Hotels in Ireland are reporting sharp demand but inflationary pressures could eat into profit margins, says Gerardo Larios Rizo, head of Hospitality Sector at Bank of Ireland.

The Irish hotel sector and wider accommodation services (aparthotels, self-catering, guest houses, etc.), delivered a much stronger than anticipated performance during the first half of 2022.

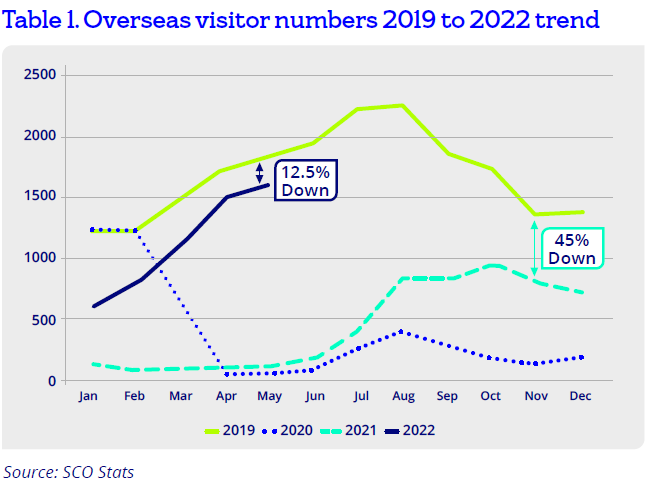

Domestic demand continues to play a key role in the recovery of Irish hotels, while international visitor numbers continue to grow; Ireland welcomed 1.6 million passengers during the month of May 2022, compared with 1.8 million arrivals pre-pandemic (May 2019).

“Overall, the strong performance to date has supported positive business sentiment despite prevailing socio-political uncertainty”

On average, hotel properties both in Dublin and the regions are reporting sharp demand, combined with record average room rates.

Food and drink sales trends are also encouraging, but lack the buoyancy of room sales, perhaps because of the inflationary price adjustments reported by the majority of operators. Staff shortages remain an issue of concern for many operators particularly during peak summer trade of July and August. Overall, the strong performance to date has supported positive business sentiment despite prevailing socio-political uncertainty.

Hotel sector key activity and trends H1 2022

- Prevailing staff shortages continue to impact hotel operations. The heightened summer demand, combined with rising COVID-19 cases in recent weeks, will continue to present operational challenges to hotels, bars and restaurants in the short to medium term.

- Airlines disruption. Recent air travel disruption reported in In Ireland and across the globe could impact the recovery of air capacity/ air travel. So far this year, British Airways has cut down 13% of its summer schedule (30k flights)

- Domestic demand. The sustained decline in unemployment levels in Ireland continues to fuel and support discretionary spend by the domestic market. The seasonally adjusted unemployment rate for June 2022 was 4.8%, up from a rate of 4.7% in May 2022 and down from 6.3% in June 2021.

- Overseas travel showing encouraging recovery. May 2022 arrivals were up by 8% vs. April 2022. Year to date arrival figures (January-May 2022) rose to 5.5 million compared with 7.4 million for the same period in 2019, down 25%. Visitors from GB accounted for 36% of arrivals (2m) in the five months to the end of May (Table 1)

- Strong average room rates reported by Irish hotels. Over the last couple of months Irish hotels have been accused of price-gouging by numerous stakeholders who believe rates charged to customers are excessive. However, it is important to understand there are a number of factors are influencing this, including:

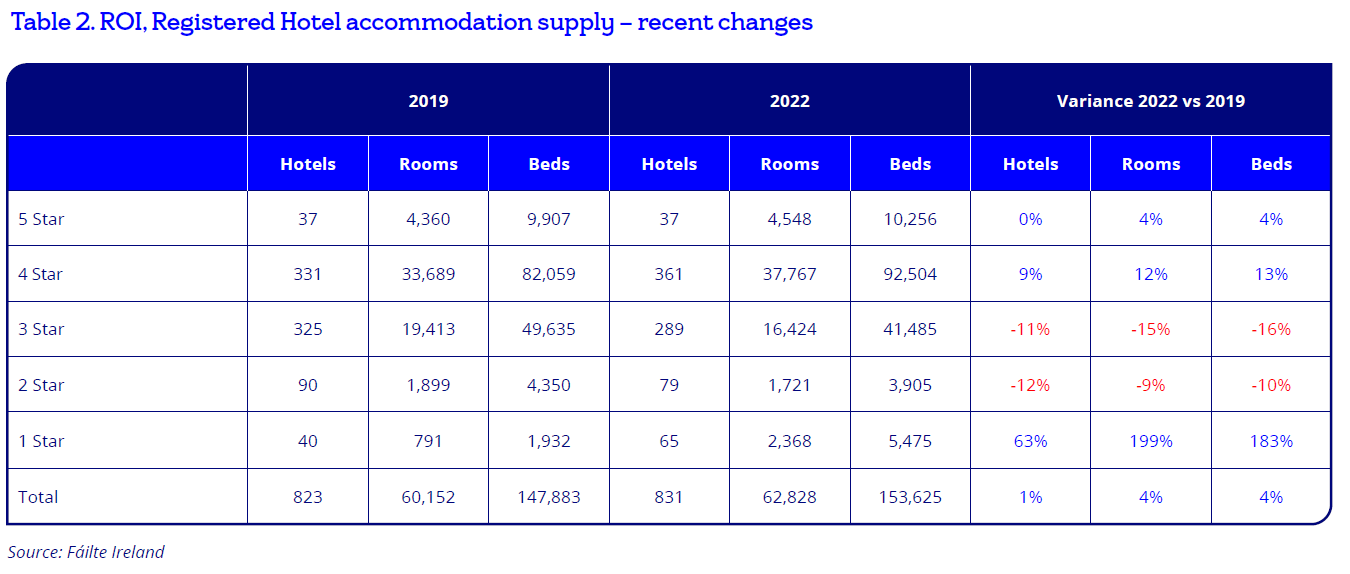

- Increase of 17K beds in the 4 and 5 star segment / Decrease of 6.5k beds in the 1, 2 and 3 star beds. (Table 2)

- Hospitality VAT Rate decreasing from 13.5% to 9%

- Shorter lead in times (fewer people booking holidays well ahead of time)

- Capacity constraints. In Dublin a sizeable amount of bedroom stock is out of circulation (Direct provision, refurbishments, staff housing, etc.)

- Inflation. Increases in the cost of linen, food, drink and other essentials to the sector as well a rising energy prices are keeping profit margins at bay for the hotel and wider food and drink sectors.

Hotel sector key performance metrics H1 2022

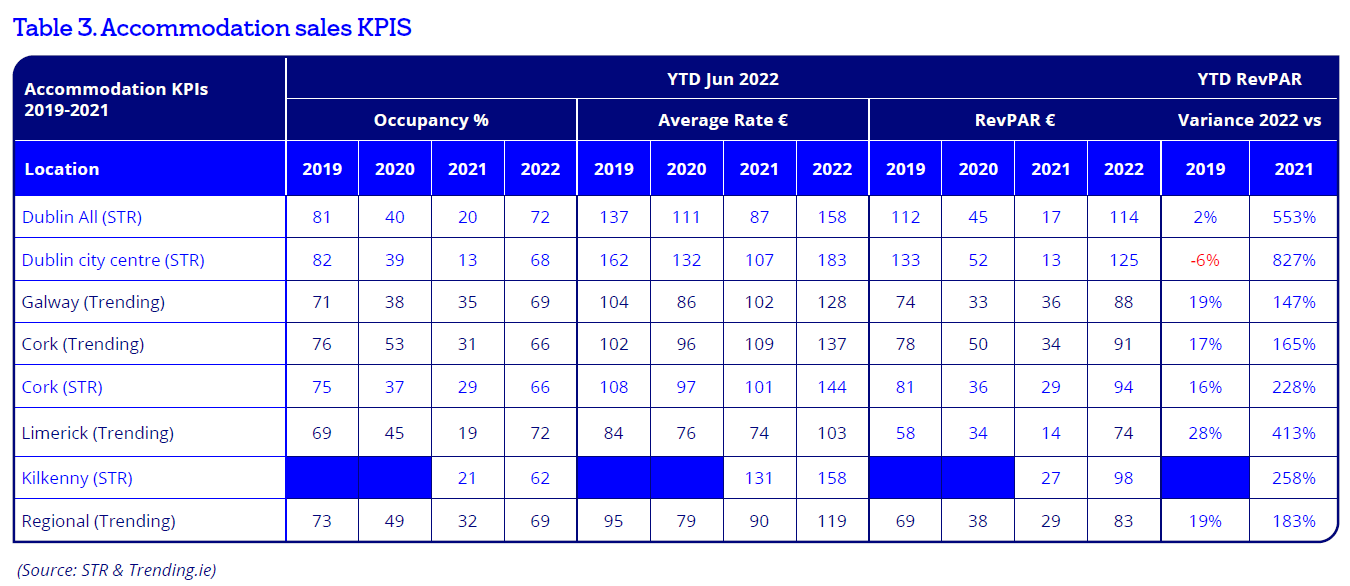

- Galway city. January to June 2022 (H1) RevPAR of €88 is 19% ahead of the comparable period in 2019. Occupancy only marginally behind for the period while average rate was up 23%

- Limerick city. Stellar performance with occupancy at 90% and an equally strong rate of €114 reported for June 2022. Year to date 2022 (Jan to June) figures show a RevPAR of €74 compared to €58 delivered for the comparable period in 2019 (28% higher)

- Cork city. The Cork capital reported a €40 average rate increase for the month of June 2022 compared to 2019. Jan to June 2022 (H1) RevPAR of over €90 is well ahead of 2019 figure for the same period.

- Dublin. Strong performance to date for the Dublin region although city centre is still marginally behind 2019 figures with occupancy to date still 14% behind same period in 2019.

Transaction activity & new hotel openings

- Hotel property transaction activity was strong in the first half of this year. Properties that exchanged hands included Ballymascanlon House Hotel in Louth sold for €15m, Killashee Hotel in Kildare for €25m, Hendrick Hotel in Dublin for €35m, The Bush Hotel in Leitrim (undisclosed sum) and Dunboy Castle in Cork (undisclosed sum).

- H1 2022 Hotel openings:

- JMK Hotels – Hampton by Hilton, 3 star 249 bedroom hotel in Chancery Street Dublin 7.

- Dalata hotels – The Samuel, 4 star 204 bedroom hotel in Dublin 1.

- Irish group Staycity recently opened its sixth property in France (216 studio and one bed apartments in Pairs, La Defénse) The group operates 30 properties across 14 European destinations, with recent openings in Manchester, Frankfurt and Dublin.

Government Supports & Schemes

The majority of schemes and grants implemented to support businesses during the pandemic have now been removed. However, a number of schemes, grants and supports remain in place from a number of government bodies (not all COVID-19 related):

- Irish businesses that availed of tax warehousing from Revenue have a further period of grace before the accumulated liabilities start to be repaid (Q1 2023).

- The Minister for Finance announced the extension of the 9% Value Added Tax (VAT) rate for the tourism and hospitality industry. The lower rate of Hospitality VAT will remain for these sectors until 28 February 2023.

- Failte Ireland

- Gala Dinner Venues Capital Investment Scheme 2022

- Destination Supports for International Business Events

- Strategic Banking Corporation of Ireland (SBCI).

- Energy Efficiency Loan Scheme; A low-cost scheme designed to support eligible SMEs, investing in the energy efficiency of their enterprises.

- COVID-19 Loan Scheme; A medium-term, lower cost scheme to fund working capital and investments for businesses, impacted by COVID-19.

- Sustainable Energy Authority of Ireland

- EXCEED grant, Energy Efficiency Obligation Scheme, Accelerated Capital Allowance, Support Scheme for Renewable Heat, Energy Audits & Contracting.

Lending activity

Heightened funding activity in the hospitality sector derived from refinances, equity releases to take out investors and acquisitions. Cash deposit balances, which continued to grow in the first half 2022, continue to impact on the hotel sector demand for working capital facilities. Uncertainty about interest rates over the last quarter has led to a decisive increase in customers seeking to fix their interest rates.

2022 H2 Outlook

Notwithstanding strong trade reported by the hotel sector for H1, there is a degree of uncertainty about the second half of the year. The aggregate impact of the war in Ukraine, inflation, and the threat of recession is somewhat dampening optimism.

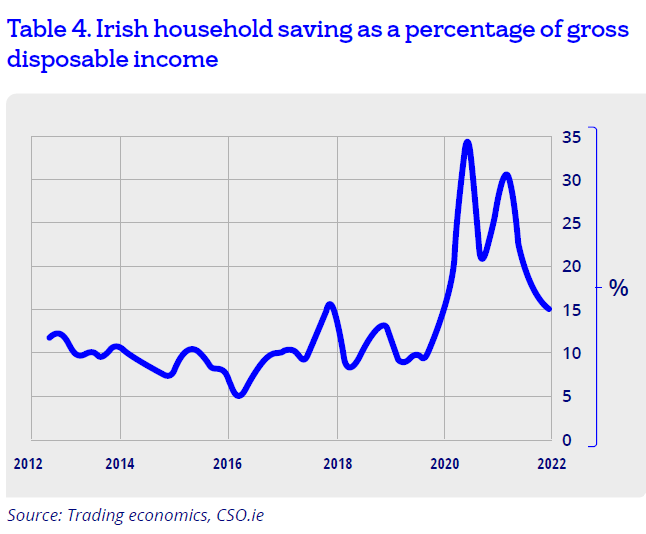

The positive employment trends give some level of confidence as to the sustainability of discretionary spend, which to date has been bolstered by pandemic savings (table 4). As we look to the future, hotel properties are seeking to maintain the gains made in average room rates over the last year; these increase will be essential to counteract the impact of inflation and the impending higher rate of VAT.

An increasing number of hoteliers are planning investment/upgrades to their premises to improve on energy efficiency and enhance their green credentials; soaring utility prices have considerably shortened the payback period of some of the more investment-heavy solutions like Photo Voltaic (PV).

Trends

- Hotels, bars and restaurants located in through traffic areas that might have benefited from commuter trade are still experiencing soft demand for food and beverage services. A large number of companies have already announced plans to bring staff back into the office but numbers remain comparatively low.

- Consumer post-pandemic optimism eroded by inflation-driven caution. Recent Bank of Ireland debit and credit card data spend (June 2022) showed a decline/slowdown in spending across all sectors.

- Some businesses have expressed concern about meeting demand expectations during peak summer trade due to ongoing staff shortages combined with a surge of COVID-19 infections.

- The hotel sector has so far been able to pass on cost increases to customers, however softening consumer confidence could hinder further price increases in the near future.

- Escalating numbers of tour/groups business and the gradual increase in booking lead-in times are likely to erode some of the strong average room rates reported to date.

- A number businesses that availed of the warehousing of tax obligations during the pandemic are already negotiating the repayment of their obligations and incorporating this into their 2023 cash flows.

Hotel development

The encouraging pickup in demand for hotel accommodation in Ireland this year, has highlighted capacity issues primarily in the Dublin region. A sizeable amount of hotel bedroom inventory is currently out of circulation, mainly because of alternative uses such as direct provision; the reduced supply has sparked the debate about the need for additional accommodation.

However, the recovery of average hotel rates and occupancy that has ensured, could ultimately fast track the development plans of a number of projects that make up the current 17k hotel bedroom development pipeline for the capital.

Consumer Confidence

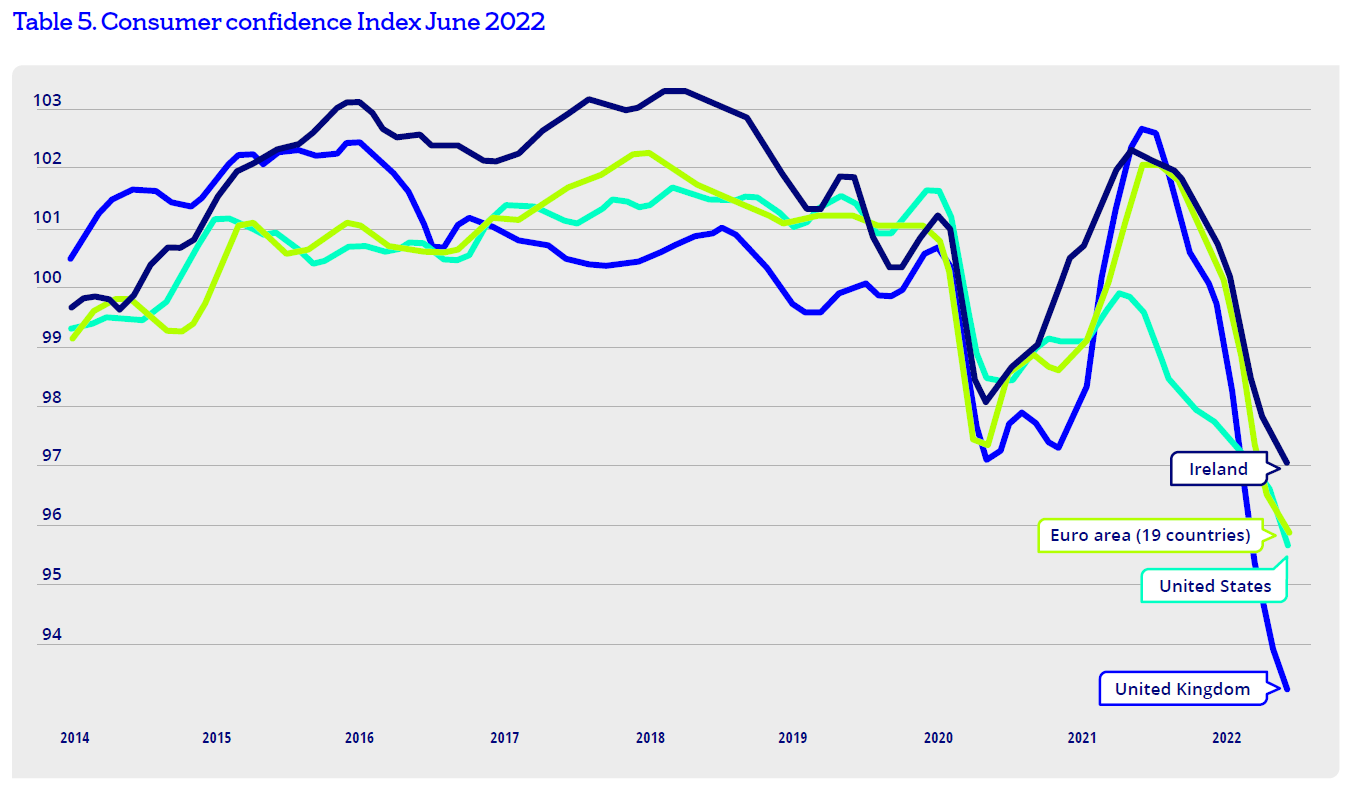

As we move away from the pandemic, the varying government approaches are having an impact on consumer confidence and this could have repercussions on the speed of recovery for each individual market. The consumer confidence index from the Organisation of Economic Co-operation and Development (OECD) shows our top three markets are behind Ireland when it comes to consumer confidence, and thus their return could follow slightly different paths (Table 5).

The Ukraine war is also impacting on travel plans; a recent US travel survey 62% of respondents cited concerns about the war in Ukraine spreading to nearby countries as a factor impacting plans to travel to Europe this year.

Source: OECD

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple