Supply chain disruption on a scale not seen for decades is impacting industry, says head of Manufacturing at Bank of Ireland Conor Magee.

Irish manufacturing indicators for October, while rebounding from recent months downward trends, continue to be negatively impacted by supply chain chaos.

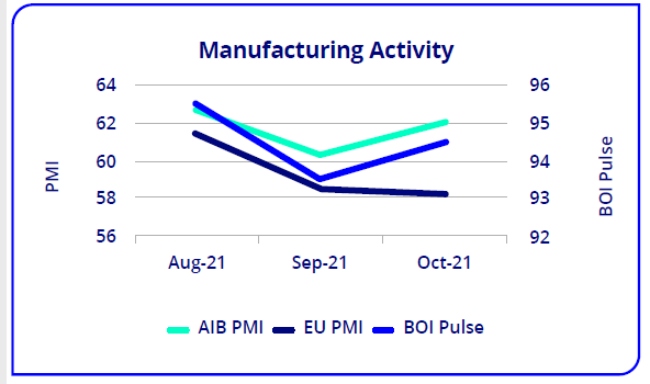

Bank of Ireland Industry Pulse for October was 94.5 up from 93.5 in September while AIB Irish Manufacturing Purchasing Manager’s index (PMI) for the manufacturing sector came in at 62.1 up from 60.3 in September.

“The reality is that as Covid-19 cases are now rising again, manufacturing will be confronted with renewed higher sick leave, and supply chain pain is likely to worsen in the short term before green shoots of improvement start to appear”

Both indicators reflect continued robust expansion with acceleration of both orders intake and production output. By contrast EU PMI data lost further momentum registering 58.3 in October marginally down from 58.6 in September.

Massive supply chain disruption not witnessed for decades continues to drive delays, lead times, shortages and inputs pricing all in the wrong direction. The reality is that as Covid-19 cases are now rising again, manufacturing will be confronted with renewed higher sick leave, and supply chain pain is likely to worsen in the short term before green shoots of improvement start to appear. As the supply of multiple inputs continue to lag demand, inflation continues its upward trend standing at 5.1% in October, its highest level since 2007.

Keep an eye on inflation

EU inflation stood at 4.1% with energy being the highest contributor.

Previous forecasts have been significantly understated and inflation is looking less and less transitionary as has been previously argued by many commentators.

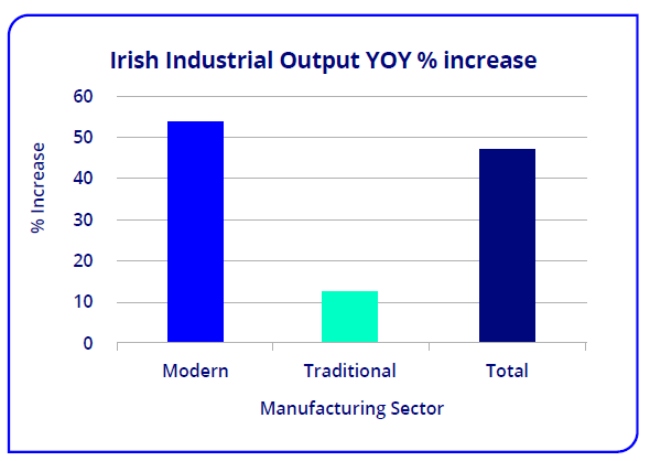

In line with Ireland’s continued strong manufacturing performance, Irish manufacturing production data released on November 8th showed a 2.5% expansion in Q3 2021 versus Q2 and a significant annual increase in September of 46.9%, split 53.6% modern and 12.1% traditional.

This will no doubt translate into a very significant contribution to our 2021 GDP growth.

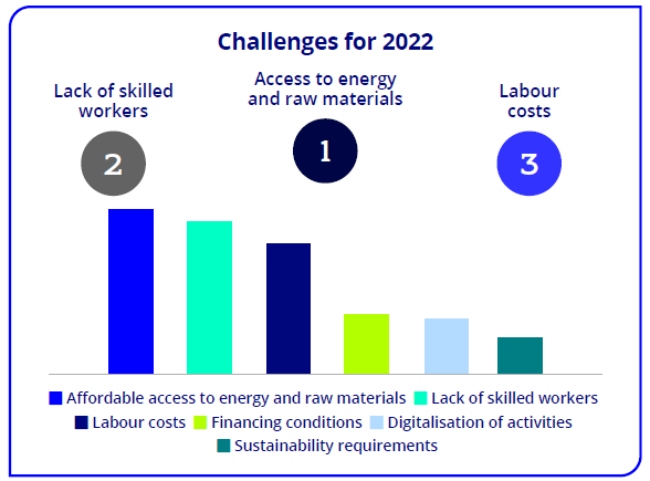

Looking ahead to 2022, Eurochambres the association of European Chambers of Commerce and Industry published its survey EES2022 of 52,000 companies and while general optimism for 2022 prevails, the top three challenges remain around supply chain, energy and labour.