Bank of Ireland head of Tech, Media and Telecoms Paul Swift looks back on a seismic 2021 and predicts the trends for 2022.

“Ireland’s technology sector is expected to expand further over the course of 2022”

Excerpt:

Summary

Technology

Ireland’s technology sector continued to perform strongly through 2021 with LetsGetChecked and Fenergo joining the ranks of Ireland’s growing list of ‘unicorns’. Both businesses secured strong support from international investors, a further endorsement of the strength and reputation of Ireland’s indigenous technology sector. TechIreland.org also published its Software as a Service (SaaS) report for 2021, capturing the continued growth of the sector with over 400 Irish technology companies classified as SaaS, creating solutions in artificial intelligence (AI), talenttech (recruitment), customer relationship management (CRM) and internet of things (IoT). The report highlighted data on activity for Irish SaaS companies during 2021 that saw 33 companies being acquired while three companies completed initial public offerings (IPOs).

Media

We continue to see further evidence of content providers moving to subscription-based models with content now placed behind a paywall, to position these businesses on a more sustainable model, as sales and advertising revenues continue to decline. Silicon Republic introduced its paywall last October following other titles such as the Irish Independent, The Business Post, The Examiner and The Irish Times that have rolled out similar models in recent years. In most cases, readers can still access free articles before having to pay for content. However, the hope among content providers is that over time, readers will buy into the new model, and add another subscription to their ever-growing list, that already comprises of gym membership, access to software, music, and entertainment.

Telecoms

There was further consolidation in the sector during the period with Viatel Group continuing on their acquisition trail of recent years with the acquisition of Skytel Networks, a Wexford based provider of connectivity and voice services to both consumer and business customers across Ireland in October. This was their fourth acquisition in twelve months, further expanding their presence in the Irish market and internationally. The roll out of the national broadband plan continues despite having lost some ground owing to COVID-19 in the first half of the year.

Commercial providers such as Eir, SIRO and Virgin Media also announced plans to expand and/or upgrade their fibre networks and offer high-speed products to customers across the country, representing an investment of more than €1.8 billion.

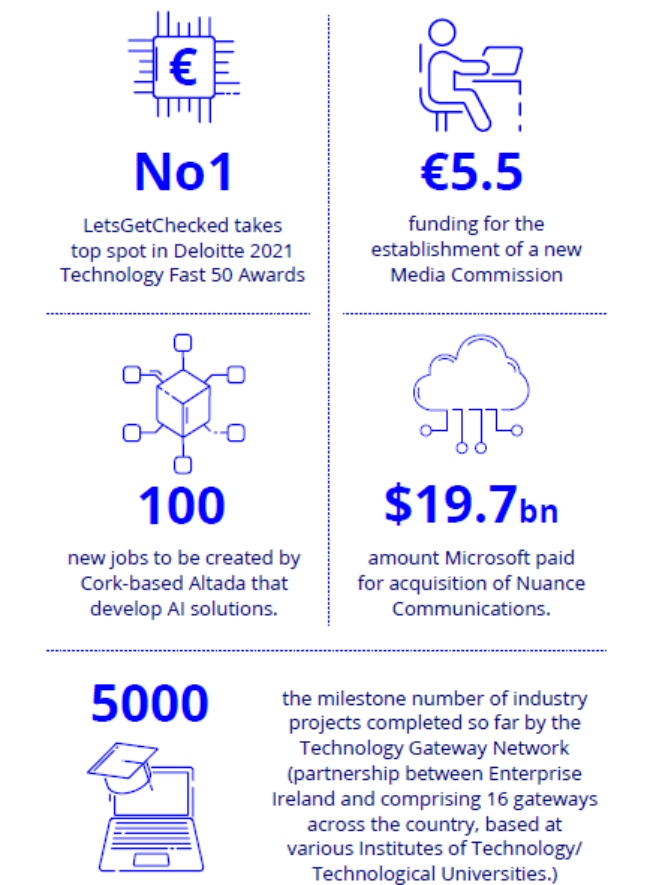

Key tech numbers 2021

Key trends

- HR (Human Resources) tech: As new ways of working continued, centralised HR systems became critical for businesses. Productivity, culture, employee engagement, communication, and employee development amplified the need for effective technology solutions to help manage the challenges associated with remote working, which has driven an increase in demand for these types of solutions.

- Influencer/Social media marketing: Over the course of the pandemic, we have seen an increase in SME’s creating content of their own such as men’s/ladies fashion, pubs/restaurants and even construction businesses producing content to showcase their offerings to try and drive sales while the country entered various stages of lockdown. People’s shyness or reservations about being videoed seems to have been well and truly overcome as more and more businesses saw the potential benefits of social channels. In many cases businesses are now using social media influencers to endorse products and services among their followers to drive sales by engaging customers through unique and differentiated content.

- Digital transformation continues: Many SMEs sought to either explore how they could replace outdated technology with more robust digital tools in order to support and maintain productivity or with a view to keeping up with competition and trying to stay relevant to existing customers while attracting new ones. As markets continued to shift, customers demanded enhanced, digitally enabled, experiences. Many of these tools (customer relationship management/project management/content management) that could assist businesses to exceed customers’ expectations are available off the shelf with limited customisation required.

TMT 2022 Outlook

Technology

Looking ahead, Ireland’s technology sector is expected to expand further over the course of 2022. It was recently announced that Flipdish, the food-ordering platform, founded by brothers James and Conor McCarthy have raised $100m in new funding, giving the business a valuation of $1.25 billion, making them Ireland’s latest ‘unicorn’. The business also plans to hire 700 new staff in 2022.

These will not all be hired in Ireland, as Flipdish and other similar businesses may find it increasingly challenging to acquire talent. While it was flagged that 2021 would be a difficult year to hire with restrictions on mobility creating a smaller pool to hire from, all indicators suggest this coming year presents unprecedented challenges. According to Morgan McKinley’s 2022 Irish Salary Guide, the “Great Resignation” is proving a significant threat.

The most in demand roles this year will be data analysts/ engineers/scientists, with demand for software engineers continuing unabated. Likewise, those with cybersecurity skills will also be highly sought after.

Media

Screen Ireland received an increase in budget funding of 22% for 2022 and confirmation of a new tax credit for digital gaming development companies. The increased funding will help support Ireland’s growing film, TV and animation industry and enable significant potential for further growth as both a domestic employer and revenue generator. The industry has gone from strength to strength in recent years on the back of long-term investment in the creation of talent. It is no secret that Ireland’s reputation, can-do approach and excellent producers, crews and creative ability puts the industry in a good place to benefit from the continued growth in demand from streaming channels for both live-action and animation content in the time ahead.

Telecoms

While the roll out of 5G has been talked about a lot over the last 18 months, 2022 is likely to be the year when we actually see progress in terms of widespread connectivity.

5G is the fifth generation of cellular networks. It is up to 100 times faster than 4G and it creates enormous opportunities for both business and ordinary consumers. In short, it is all about reliable connectivity; connecting things without lag, so we can engage, process, and execute actions in real time.

Businesses will now benefit from greater data-driven insights, making decisions in real-time. Connectivity among supply chain partners will also enable better interaction, improved efficiencies, and ability to alter/amend decisions reducing errors and associated costs.

Market

Looking ahead, as the worst of the pandemic appears to be behind us, we are seeing governments across the world rolling back on the various restrictions that have been in place over the end of 2021. There is now palpable optimism and business minds are focusing on recovery, renewal and growth for the year ahead. With that in mind, below are some thoughts on what the year ahead might look like.

Cybersecurity

According to a recent report by Grant Thornton, the economic cost of cyber-crime to Ireland in 2020 was estimated to be €9.6 billion. Ransomware attacks are on the rise and businesses and organisations of every kind need to be vigilant to do all they can to protect against an attack.

Some steps that The Garda National Cyber Crime bureau advise businesses to take to prevent an attack include:

- Scan for infected attachments and websites: apply patches and anti-virus updates as well as scanning for infections.

- Disable unused ports and services: engage experts if needs be to assess your system to see what you require and what can be disabled.

- Use trusted software and system updates: it is important to keep your system up to date and always ensure you are installing trusted updates.

- Backup essential files: have a secure off system back up that you can restore your files in the event of an attack.

- Engage with Cyber Security partners: security experts will ensure that you are protected from threats to your system.

- Report attacks, and do not engage: in the event of a ransomware attack, report it to An Garda Síochána immediately.

Expansion of Low-code, No-code development platforms

Given the continued shortage of software engineers, we are likely seeing an expansion in the use of these platforms, with citizen developers (employees who create application capabilities for internal consumption, either in their own jobs or for others in their organisation, that can be developed in weeks, rather than months) becoming more commonplace. Lowcode, no-code development platforms facilitate the building of software applications by employees/frontline workers, without needing deep technical knowledge. In short, it enables people, regardless of their role, to solve the problems that are right there in front of them. They can constantly innovate and iterate on their processes as the conditions in their business change, adapting their software to new processes and move faster than if they had to go through a team of developers or an IT department.

Blockchain

The lack of use cases of this technology was widely mentioned in recent years as a reason for some of the scepticism as to its applicability and scalability. Today, according to Forbes, eight of the world’s largest publicly traded companies are building various products incorporating this technology.

We are now seeing broader use cases emerging across luxury goods (tracking products and fighting counterfeiting), music rights (managing copyrighting and royalty payments), legal (smart contracts), supply chain (holistic view – point of origin, track, and trace) and healthcare (incorruptible patient records and data).

Financial services and the banking sector continue to receive the lion’s share of investment in blockchain technology, particularly in the area of payments, but now expanding further into areas of wealth and asset management and credit scoring. While blockchain and cryptocurrency are used interchangeably, cryptocurrency is just one of many potential uses of the blockchain. Yet it continues to generate enormous interest given its ability to enable parties to exchange value, without the need of a third party.

The global cryptocurrency market cap reached $3 trillion, which was an all-time high at the end of 2021. China outlawed all crypto-related transactions last Autumn and is only one of many countries and jurisdictions that have either banned cryptocurrencies outright or severely restricted it over the past few years.

ESG and TMT

An increasing focus on sustainability will feature more prominently this year with businesses looking to technology companies to create and deliver tools that integrate data and provide insights on everything from the environment, social and governance issues to support decision making.

The TMT sector itself accounts for significant emissions (estimated to be somewhere between 1.4% of global emissions across devices, networks, and data centres and 3.6% of electricity consumption), while also contributing to the world’s supply chain carbon footprint. Companies across the TMT sector need to proactively invest in renewable energy and services to decarbonise and offset emissions being created by cloud, Telco’s, and various technology platforms.

On a broader level, the TMT sector needs to take a leadership role in creating technologies and innovate to find ways for applications to support sustainability, while also leading by example in transforming organisational sustainability strategies into actionable roadmaps and proactively delivering on them.

Funding activity 2022

We continue to see an expansion in acceleration of digital technologies and expect this to continue as more businesses expand their digital footprint and transform their organisations.

We look forward to supporting both existing and new customers investing in their businesses to adequately resource their operations to capitalise on those opportunities.

Consolidation of the Managed Service Provider (MSP) space continues at pace as businesses seek to gain critical mass through acquisition and leverage new cloud-based models where a broad suite of technology products, hardware (devices) and services are bundled to enable customers to move to a recurring revenue model. We are delighted to continue our support of customers as they grow revenue and their geographical footprint.

We also look forward to continuing our support for customers delivering on Ireland’s ambition roll out of the National Broadband Plan, delivering services and supporting connectivity of customers and families throughout the country.

Full report: