The invasion of Ukraine and the consequent spiralling energy costs and inflation are inevitably reducing valuations for high-risk companies.

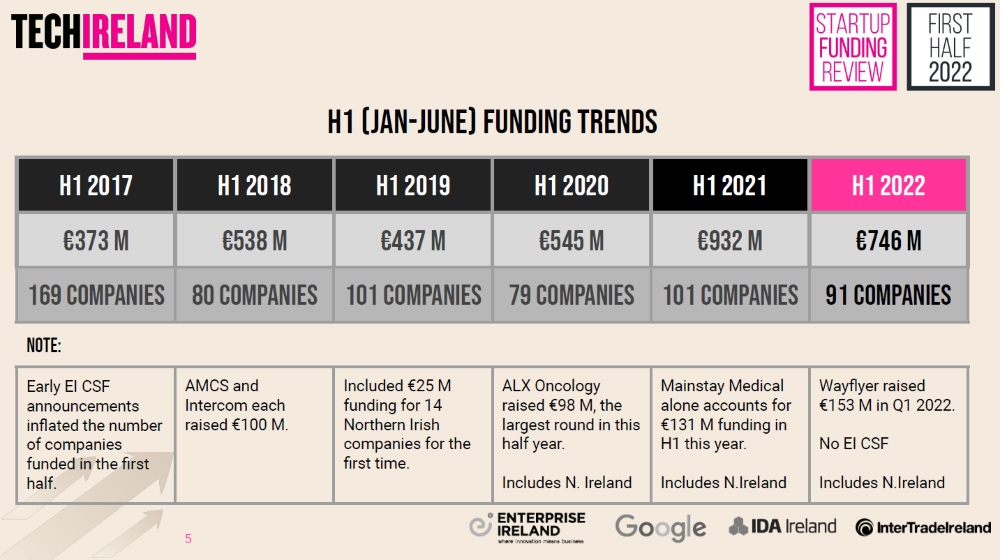

91 Irish start-ups between them raised €746.2m in the first half of 2022, according to TechIreland’s H1 Start-up Funding Review.

This is 20% lower than the same period last year, but 2021 was an exceptional year. On first glance this year’s first-half funding compares well with other previous years.

“Given the environment, it’s remarkable that Irish H1 funding numbers have held up so well. The macroeconomic picture is a challenging one”

However, the €746m total is skewed by a few large rounds; the top three outliers took 40% of the total.

The remaining 88 companies between them raised €440m.

Most of the capital inflow into Irish start-ups and scale-ups went into larger, more established companies.

The number of investments greater than €10m increased to 18 from 16 last year. Conversely, there was a drop in smaller rounds.

Rounds less than €500,000 (mostly seed and pre-seed) fell to the lowest level in five years.

A perfect storm

The invasion of Ukraine and the consequent spiralling energy costs and inflation are inevitably reducing valuations for high-risk companies.

“Given the environment, it’s remarkable that Irish H1 funding numbers have held up so well. The macroeconomic picture is a challenging one,” said Brian Caulfield, chair of Scale Ireland

While this year has seen impressive large rounds and a good number of ‘growth’ rounds (€10m to €50m), the poor number of early-stage rounds so far this year raises a concern about the pipeline of companies likely to scale in future.

“We are pleased to see the strong first half for Irish tech companies raising funds, but it remains to be seen whether the significant slowdown in the second quarter heralds a more difficult second half to the year,” said Sarah-Jane Larkin, director-general of the Irish Venture Capital Association (IVCA).

While the outlook for later-stage investments and exits is likely to remain challenging – IVCA, reported a 50% fall in funding from overseas investors in the second quarter, down to €152M from €303m in Q1. However, local funds such as Delta, Act, Elkstone and Melior are well equipped to support quality start-ups.

“The €90m Irish Innovation Seed Fund will be a vital support for Irish startups at a time when early-stage funding is cooling,” said John O’Dea from TechIreland.

The top 10 funded companies in H1 2022 include Wayflyer (€134M), Flipdish (€87.2m), TransferMate Global Payments (€66m), ProVerum Medical (€30m), Energyx (€30m), &Open (€26m), Keelvar (€23m), Perfuze (€22.5m), Vivasure Medical (€22m) and WorkVivo (€20m).

Five of the top 10 in the list are tech companies outside Dublin. It is a standout year so far for Galway, with 11 companies raising €98m. Nine Cork-based companies raised a total €68m. Success stories such as these, not to mention TransferMate Global Payments from Kilkenny, are great examples of companies scaling from the regions.

Overall, 42 companies from the regions raised a total of €253m in H1. It was also a promising first half for Northern Ireland-based companies.

In terms of sectors, HealthTech and eCommerce recorded a sharp drop in funding, whereas FinTechs registered a rise, largely driven by WayFlyer and TransferMate. Other sectors that performed well are AgriTech and CleanTech.

“While the year has had a good start, funders are resetting valuations and we are urging our clients to build in as much runway as possible and recognise that capital (especially at the later stages) is not so available as recent years,” urged Donnchadh Cullinan of Enterprise Ireland.

Female-founded start-ups are enjoying a record year with €114m invested into female-founded companies, the best first half-year performance on record – twice what was raised in the past two years and nearly six times as much as was raised in H1 2018.

“Despite the economic headwinds, the Irish M & A market proved resilient in H1 2022,” said Fergal McAleavey of Ernst & Young.

“Domestic and international investors are monitoring Irish companies closely as part of their core M&A strategic priorities.”