The Irish Grocery/Convenience sector continues to perform strongly, says Owen Clifford, head of Retail Sector at Bank of Ireland. Retailers navigating a turbulent economic environment linked to inflation, energy costs and fluctuating consumer sentiment.

“Significant revamp programmes will continue to be rolled out in 2023 nationwide by leading grocery operators as the ever more discerning consumer seeks excellence in store standards”

Retail Convenience 2022 review

Summary

- Robust performance: Robust performance delivered by the sector in 2022. Shopping behaviour and frequency patterns returned to more normalised trends with sales continuing to surpass pre-pandemic levels.

- Energy costs: Revamp/refurbishment activity focused on energy efficiency/reducing carbon footprint accelerated in 2022 driven by rising energy costs. Bank of Ireland continues to actively engage and support grocery retailers with their investment plans.

- Consolidation: Increased consolidation has become a feature of the market with larger grocery/fuel operators expanding their store network and diversifying their sales mix.

2022 key trends

- Strong growth in take-home grocery sales continued. Inflation levels across the sector hit unprecedented levels (14.7%) linked to post Covid-19 supply and Ukraine war issues

- Dunnes continues to hold the number 1 position in respect of grocery market share driven by a particularly strong performance in the wider Dublin region. Supervalu and Tesco have maintained strong market share with Tesco benefiting from increased frequency of consumer engagement – not just being used for the “big shop” in 2022. Aldi and Lidl continue to solidify their strong foothold in the Irish market.

- The large supermarket operators have been proactive in addressing cost of living concerns with targeted ad campaigns and voucher offers being strongly promoted. An expanded own-brand offering has also resonated with consumers with c10% growth delivered across unbranded lines in November/December.

- Margin growth and preservation have become an imperative for retailers linked to an increased cost framework driven by personnel, insurance and energy overheads.

- A strong pipeline of store purchase and associated revamp activity has been generated in 2022. Progressive retailers continue to recognise that in-store investment is necessary to maintain customer engagement and loyalty. Rising energy costs have accelerated the focus on energy efficient systems/equipment installation and upgrade.

Sector Developments – Key Numbers

- €25m: Investment from Musgrave in their sustainable stores strategy

- 9: Number of Joyce group stores re-branded to Tesco.

- €52m: The value of in-store contactless payments transacted per day – representing the highest level since data series commenced in 2016 Contactless compatibility now key for retail community.

- 5: Number of Applegreen trial stores stocking M&S products in a new partnership launched in 2022

Key Activity in the Sector in 2022

- Whilst shopping patterns reverted to more normalised frequency trends in 2022 – the impact of an extended period of grocery inflation (and associated cost of living) on consumer behaviour will be monitored closely in Q1 2023.

- Retailers are continuing to implement pragmatic succession planning structures to ensure that appropriate long-term value is delivered from their business. COVID-19 has been a catalyst for some retailers to investigate future options in respect of both ownership and operational models.

Sector Developments: Investment & Economic

- Supervalu, Lidl, Aldi, Tesco and Dunnes all announced new store openings/significant store revamps in 2022 across all regions supporting job creation and the wider Irish business eco-system.

- The increased cost and regulatory burden presented by the proposed living wage structure, pension auto-enrolment, spiraling energy overheads and insurance in a competitive environment has led to an up weighted focus on margin development/preservation from retailers, wholesalers and their advisors

- Consolidation and cross-sectoral partnerships remains a feature of the wider Irish grocery/convenience/forecourt market. Tesco integrating nine Joyce group stores within their network, Musgrave purchasing Italicatessen, McCambridges and the Caulfield-McCarthy group and Applegreen partnering exclusively with Marks & Spencers across five trial forecourt outlets just a flavour of the transaction activity witnessed in 2022.

- The de-carbonisation of end to end operations remains a key focus for leading operators linked to supplier, Government and consumer expectations/requirements. Multi-million euro investments linked to improving energy efficiency profile across the fleet, logistics and store network was a feature of sector announcements/strategies in 2022.

2023 Retail Convenience Outlook

Market activity focused on store investment and consolidation to continue within the sector. Margin preservation and environmentally friendly/energy saving initiatives to retain a key focus for 2023.

2023 Key Numbers

- €100m: Investment indented by Maxol Group across strategic forecourt locations in Ireland in 2023-2027

- 10: Number of bio-methane trucks added to BWG logistics fleet delivering 90% emission reduction equating to a carbon saving of 840 tonnes per annum.

- €73m: Targeted investment ear-marked by Aldi for new store development in the Dublin region.

- €11.30: Minimum wage per hour from 1st January 2023 – an increase of 80c and the first step in the phased introduction of the Living wage pre 2026.

Retail Convenience Outlook 2023

- Robust Outlook: Overall a resilient sector to economic shocks; Strong sales performance to continue but increased focus on margin preservation and cost management required linked to an extended inflationary environment.

- Funding Activity: Strong active pipeline of store purchase and associated revamp proposals– retailers recognise that customer experience/excellent standards will be key to attract and retain market share.

- Investment/Consolidation: Increased investment in partnership agreements and further consolidation of the market (especially forecourt/wholesaler sub-sectors) expected to continue in 2023.

Market

- In a competitive labour market – sourcing and retaining the best people is vital to sustain a retail business. A structured employee development plan that incorporates role variety, up-skill opportunities and competitive remuneration needs to be embedded within the culture of the business. The smart use of digital/automation tools can deliver the dual goal of increased efficiency and an improved working environment.

- Energy costs need to be addressed proactively by the wider sector; collective affinity schemes negotiated, investment in energy efficient equipment/processes and sector lobbying for sustained Government support all expected/required in 2023.

- Significant revamp programmes will continue to be rolled out in 2023 nationwide by leading grocery operators as the ever more discerning consumer seeks excellence in store standards. Movement on revamp costs linked to fluctuating material supply base to be monitored closely.

- Detailed analysis pre and post revamp will be an imperative to ensure that a maximum return on investment is delivered via sales mix improvement, margin growth and cost saving. The “localisation” trend will continue with store revamps taking a more bespoke, community focused approach.

- City centre stores will need to proactively assess all aspects of their business plan: target customer demographic, margin development, shrinkage, cost base, property costs etc. They will need to focus both on city centre dwellers and city centre employees – partner with foodservice/restaurants and provide effective delivery options etc to engage a new recurring customer base.

- Corporate social responsibility linked to sustainable and environmentally friendly in-store activities will be a key area of focus for all retailers – energy efficient equipment, elimination of single-use plastic, improved recycling facilities and reduction of food waste. This will enable an improved cost base whilst meeting consumer expectations in respect of ethical trading. The proposed roll-out of the deposit return scheme and “latte levy” in 2023 will be monitored with interest.

- Consolidation is expected to remain a feature of the market with wholesalers, fuel brands and multi-store retailers expanding their network and footprint across the sector.

- As consumers seek cheaper alternatives across some product lines, all leading operators recognise that a strong, diversified own-brand offering will be critical to maintain customer engagement as the inflationary cycle continues.

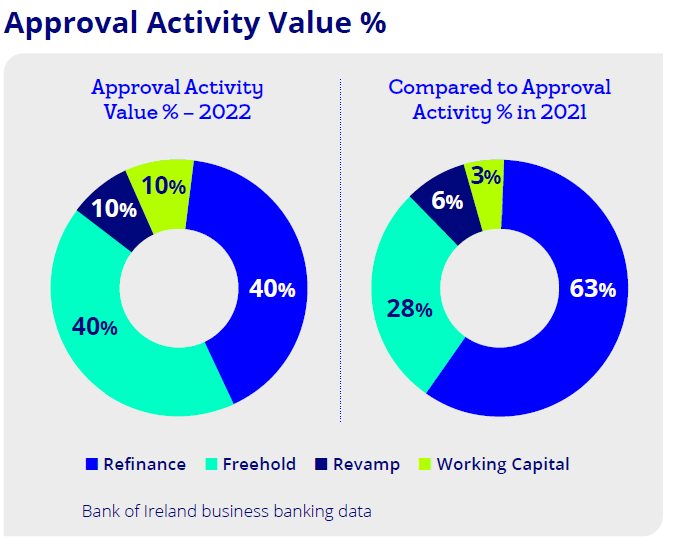

Funding Activity

- Store purchase strategies will continue to develop in 2023. COVID-19 has been the catalyst for increased levels of succession planning/retirement which is driving this activity.

- Revamp funding to continue with a particular focus on energy efficient equipment and processes.

- Robust refinance activity projected linked to loan book purchasers seeking to deleverage.

Retail Convenience Insights and Outlook 2023

View

Print