An optimistic start turns to unpredictable volatility as the clouds of an economic slowdown darken, writes Conor Magee, head of Manufacturing Sector at Bank of Ireland.

“Manufacturing SMEs will remain busy in H2 2022 with priorities around cost control and increased engagement with the imperatives of green and digital agendas”

H1 2022 lookback

Irish manufacturing enjoyed a boom 2021 despite all the headwinds induced by Covid-19, Brexit, Supply Chain Pain, Transport disruptions and labour shortages. GDP for 2021 came in at 13.5% driven by export growth and all the signs were that we could look forward to bright 2022. As 2022 started, we had good reasons to be cheerful with:

- Strong order books

- Supply chain constraints starting to ease

- Covid cases starting to recede

- Container prices were dropping

- Inflation forecasts were (as it turns out incorrectly) were forecasted to be “transitory” and less than 5%

- Business confidence surveys (PWC) predicted a stronger economy in 2022 with only 15% forecasting weaker

- More bandwidth to focus on Digital and ESG agendas

Then two shocks up ended all of the above “temporary stability.”

Russia invaded Ukraine and triggered a brutal and unconscionable conflict with enormous humanitarian consequences. Secondly, large cities across China went into lockdown and essentially closed down businesses to the rest of the world.

Optimism has turned to the new norm of unpredictable volatility with new era of:

- High inflation

- Supply chain impacted by commodity shortages from Russia and Ukraine

- Rising interest rates

- Reduced and more expensive transport routes as Russia and Ukraine are no fly zones

- The risks exposed of doing business with autocracies

- Fuel inflation, shortages and fear of rationing

- First signs of drop in demand for manufacturing as consumers shift to service spend, risk adversity increases, and business confidence drops against the prospects of a deeper economic downturn

- Purchase Managers’ Index (PMI) data is trending downwards for Ireland, EU, UK and US

Notwithstanding the gloomy narrative above, Ireland will deliver +6% GDP this year, driven by manufacturing exports. Employment and opportunities remain strong in the sector. Furthermore with Covid somewhat in the rear view mirror, I have had the privilege of visiting many of our clients as well as attending in person two manufacturing events.

Despite the headwinds, the mood music is upbeat, Irish manufacturing is resourceful and in my view many SME will benefit from multinationals (MNCs) continuing to de risk and reconfigure their supply chains to something more resilient.

Summary of key trends

- Covid-19 pandemic: While COVID-19 has gone to the rear view mirror. Manufacturing will continue to double down on employee safety and wellbeing. Mindful of new variants and current rise in cases, antigen testing, workplace cleanliness will continue to minimise absenteeism and protect operations. Hybrid working models will become a permanent feature for non-shop floor employees.

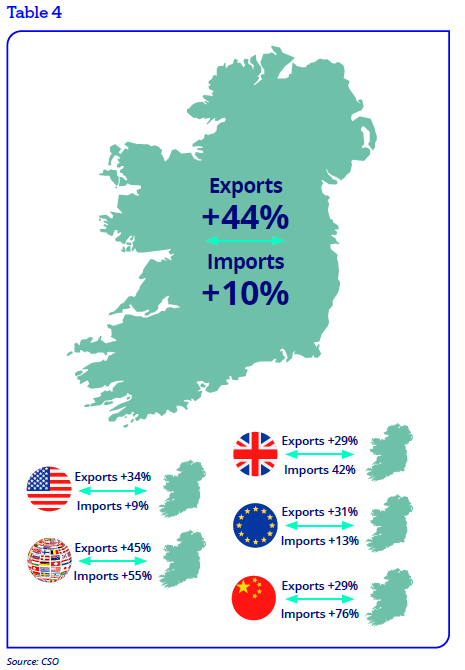

- Brexit: Depending on the level of UK exposure, businesses have been impacted to different degrees. There is of late no negative noise from Irish Manufacturing specifically in connection with Brexit. Many have benefited from new EU customers, technology transfers and unexpected higher sales volumes with the UK. The latter stems from former EU suppliers’ unwillingness to endure the paperwork burden and so Irish SMEs have been the beneficiaries. CSO data continues to underline the increase in Cross border trade with NI and shows trade up YOY (Exports + 29%) with UK. Logistics and transportation have irreversibly changed. Direct routes to EU are up from 30 to 77. Manufacturers have simply prioritised these direct and secure routes to and from EU over pre Brexit lower cost and faster land bridge alternatives.

- Russia-Ukraine conflict: Russia/Ukraine conflict has highlighted risks of:

- Key commodity bottlenecks – concentration risk

- Risk of trading with autocracies – 109K EU firms have tier 3 suppliers in Ru/Ukr.

- Accelerated the need for Strategic Autonomy e.g. chip manufacturing expansion plans in US and EU

- Factory Operations: With the headwinds of Covid and labour shortages, manufacturing has proven time and time again to be agile and creative in its response. There has been an acceleration of the digital agenda and higher levels of automation.

- Unpredictable volatility has become the new normal

- Supply Chain Resilience is top priority for manufacturing to maintain business continuity and protect reputation. The Russia-Ukraine conflict has exacerbated this headwind

- Irish manufacturing has shown remarkable resourcefulness and responded with:

- Flexibility, Just in Case, Agility now trumps efficiency and just in time models

- Stock building as insurance policy and bearing the costs of higher working capital

- Technology transfer and greater vertical integration

- Reconfigure supply chain footprint with dual and alternative supply sources

- Data Mapping supply tiers 2&3 using “digital twins” to model supply risk scenarios.

- Irish SMEs benefitting from MNC supply chain de risking strategies

- Increased online presence as fulfilment channel

- Supply Chain Disruption Costs are high: €1350m or 1.7% of revenue for 300 IE/UK companies according to survey as part of a 1500 Global sample surveyed. (Source Interos)

- Inflation will remain elevated:

- SMEs are passing on costs but not without pushback

- Given long lead times, higher price tags, lower spending capacity, consumers are delaying purchases or switching to service offerings e.g. holidays and leisure.

- 2022 Irish GDP of which manufacturing contributes 35% remains upbeat at forecast of >+6%:

- EI exports up 12% in 2021

- IDA investments are 9% up YOY H1 2022. Job approvals 2022 up YOY 44%

- PMI data latest June trends indicates slowdown in orders and production output as risk adversity, tighter spending, interest rates hikes and lower business confidence all serve to amplify fears of an economic downturn

- Labour market shortages: Addressed with increased levels of automation and in-house employee networks.

- ESG and Digital agendas are gaining more traction: Driven by a combination of digital transformation, supply chain reconfiguration, ESG metrics, regulatory compliance and higher fuel costs improving payback periods for electrification and renewable sources.

Key metrics for Irish manufacturing sector

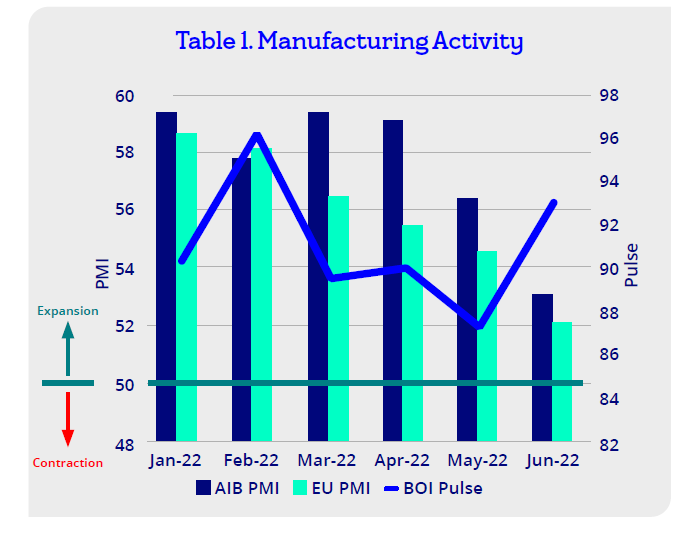

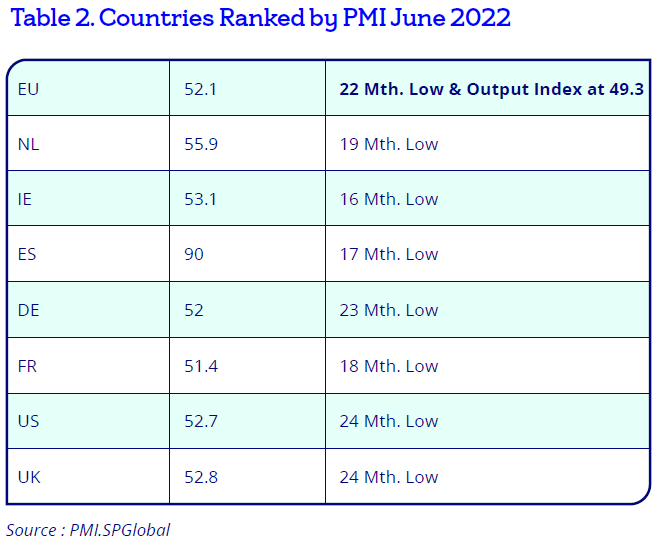

Both PMI and Pulse data show a similar pattern of slower expansion activity for manufacturing in H1 2022. A strong start in January was followed by downward trend with Russia Ukraine invasion and a strict lockdown regime in China. As per table 2 right all major economies hit PMI lows in June not seen for nearly 2 years, with EU as a whole going into output contraction mode at 49.3 just below the 50 threshold.

Bank of Ireland Economic Pulse

BOI Industry Pulse, a survey of 300 companies measured a strong 93 in June in contrast to more pessimistic PMI outlook. This possibly reflects the profile of companies surveyed but nonetheless 60% confirmed a challenging and uncertain outlook.

Irish Manufacturing Purchase Managers’ Index PMI

PMI is a survey of 250 manufacturing companies and a result greater than 50 represents expansion. Irelands PMI has declined from 59.4 in January to a 16 month low of 53.1 in June. This low is attributed to first decline in orders and output since early 2021. In particular a steep fall in export orders was noted which mirrors the sharp decline in EU and our peer countries manufacturing activity. Surging Inflation and in particular for energy shows no signs of decline in the medium term with clouds of energy security rising as we face into the heating season. On a positive side, employment remains strong and sentiment relatively upbeat.

Industrial Output, Turnover and Imports and Exports

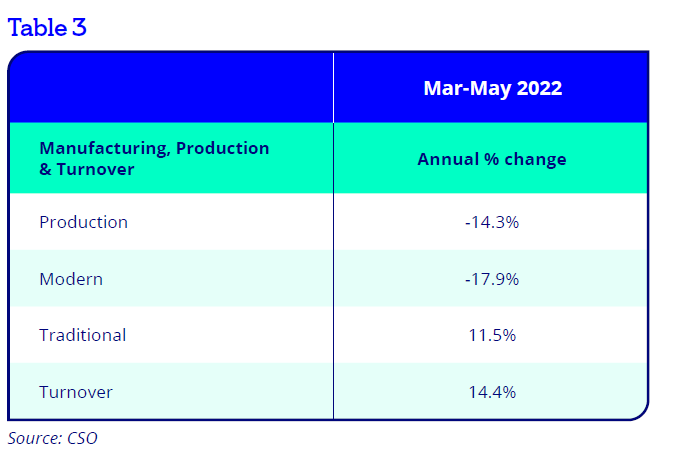

As per table 3 Industry output and turnover shows a mixed picture. Turnover YOY growth is 14.4% reflecting strong output value. However production output is down YOY by 14.3% reflecting supply chain bottlenecks.

Imports and exports performance are summarised in graphic (Table 4) for period Jan – May 2022. In totality imports were up YOY by 26% while exports are up by 34%. Manufacturing trade imports and exports were significantly up across all trading geographies including UK suggesting business adaption to the burden of Brexit. The comparison period and improvement also reflects the Covid journey from restrictions to business able to open up from start of 2022. Inflation will also have impacted with higher prices driving higher revenues. The export figures underline the strong GDP forecasts and it will be interesting to see how the slowdown in H2 will impact the full year result. At current export run rates the FY exports will be significantly in excess of €148bn recorded in 2021.

Headwinds of supply chain shortages and input price inflation with spikes in energy

Supply Chain

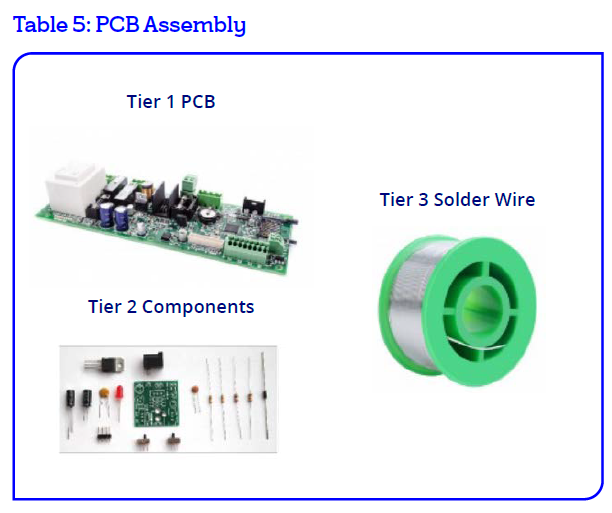

Manufacturing continues to be heavily impacted by supply chain shortages. It is reality of doing business and managing supply chain resilience remains a top priority and strategic imperative. The Russia Ukraine conflict has brought into sharp focus the necessity to go beyond tier one suppliers and dive into the deeper supply chain. Table 5 below illustrates how one commodity deeper in the supply chain can wreak havoc and disrupt deliveries.

- Multiple and continuous shocks (Covid, Lockdowns, Demand peaks, Transport Disruptions, Geopolitics) means it is no longer enough to just manage tier 1 supply chains

- A deeper dive and analysis of lower tiers is necessary to profile and mitigate risks.

- It’s not just about the

- PCB but also its individual components

- Silicon Chips but the neon gas needed for etching

- Packaging but also the paper required

- 8200 EU firms have tier 2 suppliers in Ukraine

- 190000 EU firms have tier 3 suppliers in Russia or Ukraine

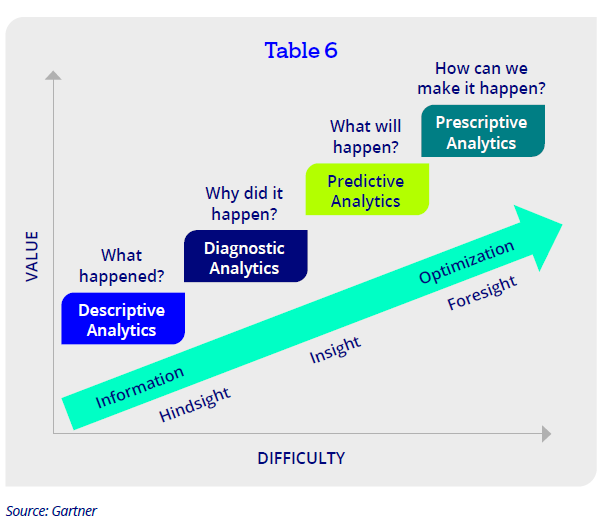

The “Best in Class” solution is lies in data and digitalisation. Creating A Digital Supply Chain Twin which is a detailed simulation of an actual supply chain in a virtual environment using real-time data to forecast a supply chains behaviours, address risks and take appropriate actions.

The more sophisticated this model becomes, and it takes time and many iterations, the better enterprises can predict, manage and mitigate risks as per table 6. As the data quality improves, data analytic tools allow model creation scenarios from a Hindsight perspective to a Foresight one.

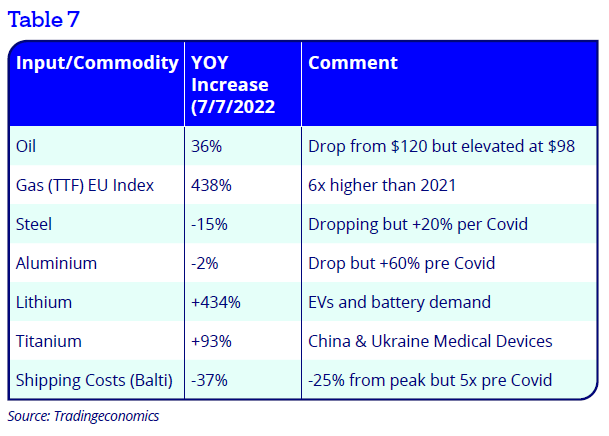

Manufacturing input price inflation

Surging inflation and cost of living crisis are the major headwinds of 2022. Many commentators forecasted a “transient” nature which would correct itself as supply and demand reached equilibrium. While energy spikes caused by the conflict make up about half of the overall rate of June inflation figure of 9.1%, many of the other inputs remain elevated. Table 7 left summarises the YOY changes for some key inputs.

How is this playing out in manufacturing? Well consumers are switching to services rather than making big purchases. There is also a pent up demand for leisure and holidays after Covid lockdowns and this has manifested itself in busy airports and accompanying chaos. The medium term impact is higher risk adversity as business and consumers will delay spending to see how inflation drivers in particular energy play out.

Funding activity in Manufacturing Sector

- Bank of Ireland Business Banking H1 2022 drawdowns are up YOY reflecting positive activity.

- Activity was strong across both traditional sectors (Metal fabrication, timber) and modern sectors (Pharma, Medical Devices, ICT).

- Funding supported increased working capital needs, M&A and MBO activity and capex requirements to accelerate growth on back of robust market demand.

- Working capital requirements were seen in stocking loans to allow higher component stocking and act as an insurance policy against supply shortages and inflation.

- Deposits are high on back of buoyant activity and this dampens appetite for borrowing.

- Noteworthy deals were completed across Pharma, ICT, Precision Engineering, Circular Economy, Plastics.

Survey Update – Business is more tuned into the importance of risk management

- Recent PwC survey of 3584 businesses. Key findings are:

- 81% of Irish respondents predict revenue growth in next 12 months.

- 78% of Irish respondents (65% global) are increasing their spend on risk management with data analytics and process automation being the top spend areas.

- 66% of Irish respondents (75% global) struggle with the speed of digital transformations

In summary the overriding takeaway is that risk management viewed through a panoramic lens must be an integral part of business strategy in this new age where uncertainty is the new normal.

Industrial property demand

CBRE in its latest research, reported that Q1 2022 was the strongest first quarter ever recorded in the Dublin industrial & logistics market with more than 96,500m2 of transactions signed in the three-month period and demand having risen quarter-on-quarter to more than 197,350m2.

The uncertain inflationary environment is exacerbating the supply demand imbalance. Notwithstanding same new developments have been announced along M50 and elsewhere with buildings with strong ESG credentials in high demand.

Manufacturing H2 2022 Outlook – Risk adversity, Unpredictability but Continued Growth

Despite the headwinds and clouds of uncertainty around geopolitics and inflation, the outlook for H2 2022 continues to be positive and one of continued moderate growth. Supply chain disruption and the never ending journey to optimise resilience is a strategic imperative. Recent study conducted by the Economist summarised the pillars of supply chain resilience around the opportunities of digital and ESG as follows:

- Regionalise your supply chain

- Switch procurement goals from cost cutting to containing inflation

- Mitigate supply chain financial and operational risk

- Engage suppliers to track and slash scope 3 emissions

- Implement low/no code software with real-time analytics to forecast disruptions

The good news is that Irish manufacturing SMEs many of whom are the drivers and engine of our MNCs success are active in all of above. There are multiple supports available for both digital transformation ( SIRI – Smart Industry Readiness Index survey from Irish manufacturing research) and green initiatives (SBCI Energy efficiency loan scheme)

Tailwinds 2022

- Strong healthy order books and solid output levels all support, albeit lower than 2021, continued growth across manufacturing.

- 2022 GDP outlook ranges from 6% to 8% with EU forecast at 2.7%.

- Irish manufacturing momentum buoyed by strong EI exports H12022 and IDA FDI up 9% in 2021.

- Irish manufacturing SMEs should also benefit from MNCs continued de-risking and diversifying of their supply chains.

- The shocks of fuel inflation and shortages will accelerate conversion to greener alternatives.

- Some inflation impacts are being successfully negotiated with customers

- Digitalisation transformation gathers pace as enterprises recognise more and more the value of data to build more resilience into their supply chains.

- Wide range of financial supports available for both digital and green transformation.

- Record spending on research projects with 66% with Irish SMEs with a total of 143 spin out companies employing 1218 people since 2017.

Headwinds 2022

- Latest June PMI data points to a slowdown in growth. EU PMI recorded first contraction in production output in June.

- June trends indicates slowdown in orders and production output as risk adversity, tighter spending, interest rates hikes (expected at 0.5% from ECB on 21.7.22) and lower business confidence all serve to amplify fears of an economic downturn.

- An increasingly toxic mix of surging inflation, unprecedented fuel costs, ongoing supply chain disruptions and interest rate hikes, are all eroding consumer spending power and dampening consumer demand. The term “demand destruction” is replacing very recent high demand in many sectors.

- Bank of America’s latest fund manager’s survey, record that 86% of global investor respondents expect Europe to slump into recession in the next 12 months. This is up sharply from 54% recorded in previous month.

- There is also shift to services spend as consumers are prioritising spends on hospitality and leisure after the Covid lockdowns.

- Supply chain pain is likely to continue through H2 2022 and any easing will be driven by a drop in demand.

- Inflation of manufacturing inputs, Materials, Freight, Energy will continue elevated.

- Labour inflation and competition for talent will continue in H2 2022 as the immediate priority will be customer orders fulfilment. Solutions such as automation and remote working talent will continue to evolve.

- Cyber-attacks are growing in frequency and sophistication and must be integral to risk strategy

- Manufacturing SMEs will remain busy in H2 2022 with priorities around cost control and increased engagement with the imperatives of green and digital agendas.