Despite the uncertainty created by the war in Ukraine, the Irish agri sector performed strongly in the first half of 2022. However input cost inflation and increased price volatility of key agri commodities will determine performance for the remainder of 2022, says Eoin Lowry, head of Agriculture Sector at Bank of Ireland.

“Global commodity prices for dairy, meat and grain have risen to record highs since the start of the year and look set to remain at elevated levels for the remainder of 2022”

H1 2022 Review

Summary:

Despite the uncertainty created by the war in Ukraine, the agri sector performed strongly in the first half of 2022. Farmers came into the year in a strong state. Elevated agri commodity prices supported rising input costs across feed, fertiliser and fuel. However these elevated levels are beginning to impact demand, putting pressure on further price rises. It is likely that performance in the second half of the year will be driven by increased price volatility due to the uncertainty around supply and demand of key agri commodities.

Key Sector Trends in H1 2022

- Farmers enter 2022 in a strong position: There was an overall increase in average farm profitability levels in 2021 (Teagasc). The average family farm income rose by 26% in Ireland in 2021 to just over €34,300. Average dairy farm incomes rose 23% to €97,000. Average tillage farm incomes rose 77% to €59,000. Average Cattle rearing incomes rose 30% to €10,900. (Teagasc)

- War driving uncertainty: The war in Ukraine is a having a major impact on global agriculture through oil, fertiliser, and grain markets. Russia and Ukraine are an integral part of the global agricultural and food commodity trade and combined account for 30% of global grain supply. There is a real fear of a food crisis with more people exposed to food insecurity where the price of key commodities are becoming unaffordable for many poorer countries. While this may impact demand in the medium term, it looks like the market will be driven by supply in the short term.

- Agri Commodity Bull Run continues: Agri commodity prices, which had been rising since January 2021 surged to record levels when Russia invaded Ukraine in February. While the FAO Food Price Index has fallen 3% in June from peaks seen in March, it remains 23% higher than June 2021(FAO). This has translated into increased output prices on Irish farms. Overall the agricultural output price index is up 28% in the 12 months from May 2021 (CSO). In the 12 months to May 2022, milk prices are up 37%, cattle prices are up 17%, grain prices are up 33% while pig prices are up 28%.

- Input costs soar across farms: As a result of soaring energy prices and global grain prices, agricultural input prices increased 42% in the 12 months from May 2021 (CSO). Fertiliser prices are up 164%, energy prices are up 51% and feed prices are up 33% in the 12 months to end of May 2022.

- Debt levels on Irish Farms continues to fall: On average, Irish farms are lowly borrowed with only 37% of farms having debt and the average borrowing is €69,000 (Teagasc). Debt levels on Irish farms continue to decline as Irish farmers pay down debt at a faster rate than taking out new borrowings. At the end of December 2021, outstanding debt on Irish farms was at its lowest level in over a decade at €2.8bn (Central Bank). In the 12 months to the end of March, Irish farmers reduced outstanding debt by €207m (-7%) (Central Bank). At the same time, new lending to Irish farms fell by €70m (-34%) (Central Bank) in the first three months of 2022 compared to the same period in 2021 reflecting the strong farm output prices, cashflows and profitability, on average across farms.

- Positive sentiment but cautious outlook: While sentiment and mood remains strong on farm as a result of high farm gate prices, soaring costs and inflation are beginning to impact sentiment. Despite, overdraft utilisation rates are at their lowest level in 5 years many farmers are concerned about increasing input costs and the impact on farm cashflows.

- Limited supply driving land prices: Agricultural land prices rose 16% to €11,906 per acre in 2021 (Farmers Journal Land Report). While the price increase may be attributed to improved farm economics lower it is more likely to be driven by lower supply. The number of farms put up for sale fell by 15% compared to 2020 while the number of acres on offer was down 11% compared to 2020.

- Slowdown in farm development: While there was an initial resurgence in farm development investment as the economy opened up post Covid, this activity is beginning to show signs of slowdown driven by uncertainty around building costs, availability of building contractors, and uncertainty around increased environmental regulations and the evolution of the Common Agricultural Policy.

Key Sector Developments in 2022

- €91m in additional supports to farmers to deal with impact of war: In March, following the invasion of Ukraine, the Minister for Agriculture, Food and the Marine tasked Teagasc with heading up a National Fodder and Food Security Committee to explore all options to minimise the impact on farms and plan in the short to medium term. A number of support measures for farmers were subsequently put in place to deal with the impact of the war in Ukraine. A €12m Tillage Incentive Scheme was launched to encourage the growing of tillage crops. Two separate supports packages worth €20m for the pig sector were put in place while the horticulture and veg sector received a targeted package worth almost €3m. A €56 million Fodder Support Scheme was also announced to assist growing fodder to ensure adequate stocks for the winter ahead. Recognising the challenging environment facing farmers in 2022, Bank of Ireland launched a €100m Agri Assist loan fund, to support farmers dealing with the rapidly increasing cost of farm inputs. The fund which is open until the end of November 2022, provides additional working capital to farmers at competitive rates with extended repayment terms of up to 3 years.

- 25% target cut in agriculture emissions by 2030: The agriculture sector will be required to its emissions by 25% by 2030, compared to 2018 levels. This target reflects a challenging but achievable ambition for the sector. Agriculture was responsible for 37% of national greenhouse gases (GHGs) emissions in 2020. Ag Climatise, the roadmap developed by the Department of Agriculture, Food and the Marine (DAFM) outlines the key actions the sector must take to address climate change. Bank of Ireland is ready to support farmers to embrace these changes in the knowledge that much of what is being asked of them, will in the first instance, enhance the environmental sustainability of the farm but can also contribute to improving overall farm profitability. Bank of Ireland is confident about the future of the sector and is committed to supporting farmer’s transition to a greener footprint. Banks have a unique role in helping to bridge the gap between finance and sustainability. We expect there will be a requirement for continued investment in infrastructure that improves the overall environmental sustainability of farms, and we will continue to work with farmers to support their future business requirements.

- New Common Agricultural Policy (CAP) agreed: The details of Ireland’s CAP strategic plan are now in the final stages with the new CAP to come into effect on 1st of January 2023. Eco-payments, convergence, and limiting the maximum level of payments will impact every farm- where some farmers will gain, while others will lose out as the EU aims for a fairer distribution of funds.

H2 2022

Summary:

While markets remain uncertain as to the evolution of the war in Ukraine and the likelihood of a global recession, price volatility, driven by supply and demand dynamics looks set to become a key feature of agri commodity markets over the next 12-18 months.

Key numbers for H2 2022

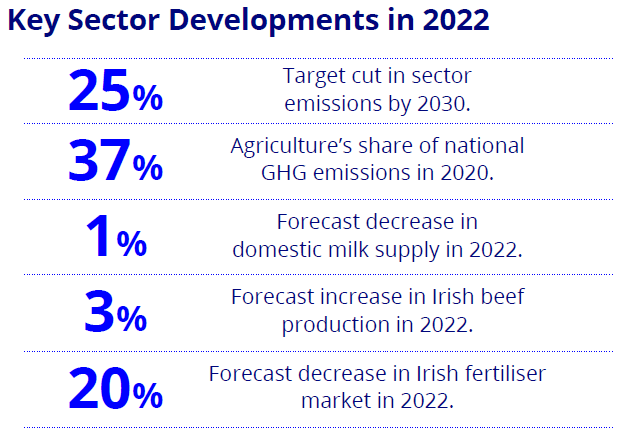

- 25%: target cut in sector emissions by 2030.

- 37%: Agriculture’s share of national GHG emissions in 2020

- 1%: forecast decrease in domestic milk supply in 2022

- 3%: forecast increase in Irish beef production in 2022

- 20%: forecast decrease in Irish fertiliser market in 2022

Key Sector Trends in H2 2022:

- Heightened volatility and Agflation: Global commodity prices for dairy, meat and grain have risen to record highs since the start of the year and look set to remain at elevated levels for the remainder of 2022. The war in Ukraine has been a key driver of grain prices which is supporting meat and dairy prices. However we are now in a period of Agflation (where food prices rise more rapidly than the prices of other goods and services) and this looks set to impact demand across meat, dairy and grain products.

- Continued input price inflation: Input costs (such as feed, fuel and fertiliser) look set to remain high for the remainder of 2022, driven by higher energy costs and availability, increased freight costs and the war in Ukraine. Pigs and poultry are significantly impacted by the increased cost of grain where feed traditionally accounts for 65-80% of production costs.

- Higher energy cost environment in Europe could reduce output: EU gas prices are 8 times higher today than 12 months ago. Given that 80% of fertiliser production cost is gas, key European Nitrogen producers curtailed production this season. As fertiliser is a key input to Irish farms, any energy restrictions in the EU over winter, will determine fertiliser supply and hence prices. However if prices become excessive, demand will fall as we have seen in 2022. It is expected that the Irish fertiliser market will decrease by between 20% in 2022 as a result of high prices.

- Stable average farm incomes despite rise in costs: In 2022, some farmers will require additional working capital to manage the increased costs. It is expected that average family farm incomes will remain ahead of 2019 and 2020 figures but could be marginally lower than 2021. However that will depend on farm system.

Key sector outlooks

Dairy: Higher costs limiting supply

European milk supply is back 1% for the first half of the year with declines (1.5-2%) seen across the three largest European producers, Germany, France and the Netherlands compared to the same period 2021. Irish milk production is forecast to decline by 1% in 2022- the first time supply volumes have declined since the removal of milk quotas. For the first 6 months milk supply was down 0.6% compared to the same period last year. Despite higher cow numbers, higher costs (feed and fertilisers) and poorer weather have limited supply at farm level. The drop in supply has seen dairy processors that had imposed restrictions now lift supply curbs. The outlook for milk prices over the remainder of the year looks set to remain strong with limited supply growth but will depend on global economic situation. The FAO Dairy Price Index is up 25% in the 12 months to June 2022 driven by reduced supply and strong demand. The outlook for 2022 is that base milk prices will average €0.51/l for the full year- an increase of €0.14/l on 2021. Two of the largest costs (feed and fertilisers) on dairy farms have increased 6-8cpl in total.

Tillage: Grain markets and fertiliser prices move in opposite directions

The FAO Cereal Price Index reached a near-record level in May and despite declining marginally in June, is still 48.5% higher than the same time last year. The recent declines are driven by new harvest availability, exports from Ukraine, improved crop conditions in some major producers, higher production prospects in the Russian Federation, and slower global import demand. Concerns over demand prospects amidst signs of an economic slowdown are currently adding to the downward pressure. Green harvest prices remain unset, however indications are that they will be in the region of €285-300/t. This would place them at almost €100 higher than harvest prices last year. Fertiliser prices have risen significantly and are up €50-70 per tonne of grain this year. That should mean the additional costs deriving from fertiliser and other crops inputs will be absorbed by the increased farm gate prices. Crop yields are variable due to the exceptionally dry early summer. For many tillage farmers, while the 2022 harvest is nearing completion, the focus now turns to the 2023 crop. And with soaring fertiliser prices and weaker outlook for grain markets, 2023 could prove a more challenging year than 2022.

Beef: record meat prices boost beef prices

European beef prices have risen 27% to €4.85/kg in the 12 months to end of June 2022. Prices are now stabilising nut remain much higher than historical levels. EU beef supply is expected to be 0.5% lower in 2022 mainly due to reduction in the size of the cow herd. Beef prices are also boosted by higher prices for other proteins. World prices across all meat types have increased, with poultry prices rising sharply, reaching an all-time high, underpinned by the continued tight global supply conditions impacted by the war in Ukraine along with the Avian Influenza outbreaks in the Northern Hemisphere. The FAO Meat Price Index is at record highs and has risen 13% in the 12 months to June 2022. Irish cattle slaughterings are up 11% in the first 6 months of the year compared to the same period in 2021. For 2022 as a whole, Irish beef production is forecast to increase by 3% compared to 2021 (Teagasc).

Pigs: Stability and profitability returning

Light is beginning to appear, after a challenging 8 months where pig farmers were hit with rising feed prices coupled to low pig prices and each pig sold was losing c. €50 on average. Feed price rises have started to stabilise and pig prices have increased 25% from the lows in Q1. The current pig price of c. €2/kg is 22% higher than last year and 19% higher than the five year historic average. Feed prices have stabilised at a high level and continue to put pressure on margin. It is expected than feed costs will remain high over the next 12 months. While the remainder of 2022 will be challenging for the average pig farmer in terms of profitability and cashflows, limited supply across Europe, coupled with strong demand should support prices for the remainder of the year and into 2023. This should see the sector return to profitability by the end of 2022.