How Ding stepped up to fill a considerable void and help its vast customer network with fee-free, secure payment infrastructure via its mobile top-up solutions.

The latest study by Irish-founded specialist telecoms giant Ding comes as a breath of fresh air for those seeking a good news story amidst the current wave of global economic and societal turmoil.

As we slowly adapt to living against a backdrop of personal health concerns and the most challenging business struggles of our generation, perhaps one of the more overlooked areas of the global capital movement sector has been the lasting impacts the money markets have had on lower-income migrant workers and their essential remittance flows to loved ones in their home nations.

“Sending value home in other forms, such as mobile top-up, has seen a rapid surge in demand over the past six months”

With migrants of all demographics and backgrounds isolated more than ever due to travel restrictions and national lockdown restrictions across the planet, those who rely on their regular payments home can often be overlooked in the grand economic debates we read in the news.

There have been a number of reasons why remittances have decreased over the last six months, including:

- Job losses for migrant workers meaning less money earned and sent home

- Border closures limiting the movement of workers

- Volatile exchange rates meaning sending money is less desirable

- People unable to visit physical stores as a result of government enforced lockdowns

With payment flows on the wane and senders and recipients looking for more convenient, reliable and secure methods of receiving remittances, Ding have stepped up to fill a considerable void and help their vast customer network with fee-free, secure payment infrastructure via their mobile top-up solutions.

Ding succeeds amidst the Covid challenges

Despite the overall decline in global remittances, sending value home in other forms, such as mobile top-up (aka ‘mobile remittance’), has seen a rapid surge in demand over the past six months across all major receive regions for Ding customers.

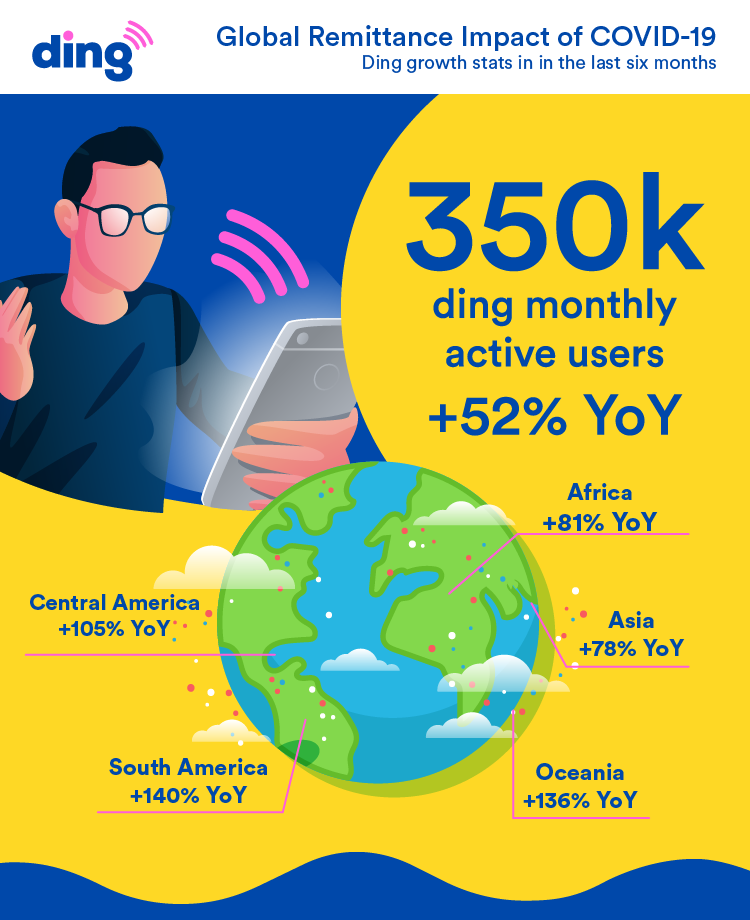

Analysing the markets in which Ding has experienced such unprecedented growth over the past six months (versus the same period in 2019), we can see double and triple-digit growth across the key regions in which their essential remittance flows are most needed:

- Africa +81% YoY

- Asia + 78pc YoY

- Central America +105pc YoY

- Oceana +136pc YoY

- South America +140pc YoY

With over 350k (+52pc) monthly active users of their service, it’s clear the firm’s longstanding goodwill in the communities they serve – and the genuinely decent commitment to waiving all fees for their user base has yielded significant returns on their new customer acquisition journey.

You can find more facts and figures on the state of remittance over on the Ding site if this areas of further interest and of course, please stay tuned to our regular Irish business news updates for the inside track on business growth and entrepreneurial success.

By Luke Fitzgerald

Published: 5 November, 2020