Dampening consumer demand does not bode well for manufacturing, writes Conor Magee, head of Manufacturing at Bank of Ireland.

Irish Manufacturing indicators for May 2022, while remaining resilient and in expansion territory, showed the first signs of slowdown.

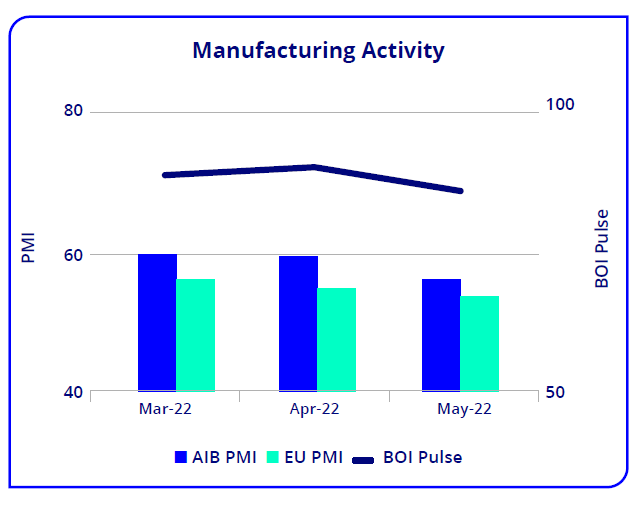

Bank of Ireland Industry Pulse for May was 87.3 down from 90.1 in April. AIB Irish Manufacturing Purchasing Manager’s Index (PMI) for the manufacturing sector moved downwards to a 15 month low of 56.4 from 59.1 in April.

“An increasingly toxic mix of surging inflation, unprecedented fuel costs, never ending supply chain disruptions and interest rate hikes are all eroding consumer spending power and dampening consumer demand”

Rates of increase of orders and output slowed sharply in the month, as a combination of higher prices and a shift in spend to services such as hospitality and travel all served to dampen demand.

Additionally business confidence hit a 19-month low on the back of the ongoing Ukraine conflict and persistent high inflation, both of which show no obvious short term signs of improvement.

While many businesses will no doubt adopt a more cautious approach to growth, given the ongoing volatility, the fundamentals and opportunities for many remain strong and Irish GDP is forecasted to grow by 6%.

EU PMI data for May at 54.6 down from 55.5 or an 18 month low, paints a more fragile picture.

Orders fell for the first time since June 2020. An increasingly toxic mix of surging inflation, unprecedented fuel costs, never ending supply chain disruptions and interest rate hikes are all eroding consumer spending power and dampening consumer demand.

This is further exacerbated by a shift to spending in services, particularly travel as people revisit family members and reactivate postponed travel plans. In summary, there is no escaping the reality that current negative trends without improvement all point to higher downside risks in the global economic outlook.

Exabytes and Gigacorns – the imperatives of Digital and Green Agendas

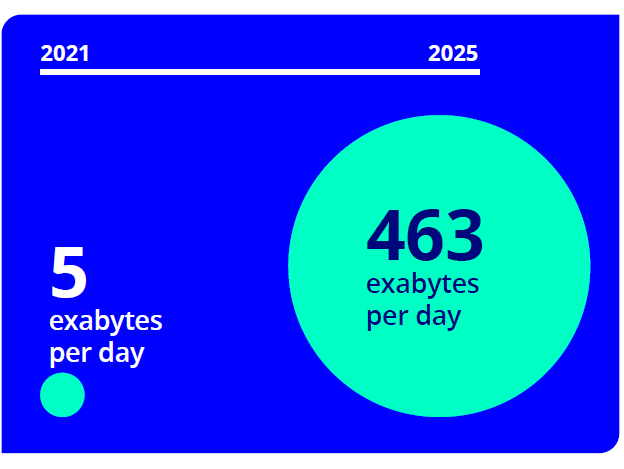

Putting aside the clouds of uncertainty for a moment, let’s talk about Exabytes and Gigacorns. One relates to Industry 4 and digital transformation, and the other to the green agenda. We are familiar with a Gigabyte (GB) of data which equals approx. 1,000MB or 1bn bytes of data. An Exabyte equals one billion GB, or one Quintillion bytes of data.

Who cares and why is this important? Well according to Accenture, the world will produce 463 Exabytes of data per day by 2025, an exponential increase from just 5 Exabytes per day in 2021. This report brings into sharp illustration the economic value of data to all enterprises.

The good news is that many Irish Manufacturing SMEs recognise this growth lever and are taking advantage of SIRI (SMART Industry Readiness Index) surveys. These are available from Irish Manufacturing Research, and enable businesses to map their journeys to smart factories, real time data and enhanced connectivity with suppliers and customers. Furthermore the Irish Government has just announced a new €85 million digital transition fund that will provide grant aid for businesses.

Gigacorns? We are familiar with a Unicorn – “A privately held start-up company with a valuation of $1 billion”. The term was first popularised by VC Aileen Lee.

A Gigacorn also known as a Climate Unicorn is “a company whose technology can impact global CO2 emissions by 1 gigaton (GT) of CO2 per year while being commercially viable.” The term has been coined by Christian Hernandez.

Considering the EU alone emits around 3 GT per year (see chart), this is a hugely aspirational target. But that’s exactly the point! It underlines the ambition needed to seriously address the climate crisis. While no Gigacorns exist as yet, the hunt is on. Many VC companies are using the term in their pitches to attract gigacorn potentials.