Bank of Ireland head of Motor Sector Stephen Healy looks back on a turbulent 2021 and predicts a return to growth in 2022.

“The sector is predicting growth in new car sales, potentially back to pre-pandemic levels, to circa 120,000 new cars in 2022”

Excerpt:

2021 in Review

- Level 5 Covid restrictions were in place for the first 4.5 months of 2021. Motor dealers continued to open for vehicle aftersales, an essential service, and consumers could visit dealers to have maintenance carried out.

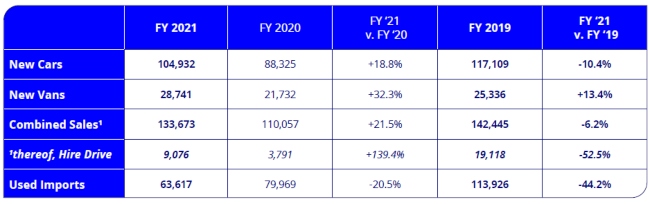

- For new and used vehicle sales, dealers engaged with customers remotely and operated a “click and deliver” service. By the end of H1 2021, combined sales of new cars and vans were ahead 27% compared to H1 2020 and 16% behind H1 2019. Considering the restrictions in place, this was a phenomenal performance by the Irish motor sector.

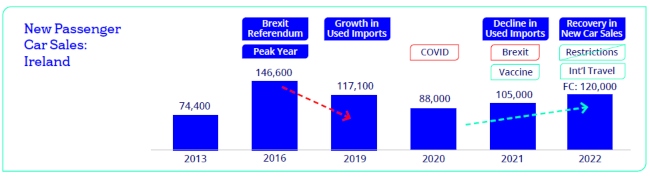

- Some consumers postponed taking delivery of new vehicles until restrictions were lifted and this led to a strong start to the second half. For the first time, registrations of new passenger cars in July exceeded registrations in January of the same year highlighting a release of pent up demand in the month. Encouragingly, new car registrations in the month of July were c. 7% higher than in July 2019 (pre-pandemic).

- International travel resumed in July and rental car companies began to increase their fleets again. Fleets for the hire drive market were substantially reduced during the pandemic as car rental operators sold cars in order to increase liquidity and maintain viability.

- In July, hire drive registrations represented c. 15% of new car sales in the month. This is line with historic trends as hire drive sales typically account for about 15% of annual new car sales.

- Overall, in 2021, the hire drive channel accounted for 7.6% of new car registrations (v. 3.3% in 2020).

- New vehicle supply issues, caused by global supply chain challenges, started to bite in the second half of the year.

- Nonetheless, by year end, new passenger car registrations increased almost 19% year on year to 105k units. Compared to pre-pandemic levels, new car sales were 10.4% lower than sales in 2019 (117k units). New car sales in the UK increased 1% but declined 2.4% in the EU with supply challenges particularly impacting the second half of 2021.

- Light commercial vehicle registrations (LCV) increased by 32.3% year on year to 28.7k units. New van sales were 13.4% higher when compared to 2019 and highlights strong demand.

Outlook for 2022

- The motor outlook remains optimistic and we continue to support this important sector. In 2021 new car retail sales were almost on a par with 2019 levels if we exclude the hire drive sales channel. Hire Drive companies are now actively replacing fleets and this will be supportive to the overall car market in 2022.

- Demand for electric vehicles continues to rise and ECV sales could be in excess of 20% of new car sales in 2022 subject to supply being available to meet consumer demand. New van sales continue to be strong, with high demand for delivery vehicles.

- New vehicle supply issues will likely impact volumes in Q1 2022, however global supply is expected to improve from Q2 onward.

- The Irish market experiences a second peak in July each year, and improved supply in Q2 could bring about a stronger Q3 than seen in recent years. Market seasonality is likely to differ this year as a result of these supply constraints. Nonetheless the sector is predicting growth in new car sales, potentially back to pre-pandemic levels, to circa 120,000 new cars in 2022.

To read full report:

Motor Sector 2021 Insights/Outlook 2022

View

Print

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

For support in challenging times, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple