In our latest Motor Sector update, Stephen Healy covers the changing landscape, accelerating demand for electric vehicles and ongoing supply challenges in 2023.

“In order to achieve electric vehicle targets set out in the latest Climate Action Plan, the new car market simply needs to grow”

The ‘Car Parc’

How many cars are now on our roads? Back in 1915 there were about 10,000 cars registered in Ireland. 100 years later, the CSO recorded 1.9m licenced cars in Ireland. By 2021, there were 2.2m passenger cars licenced for use. These 2.2m cars are referred to in the sector as the size of the “parc”. In addition, there are 385k commercial vehicles, 84k tractors, 47k motorcycles and 183k designated as ‘other’ on our roads, bringing the total vehicle parc to 2.9m units. 80% of cars in the parc are aged 4 years old and older and 63% are aged six years old and older. The average age of passenger cars on Irish roads is nine years and continues to age and this trend is mirrored in most countries across Europe. Full details can be found in the Irish Bulletin of Vehicle and Driver Statistics 2021 (annual publication) issued by the Department of Transport.

Electric vehicle demand accelerating

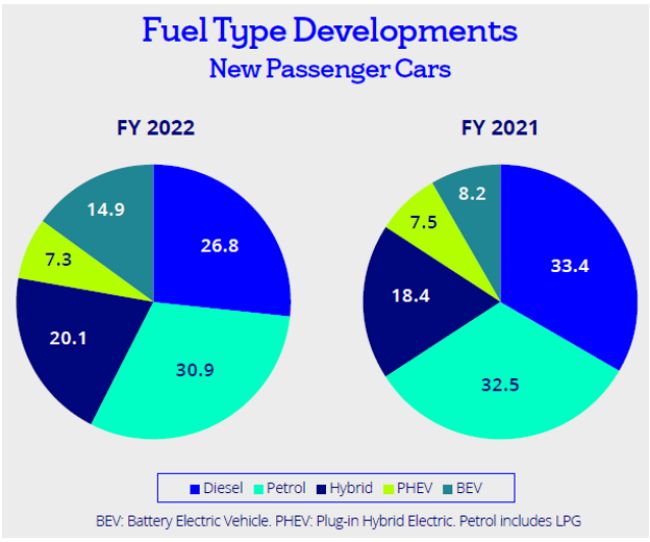

Much has changed in the sector since 1915 and the industry is now transitioning to electric vehicles. As recently as 2015, the combined share of electric vehicles and hybrids was less than 2% of new car sales in Ireland. The recent take up of electric vehicles has further accelerated with the combined share of electrically chargeable vehicles (ECV = BEV + PHEV i.e. those with a plug attached) representing 22% of new car sales in 2022. Combined sales of ECVs and Hybrids (no plug) now account for 42% of new cars registered annually. BEVs alone account for almost 15%. Subject to supply improving, the sector expects BEV sales to increase to 20% of new car sales in 2023. Current forecasts suggest BEV sales here will account for 35% of new car sales by 2025.

Diesel still popular

Declining from a peak of over 70% in 2014, diesel share of new car sales represented 27% of new cars sold in 2022. Comparably, new diesel cars represent <10% of new car sales in the UK in 2022. Ireland ranks highest in Europe in terms of diesel share of new cars sold as diesel continues to be a popular choice in rural areas. Consumer demand is evolving and transitioning continues gradually.

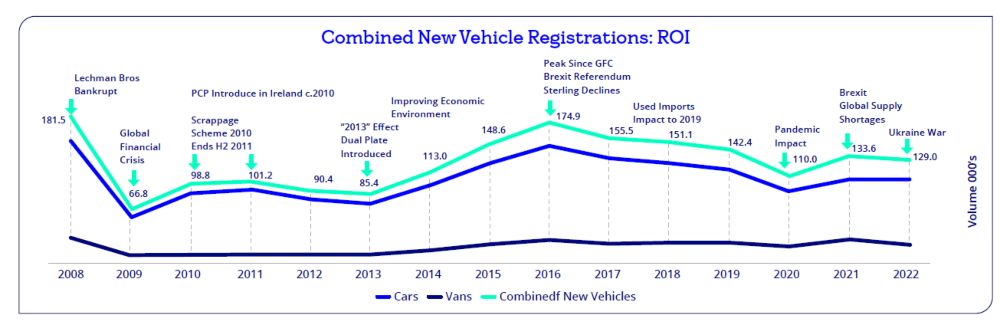

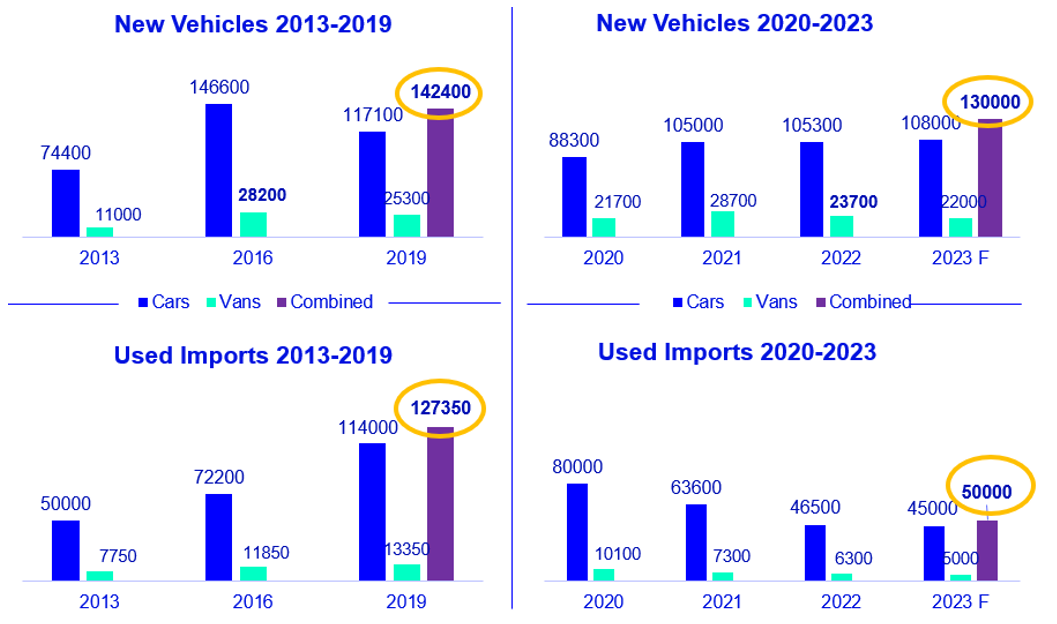

Market pre-pandemic

Post global financial crisis, the new passenger car market peaked in 2016 at 147k units (175k incl. new vans) following strong growth from a low base. New car sales contracted c. 20% from 2016 to 2019 following the Brexit referendum in 2016. Volumes of used imported vehicles increased materially during the same period, and peaked in 2019 at 114k units due to a weakened sterling and perceived value when importing from the UK. Prior to the Brexit referendum in 2016, imported used cars averaged c. 50k per annum (note: used imports returned to this level following Brexit in 2021). The effect of this increased the cost to change for consumers and thus dampened new car demand. Many dealers adapted to this environment by increasing purchases (and sales) of used cars to balance lost opportunity from the new car sales channel. Dealers have multiple income channels including that from new and used vehicles, aftersales service and parts, “F&I” commission, bodyshop repairs and, in some cases, testing centres (mainly heavy commercial test centres).

Market post-pandemic

2021: Vehicle supply issues, caused by global supply chain challenges for new vehicles and Brexit for used vehicles, started to bite in 2021. By year end, new passenger car registrations increased almost 19% year on year to 105k units despite pandemic restrictions in the first 4.5 months of the year. Compared to pre-pandemic levels, new car sales were circa 10% lower than the 117k units sold in 2019. Light commercial vehicle registrations (LCV) increased by circa 32% year on year to just under 29k units. There were more new vans sold in 2021 than in the peak year of 2016 and highlights strong demand for commercial vehicles throughout the pandemic. Used imported vehicles fell materially in 2021 due to Brexit and some dealers increased stocks in Q4 2020 in anticipation of market disruption. Used car values began to rise and motor dealers recorded higher vehicle margins for both new and used vehicles. This fed through to dealers posting record financial results per 2021 audited accounts.

2022: Pent up demand carried over into 2022, however, supply shortages impacted the true market potential. This is due to continued global supply chain challenges and microchip shortages in the sector, impacting manufacturing output. New car sales were more or less flat and increased 0.3% year on year, but compares favourably to a decline of 2% in the UK and a decline of 4.6% overall in the EU. It is worth noting that December 2022 marked the fifth consecutive month of growth in the EU as improved supply became available. Back in Ireland, new car rental registrations contacted by 40%, as vehicle distributors favoured supplying the more profitable retail sales channel during supply shortages.

If we exclude new car rental registrations, retail new car sales increased 4% in 2022. LCV sales declined 17.7% however, this again was due to severe supply shortages across Europe. Vehicle distributors in Ireland report strong unfulfilled order banks that will spill over into 2023.

Car rental sales accounted for circa 5% of new car registrations 2022 (v. 15% historic average). The supply shortage has led to increased car rental prices in Ireland, and across Europe, a trend widely covered in the media. Car rental companies here have experienced a material improvement in both revenue and profitability since H2 2021 following a difficult period during the pandemic. They are finding it challenging, however, to replace short term rental fleets and there is pent up demand in this segment that will be satisfied when new vehicle supply improves.

Growth needed

The Irish government published the Climate Bill and refreshed the Climate Action Plan (CAP) in Q4 2021. In the latest CAP, the 2030 target for electric cars was increased to 845,000 (+5k). Additionally, a target of 95,000 has been set for electric vans. There are c. 50,000 electric vehicles on our roads today from a total of 2.2m passenger cars – we have quite a way to travel yet.

In order to achieve electric vehicle targets set out in the latest CAP, the new car market simply needs to grow. The state can support the transition by continuing grants and incentives to accelerate BEV sales. This helps bridge the price gap until prices of BEV’s align with the internal combustion engine (ICE). Government supports are vital to support the continued growth of electric vehicles in Ireland.

Used vehicles

Used cars are also in short supply due to lower new car sales in 2020 and 2021, increased vehicle registration tax (VRT) – which impacts affordability and demand – and reduced volumes of used imports due to Brexit. Residual values strengthened again in 2022 however, motor dealers now report values have levelled off.

95% of used imported cars were sourced from the UK pre-Brexit. Dealers continue to import used vehicles where value is present, however rising residual values in the UK and tighter supply there have significantly impacted volumes imported to Ireland.

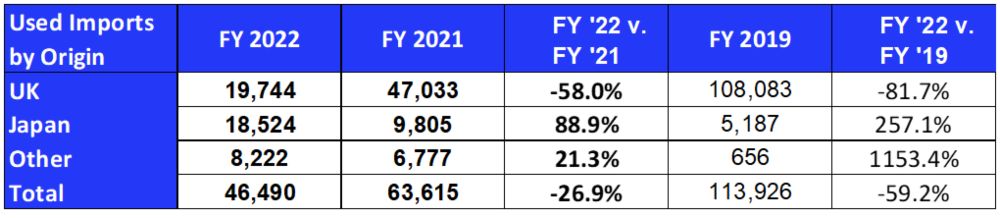

In 2022, used car imports declined by circa 27% year on year compounding a shortage of used cars in the market. The volume of used cars imported from the UK declined 58% last year (-82% from peak year) representing just 43% of overall used imports. Dealers sought alternative sources to maintain supply and imports from Japan have increased notably. The share of Japanese used imports has increased to circa 40% of used car imports in 2022 and higher demand is likely in 2023.

2023 outlook

We remain cautiously optimistic with regard to our outlook for this important sector in Ireland. In 2021 new car retail sales were almost on a par with 2019 levels if we exclude the hire drive sales channel. Constrained new car and van supply impacted the true market potential in 2022. The new car market was more or less flat in 2022 and finished about 90% of 2019 pre-pandemic levels. New van sales in 2022 came in at roughly 93% of 2019 pre-pandemic levels (albeit -18% v. 2021). This was caused by supply side constraints rather than weak demand.

New and used shortages will continue in 2023, however, new vehicle supply is expected to improve in the second half of the year (for the 2024 market). It is likely that the impact of supply shortages will vary by brand this year as was seen in 2022.

Interest rates are on the rise, however vehicle distributors here subvent interest rates to make new vehicles attractive to consumers. We also operate in an inflationary environment and the uncertainty it brings. Savings remain at an all-time high and we have almost full employment in Ireland. Demand for electric vehicles continues to grow. As stated in our last Insight & Outlook report, it’s important to remember those positive nuggets. Looking forward, despite the well reported challenges, motor dealers here report strong order banks built for the important January market.

The story of strong forward orders are supported by an improvement in sentiment per Bank of Ireland’s Consumer and Business Pulse surveys. The overall reading in December marked a second consecutive gain. The consumer index in December recorded the best reading since May 2022.

The Society of the Irish Motor Industry (SIMI) expects a new car and new van market of 108k and 22k respectively in 2023, more or less in line with 2022 volumes.

Supporting customers

The sector is transitioning to low emission and electric vehicles over the course of the next decade and we fully support our partners as the sector continues its transition. Bank of Ireland Finance (BIF) is partnered with 21 motor franchises and these franchises represent c. 45% of annual new vehicle sales.

We note increased activity in motor dealer acquisitions in 2022. Consolidation of single operators into larger dealer groups is likely to continue and may accelerate in 2023. Refinance opportunities will present themselves from time to time and we welcome the opportunity to discuss these needs with both current and new customers.

Sources:

- Society of the Irish Motor Industry (SIMI),

- Society of Motor Manufacturers and Traders (SMMT)

- Central Statistics Office (CSO)

- Climate Action Plan 2021

Main image at top: Photo by Hyundai Motor Group on Unsplash

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

For support in challenging times, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple