Used imports YTD

Registrations of used imports declined 36.8% year on year to 11,641 units in the first quarter of 2022.

Market news

The war in Ukraine is principally a humanitarian disaster. Watching the crisis unfold is grim but I take pride in the phenomenal empathy of the Irish in support of the Ukrainian people.

The war impacts many sectors to varying degrees and the motor sector will not be immune to the crisis.

The sector has already experienced disruption with some manufacturers halting production lines temporarily.

Ukraine, for example, is a large supplier of wiring harnesses used in new vehicle production. Russia is the world’s biggest supplier of Palladium, used in catalytic converters, and aluminum prices have now surpassed 2008 record levels.

Automotive manufacturers have extensive and complex supply chains and can source parts from alternative suppliers, so parts supply impact is likely to be temporary. The delays that result, however, compounds vehicle inventories already at all-time lows.

In support of sanctions, many automotive manufacturers have halted exports to and/or production within Russia.

The production of semi-conductor chips are already in short supply to the sector and the war has the potential to impact the recovery in global chip supply. This is because Ukraine is a major supplier of chemicals and gas, particularly neon gas used in production of microchips. Some microchip producers however, e.g. Intel, have downplayed the impact stating that supply chains were diversified post the annexation of Crimea.

Disruption to vehicle production may lead to longer lead times for consumers here. In the mid-term, rising commodity and energy input costs could potentially lead to higher vehicle prices, depending on the length of the war. Notwithstanding these challenges, consumer demand here for new and used vehicles remains strong.