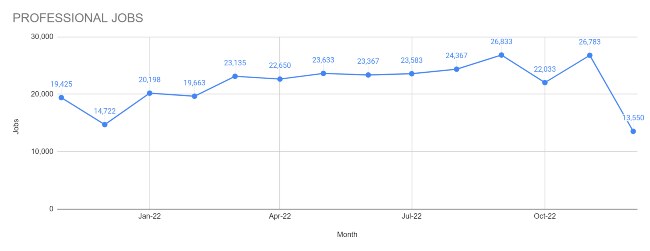

The number of professional job vacancies available in Ireland in the fourth quarter of last year (2022) decreased overall by -17% compared to the immediately prior third quarter.

According to the latest Morgan McKinley Ireland Quarterly Employment Monitor, the reduction is mainly due to the expected decrease in job vacancies for the month of December, which showed a -42% sequential decrease from November.

New job opportunities coming to market in December were only -8% back compared to December 2021. Indicatively, the number of job vacancies in November 2022 was up +38%, year on year.

“Ireland has become less attractive to overseas technology candidates and overseas hires have also become less of a priority for Irish technology employers”

The Morgan McKinley Monitor also recorded an overall increase of 5.4% in the number of professionals actively seeking new job opportunities between Q3 2022 and Q4 2022.

December 2022 saw a drop of -49% in professional job applicants from the prior month, however it still represented an increase of +30% from December 2021.

Jobs market pulse

The Morgan McKinley employment monitor measures the pulse of the Irish professional jobs market by tracking the number of new job vacancies and new candidates in the Republic of Ireland each quarter.

To reflect the changing dynamics of the current employment market, Morgan McKinley are including both permanent and contract jobs in the employment monitor.

Workers want hybrid

Morgan McKinley notes that work flexibility continues to be a dominant requirement for talent across all sectors with a hybrid 2–3-day on-site option becoming the average offering of employers.

Combined housing and cost of living challenges are also having a significant impact on hiring processes. In some sectors, employers are paying for short-term accommodation.

Many employers are also starting to request local candidates only, to mitigate against housing challenges that face employees. This includes talent transferring across Ireland as there is a concern they will not be able to secure accommodation.

Daunting economic challenges

“The Christmas period can affect hiring processes which can drastically slow down, or even come to a complete halt,” explained Trayc Keevans, global FDI director at Morgan McKinley Ireland.

“However, job postings in the last quarter of 2022 overall remained stable despite the economic headwinds employers are facing. There’s little doubt that the economy faces some daunting challenges in 2023, however, the labour market is in a strong position to withstand the forecast turbulence.

“There was a steady flow of downsizing announcements and job cuts in the technology sector towards the end of 2022. However, technology talent was not always the focus of the roles being cut, and very often it was more sales, talent acquisition, and broader business support roles that were most affected. There is a sense of realism in the number of roles available in the sector going into 2023. The constant growth in technology has finally slowed (e.g., many operations benefited from the reliance on technology during the pandemic) but at Q4 2022, roles were still looking steady for 2023.

“Ireland has become less attractive to overseas technology candidates and overseas hires have also become less of a priority for Irish technology employers. Factors such as remote working options and, to a lesser extent other economic and housing crisis variables, resulted in overseas job seekers putting pause on their plans to relocate to Ireland or considering alternative locations in the short term. In addition, Ireland’s technology employers have benefitted in local hiring and have taken advantage of available personnel from multinationals already in the market.”

Keevans said the demand for cybersecurity professionals continues to rise due to the existing skills gap and the rising threat from cybercrime and this is being driven primarily by the financial services sector. There has been a shift from just being cyber aware to the development of specialist security teams. This has led to an increase in hiring and building of inhouse security teams to offset the costs incurred in engaging third party consultancy support.

The Financial Services sector has maintained consistent levels in hiring and salaries, with the mix of roles approximately 60% permanent to 40% contract. The dominant discipline for hiring continues to be across all areas of risk and compliance. There has also been growth in demand for mortgage professionals on the back of the relaxation of mortgage rules by the Central Bank for first time buyers and an anticipated increase in demand from the market, for the retail banks.

Keevans said there is sustained hiring for senior financial services talent with experience in Controlled Functions following the publication of the Central Bank (Individual Accountability Framework) Bill 2022, published July 2022, the introduction of the Senior Executive Accountability Regime (SEAR), business and conduct standards, and an improved fitness and probity (F&P) regime to improve accountability and trust in the financial services sector.

“In accountancy and finance, recently qualified accountants were in short supply over the last quarter. Many graduates are emigrating to Australia, Canada, and the United Kingdom to gain more international experience. Consequently, this is leaving a shortage of graduate accounting and finance talent. Specifically, there is a strong demand for candidates who have tax experience across all levels, as well as those who have experience in financial planning and analysis. More recently, there has been a rise in demand across the commercial banking sector for commercial accountants, finance managers, business partners, and business providers.

“Within the legal sector, in-house positions have decreased by 10-15% in the last two quarters of 2022. However, the number of roles in private practice roles has increased by a similar percentage in the same period. The last quarter saw a continuation of the trend in shortage of newly qualified lawyers who have taken to travel and work in countries like Australia, New Zealand, and the United Kingdom, as they were not afforded that opportunity during the pandemic.

“The last quarter saw strong demand for candidates with company secretarial experience as well as property and capital market law experience. Employers are also adopting more flexible working-from-home arrangements to improve their attractiveness. Flexible working arrangements remain a big draw for candidates in today’s hiring market.

“In engineering, there was an increase in demand for those with experience in automation, largely driven by a need for greater efficiency, rapid deployment, and scalability. The last quarter also saw candidates moving to the data centre industry due to higher salaries and benefits. There was also a strong demand for those with project management and process engineering expertise due to the large number of manufacturing projects currently taking place in Ireland.

“While construction is very sensitive to any downturn in the economy, the sector is currently very stressed with one in four construction jobs vacant. This is particularly the case with project managers, quantity surveyors, carpenters, and site managers as there is not the same level of talent coming through as there was before,” Keevan said.

Current most in-demand positions by discipline:

- Technology: Security Analyst, Full Stack Developer, Data Analyst, Product Manager, SOC Analyst, SOC Engineer, Software Engineer

- Life Sciences: Qualified Persons, Validation Specialists (processed cleaning or equipment validation), Quality Control Specialists, Qualified Engineers (mechanical, chemical, electrical, process engineering)

- Financial Services: Risk Manager, Compliance Manager (MIFID), Mortgage Specialist, Relationship Manager, Enterprise Risk Manager, Risk Analyst, Claims Handler, Business Change Project Managers, Project Managers, Regulatory Project Managers, ERP, Cloud Migration, Technology Delivery Managers, and Analysts (Technical and Business)

- Accountancy and Finance: Senior positions from Big Four/Top 10, Senior Tax Managers/Directors, Commercial Accountants, Finance Managers and Business Partners/Financial Business Providers

- Legal: Company Secretaries, Employment Lawyers, Corporate Lawyers, Capital Market Lawyers, and Property Lawyers

- Marketing: Internal Communications Specialist/Manager, Communications Executive/Manager, Brand Manager, Digital Marketing Executive/Manager, Brand Manager, Marketing Executive Manager, and Head of Marketing

- Engineering: Process Engineer, Project Engineer, Automation Engineer

- Supply Chain & Procurement: Planners, Buyers, Procurement and Category Managers in the IT Sector

- Multilingual: Inside Sales representatives, Customer Support, Process Analysts, and Content Moderators

- Construction: Quantity surveyors, Site Engineers, Project Managers, Site Managers, Document Controllers

- Business Support: Reception, Medical Administration, Sales Admin, Customer service, EA/PA, Office Manager, Legal admin/grads

Main image at top: Trayc Keevans, global FDI director at Morgan McKinley Ireland