Despite the multiple headwinds of 2022, Irish manufacturing delivered a record performance. However 2023 will see a return to more modest growth, says Conor Magee head of Manufacturing Sector at Bank of Ireland in his H2 2022 Insights and H1 2023 Outlook for the sector.

A year of growth, war, geopolitics, China lockdowns, inflation, energy security risks, growing risk adversity and the new accepted norm of unpredictable volatility.

“Manufacturing SMEs are likely to be very busy again in 2023 but hopefully with more bandwidth to spend on important green and digital agendas”

Irish Manufacturing started 2022 on an optimistic note with COVID-19 receding, Brexit in the rear view mirror, supply chain pain moderating, high order books and a positive outlook for more stable operations following 2021 turbulence.

Just as manufacturing eased back from firefighting mode to a more strategic focus, two shocks disrupted this new found “temporary stability”. Russia invaded Ukraine and triggered a brutal and unconscionable conflict with enormous humanitarian consequences. Secondly, large cities across China went into lockdown and essentially closed down businesses to rest of the world.

Early optimism was short lived and Manufacturing was confronted with the new norm of unpredictable volatility. A whole new set of headwinds entered the already full agenda including:

- Commodity shortages and associated inflation from Russia and Ukraine

- “Hidden” supply chain bottlenecks as Manufacturing grappled with lower tiers of supply

- China lockdowns continue to impact

- The risks exposed of doing business with autocracies

- Reduced and more expensive transport routes as Russia and Ukraine are no fly zones

- Trade sanctions

- Energy security, shortages and fears of rationing

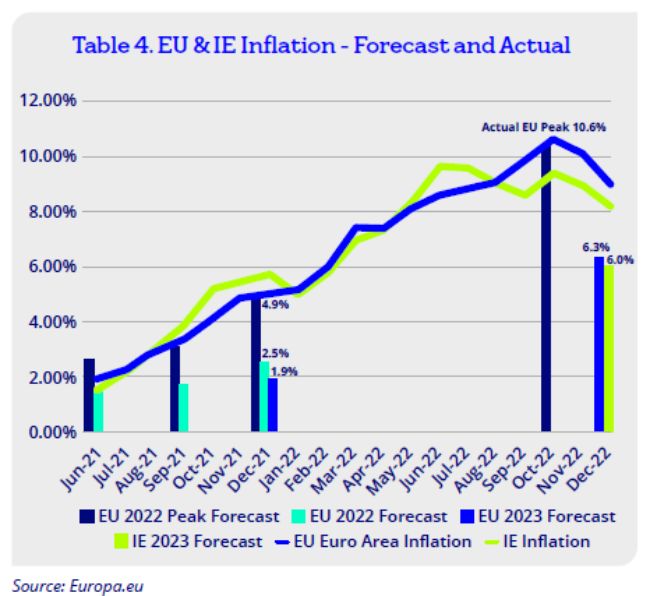

- Persistent High Inflation with actual measure double that of start of year forecasts

- Demand for manufacturing goods drop as consumers shift to service spend, risk adversity increases, and business confidence drops against the prospects of a deeper economic downturn

- Purchase Managers’ Index (PMI) starts to trend downwards for EU, UK, US from Jul. and for IE from Nov.

- Rising interest rates

Despite these “headwinds”, Irish Manufacturing has delivered a stellar performance in 2022 with huge resilience dividends acquired during the 2021 “adjustments” to COVID-19 and Brexit. Multi-National Corporations (MNCs) and Small to Medium Enterprises (SMEs) across Manufacturing have delivered a record set of numbers to the Irish economy including:

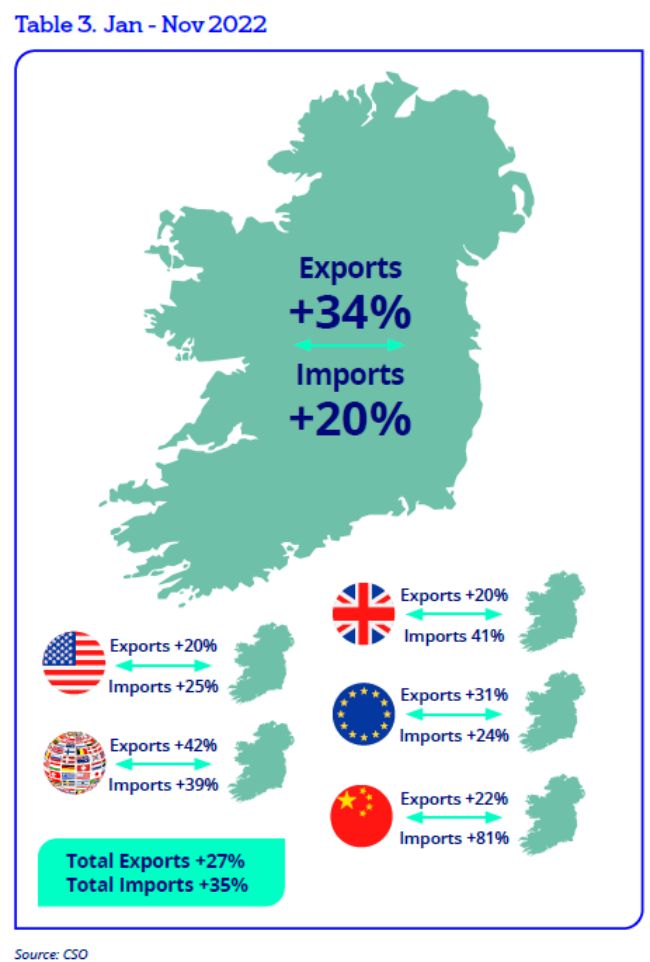

- Value of Irish exports are up year-on-year by +27%

- Corporation tax overall is up by 50% to €22.6BN of which ca. €5BN is attributable to Manufacturing

- MNC Employment grew 9% to highest level of 301K

- SME/ Enterprise Ireland Employment grew 5% to 218K

- Employment in Manufacturing stands at 260K up from 230K in 2018

- Manufacturing are embracing the Green Agenda driven in part by energy security

- SMEs proven to be the engine of MNCs and Manufacturing growth

2023 will see a correction to flat and best case moderate growth depending on subsector. Employment and opportunities will remain strong in the sector. The green agenda is one of those opportunities and will gain momentum as businesses move from plans to action to compliance with regulations and customer expectations. Investment in automation and digitalisation will gain ground. Irish manufacturing SMEs will continue to benefit from MNCs continuing to de-risk and reconfigure their supply chains to something more resilient. In summary, 2023 is a mixed picture for manufacturing characterised by a kaleidoscope of slower growth, moderating orders, reduced business confidence, macroeconomic uncertainty, the impact of all of which are all dependent on subsector health and the economic performance of our trading partners. The era of predictable unpredictability is here to stay.

Summary of Key Impacts

- COVID-19 Pandemic: While COVID-19 has gone to the rear view mirror, Manufacturing will continue to double down on employee safety and wellbeing. Mindful of new variants, antigen testing and workplace cleanliness will continue to minimise absenteeism and protect operations. 2023 will be a year where hybrid working models become “operational”. Given the “problem solving, innovation and collaboration” culture of Manufacturing, businesses will strive to maximise employees’ presence onsite.

- Brexit: Exposed Irish Manufacturing has adjusted and there is of late no negative noise from players specifically in connection with Brexit. Many have benefited from new EU customers, technology transfers and unexpected higher sales volumes with the UK. The latter stems from former EU supplier unwillingness to endure the paperwork burden and so Irish SMEs have been the beneficiaries. CSO data continues to underline the increase in cross border trade with NI and shows trade up YOY (Exports + 20%) with the UK. Logistics and transportation have irreversibly changed. Direct routes to EU are up from 30 to 77. Manufacturers have simply prioritised these direct and secure routes to and from EU over pre-Brexit lower cost and faster land bridge alternatives. The concern now has shifted to the UK economy recession and how that will impact demand.

- Russia Ukraine Conflict: Sadly the Russia Ukraine conflict continues. It has highlighted risks of:

- Key commodity bottlenecks – concentration risk

- Risk of trading with autocracies – 109K EU firms have tier 3 suppliers in Russia Ukraine.

- Accelerated the need for Strategic Autonomy e.g. chip manufacturing expansion plans in US and EU

- Factory Operations: With the headwinds of energy inflation and labour shortages, Manufacturing response has been twofold. Behavioural and shift pattern changes to optimise energy usage (see more under ESG section) and an acceleration of the digital agenda and higher levels of automation.

- Unpredictable volatility has become the new normal

- Supply Chain Resilience is top priority for manufacturing to maintain business continuity and protect reputation. Russia Ukraine conflict has exacerbated this headwind

- Irish Manufacturing have shown remarkable resourcefulness and responded with:

- Flexibility, Just in Case, Agility now trump efficiency and Just In Time models

- Stock building as an insurance policy, and bearing the costs of higher working capital

- Technology transfer and greater vertical integration

- Reconfigure supply chain footprint with dual and alternative supply sources

- Data Mapping supply tiers 2 & 3 using “digital twins” to model supply risk scenarios.

- Irish SMEs benefitting from MNC supply chain de risking strategies

- Increased online presence as fulfilment channel

- Supply Chain Disruption Costs are high. €1,350m or 1.7% of revenue for 300 IE/UK companies according to survey as part of a 1500 Global sample surveyed. (Source: Interos)

- Inflation has eased to 8.2% in Dec. 2022 but will remain elevated in 2023

- SMEs are passing on costs but not without pushback

- Given long lead times, higher price tags, lower spending capacity, consumers are delaying purchases or switching to service offerings e.g. holidays and leisure.

- 2022 Irish GDP of which Manufacturing contributes 35% is forecast at +7.9%. 2023 at 3.2%

- Manufacturing exports up 27% in 2022

- IDA FDI growth with 242 investments won in 2022

- Purchase Managers Index (PMI) data. Latest 2022 Q4 contraction trends are driven by slowdown in orders and production output. Higher risk adversity, tighter spending, interest rates hikes and lower business confidence all serve to amplify fears of an economic downturn.

- Labour market shortages. Addressed with increased levels of automation and in-house employee networks. Tech. job losses may ease certain skill shortages in manufacturing.

- ESG and Digital agendas gained momentum in 2022. Driven by a combination of digital transformation, supply chain reconfiguration, ESG metrics, regulatory compliance and higher fuel costs improving payback periods for electrification and renewable sources.

Key trends and metrics for Irish manufacturing sector

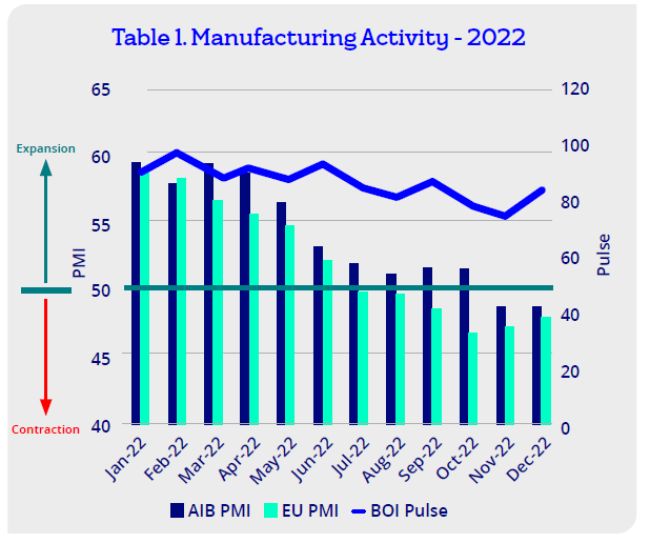

Both PMI and Pulse data show a similar pattern of early strong expansion followed by contraction, first in EU in July and then in Ireland from November. These sub 50 readings are driven by mainly falling new orders but this negative impact is somewhat mitigated by high order backlogs which are keeping output at strong levels. The concern is that new orders will not replenish order books fast enough to return to expansion territory. However both a welcome drop in inflation in December, and an easing of downturn in EU during Q4, offer fragile prospects of a return to growth in the medium-term.

Bank of Ireland Economic Pulse

BOI Industry Pulse is a survey of 300 companies measured a high of 96.2 in February reflecting strong orders, output, business optimism and growth in employment in the sector as vaccines rolled out and global economies return to pre pandemic expansion mode. This has since dropped by more than 20 points to 74.8 in November reflecting the slowdown and growing negative outlook.

Irish Manufacturing PMI

PMI is a survey of 250 manufacturing companies, and a result greater than 50 represents expansion. From a high of 59.4 in Q1, the measure has seen a downward trend and into contraction territory of 48.7 in Q4 as orders decline and demand weakens. The concern is that this scenario drags on into Q2 and starts to impact employment and output levels.

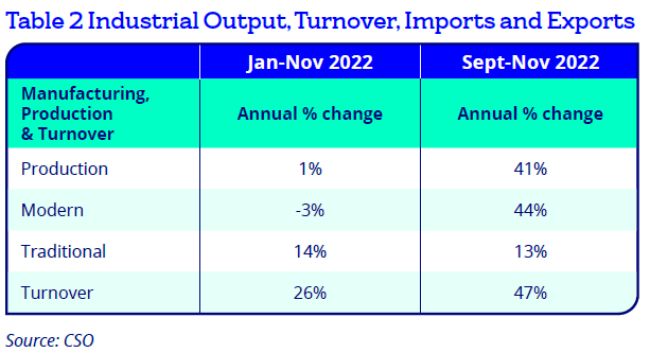

Industrial Output, Turnover, Imports and Exports

As per table 2 Industry output and turnover shows YOY growth. While the YTD figures show marginal overall growth in output at 1%, the most recent 3 months data from Sept. to Nov. shows high growth in both sectors at 41% but in particular at 44% concentrated in the modern sectors of Pharmaceutical, Medical Devices and ICT. Manufacturing turnover annual growth is strong at 26% and aligns with the export performance reviewed below.

Imports and exports performance are summarised graphically (Table 3) for the period from Jan. – Nov. 2022. 2022 was a record year with total exports at €175Bn up 27% from €136Bn in 2021. Imports were up YOY by 35% to €106Bn from €77Bn. These dramatic increases can be explained by a combination of volume, inflation and stockpiling in the case of imports. Volumes are up with all trading partners including the UK, underlining the fact that Brexit has not had in totality a negative impact on trade. In terms of commodities, Chemicals/Pharma/Medical Devices and Transport/Machinery were the largest contributors to growth in both imports and exports.

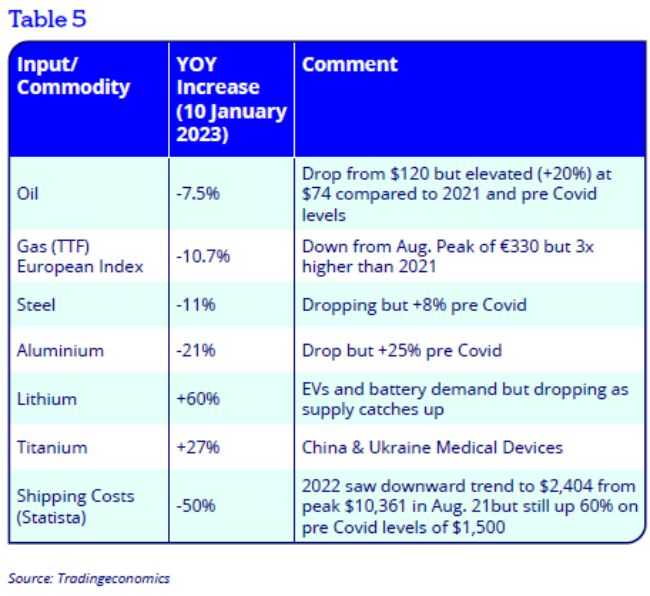

Manufacturing Input Price Inflation

Surging inflation and the cost of living crisis were the major headwinds of 2022. Many commentators forecasted a “transient” nature which would correct itself as supply and demand reached equilibrium. Indeed as Table 4 shows, forecasts this time last year were about 50% of actual peaks with EU inflation peaking at 10.6% and Ireland inflation at 9.4%. Energy spikes caused by the conflict make up about half of the overall impact. The good news is that inflation is easing, down to 8.2% in December, triggered by milder winters, energy storage and interest rate hikes. However, it is forecasted to remain elevated at around 6% in 2023 before falling to around 3% in 2024.

Table 5 summarises the YOY changes for some key inputs. Although the downward trend is positive, the reality is that a residual inflation impact remains with most input prices still elevated when compared to pre pandemic levels. In the absence of full price increase offsets, Manufacturing will see margins adversely impacted during 2023 before a correction in the price / cost equation in 2024.

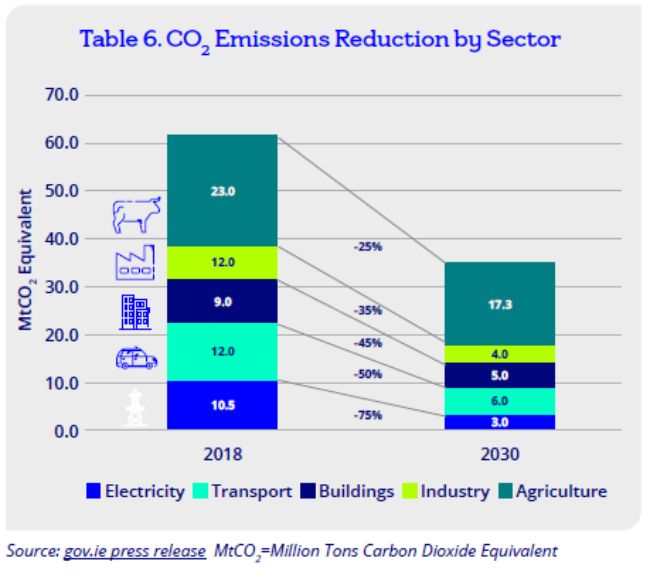

ESG – 2023 the year when Carbon targets are mandated

2023 is the year when compliance with carbon targets is no longer optional as it becomes a legal and regulatory requirement.

Carbon targets published on 28th July 2022 for Ireland are shown in Table 6. Manufacturing accounts for about 12% or 7 MtC02e of total emissions and the 2030 target is a reduction of 35% to 4 MtC02e. This will be achieved by a combination of carbon reducing activities including

- Carbon neutral heating and energy sources

- Zero polluting emissions

- Electrification of internal logistics

- High energy efficient capital equipment

- Low carbon footprint supply chain (Scope 3 emissions)

- Waste management strategy

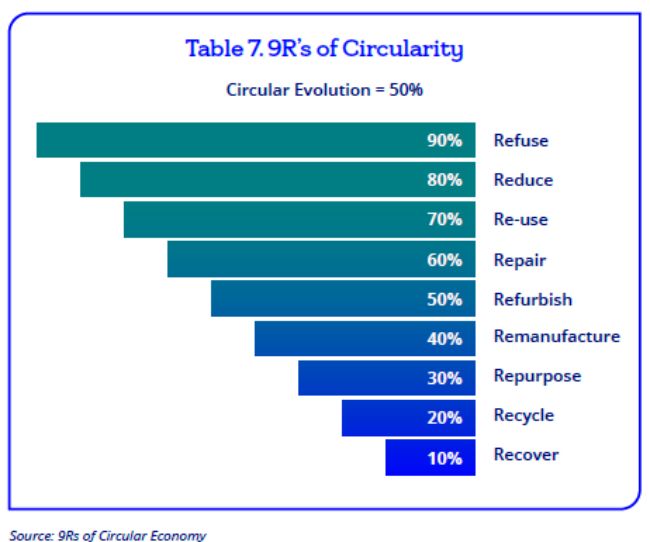

- Circular Economy strategy including a transition to 9Rs (Table 7)

Table 7 highlights that maximum Green benefit is achieved when material is designed out of a product while minimum benefit is achieved from recycle and recover, as carbon effort for both is high relative to the gain.

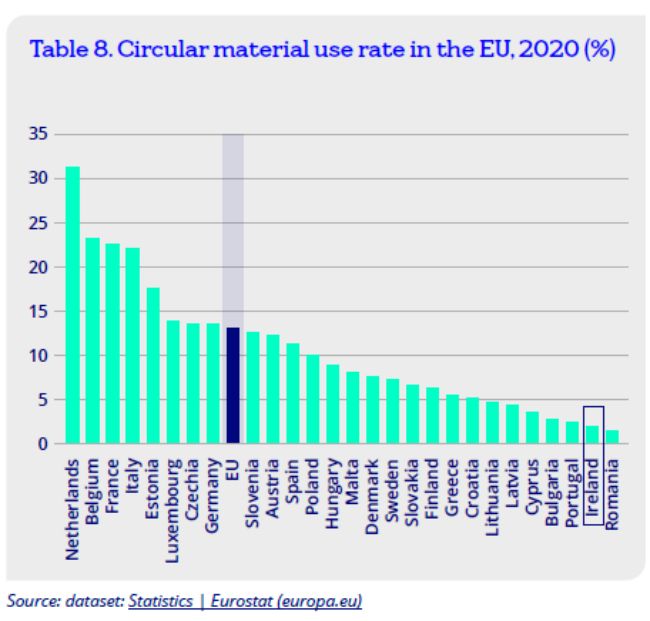

Ireland Circular Economy Act became law in July 2022 and provides for the development of a Circular Economy (CE) strategy, a Fund, targets and a levy on certain single use items e.g. paper coffee cups.

Table 8 shows that Circular Economy in Ireland accounts for less than 2% of materials consumed getting a second life when compared with the EU average of 12%. So the only way is up and represents a huge opportunity for Irish Manufacturing to pivot away from linear models and demonstrate to their customers the value of circularity.

Looking at the ESG/CE challenge through a lens of optimism and opportunity, it is important to note many positive developments to accelerate the Green Agenda.

- Over 2,250 Companies are signed up to the Science Based Targets Initiative (SBTi): 1/3 of Global Market Capitalisation.

- Companies with SBTs have collectively reduced carbon by 29% since 2015.

- Bank of Ireland joined this cohort in Dec. 2022 with its ESG goals validated by the SBTi

- The economics of renewable energy fuels continues to improve with 163 gigawatts added in 2021.

- Wind energy electricity accounted for 34% of needs in 2022, a saving of €2Bn for gas and will continue to scale subject to planning and grid constraints

- Triggered in part by energy inflation and security of supply, 2022 saw a noticeable uptick in Manufacturing embracing the Green Agenda:

- Behavioural Changes – shift planning, switching off, energy cost awareness

- CapEx projects in renewable energy sources – heat pumps and solar panels

- Price increases to customers where possible

- Avail of Government supports

- Marketing their “Green credentials” with customers

In summary, while the targets remain daunting and challenging, and pace is still too slow, a lot is happening to move the needle. Recent research by UCC/Microsoft/ERI – “Assessing the Readiness of Irish Businesses” – a survey of 380 businesses, showed that only 43% of businesses have a Sustainability Policy in place. The more we can do in this decade, the higher the down payment will be toward net zero CO2 emissions by 2050.

Funding activity in the manufacturing sector

- Bank of Ireland Business Banking 2022 drawdowns are ahead of 2021 levels reflecting the buoyant activity.

- Funding was dominated by working capital followed by M&A, MBO transactions and capital expenditure.

- With longer end-to-end cash conversion cycles due to extended supply chain lead times, businesses are in need of higher working capital requirements. BOI have supported a number of such cases with stocking loans where enterprises have no choice but to move from Just In Time models to Just In Case ones to safeguard continuity of supply and mitigate inflation risks.

- In subsectors, we saw positive developments in Green-related transactions, medical devices, pharma and technology.

- Strong sales, cash generation, have seen deposits rise. This combined with Negative Interest Rates (NIR) on deposits, has seen a lower appetite for funding across SMEs. Demand for funding continues to fall and is down 4 points (20% to 16% of firms) YOY according to a survey of 1,500 SMEs that was released in September 2022.

Manufacturing 2023 Outlook – Optimism, Unpredictability and at best Moderate Growth

Key Sector 2023 Trends

- PMI < 50 likely to continue into Q2 as Orders Intake rate declines further

- Most Inputs’ inflation including energy have eased but remain elevated impacting margins

- Threat of Stagflation – lower demand and rising prices

- The EU downturn is easing back, US recession forecast to be mild, China comeback forecast in H2

- Optimistic Ireland forecast is flat to moderate growth and dependent on subsector

- Pharma, Medtech, ICT and Modular Construction sectors remain strong

- Strong employment

- ESG opportunity as targets go mandatory

Business Sentiment and what is driving it

- Cautious optimism coupled with a greater risk adversity

- Rising interest rates and recession clouds will amplify scrutiny on investment decisions.

Regulatory Changes

- Mandatory ESG targets & demand from MNCs will drive Green compliance across SMEs

In summary and in the absence of “black swan events”, the outlook for 2023 is flat to moderate growth with H1 in contraction and a stronger H2 as major economies in the EU, US and China gain recovery momentum. Irish manufacturing fundamentals remain strong with high employment, and Green and digital opportunities to the fore.

Growth Outlook sentiment hangs in the balance of Geopolitics and Macroeconomic Volatility

PWC’s 26th Annual CEO 2023 survey of 4,410 CEOs underlines the global volatility and unpredictability we find ourselves in. Key findings are:

- 75% see declining growth in 2023 as an almost asymmetric result to 2022 when 73% saw improving growth.

- Reinvention is a strong theme with 40% believing that their business will not remain viable within a decade if they stay on current path.

- Manufacturing signal top three disruptors of, Changing customer demand, labour shortages, supply chain.

- Roughly 60% of respondents have progressed carbon reduction and greener innovations within their organisations, while 50% see the impact of same in higher costs and reconfigured supply chains.

Eurochambres, the association of European Chambers of Commerce and Industry, published its survey EES2023 of 42,000 companies in 25 European countries. Results and top challenges are summarised in Table 9 and are in stark contrast to 2022 with business confidence for 2023 at a historic low. Within this negative aggregate result of 25 countries, it is important to note that Ireland results for business confidence are in the positive green zone as per Table 10.

In summary, the majority belief among respondents is things may get worse in 2023 before they get better.

Table 9: Source: Eurochambres.eu

Table 10: Source: Eurochambres.eu

Industrial Property Demand

CBRE in its latest research, reports a strong year in 2022, albeit lower than the record 2021 for Industrial and Logistics property, driven by strong demand and lack of supply.

Table 11: Source: CBRE

Tailwinds 2023

- Irish Manufacturing is hugely resilient with enormous positive dividends gained by shocks of COVID-19, Brexit and Ukraine serving it well to navigate the uncertainty of 2023.

- SMEs have benefited from MNCs reconfiguring their supply chains to local and more secure partners

- SMEs have benefited from vertical integration changes in response to supply chain headwinds.

- The shocks of energy inflation and shortages are accelerating conversion to Greener alternatives.

- Some inflation impacts are being successfully negotiated with customers and headline value is easing

- GDP outlook at 3.2% with the EU forecast at just 0.3%

Headwinds 2022

- Supply chain pain has moderated but requires continuous resilience improvements

- Input costs remain high and are putting margins under pressure

- Labour shortages and competition for talent in a tight market continues

- Stronger threat of recession in trading partner countries and with that risk of contagion.

- Manufacturing SMEs are likely to be very busy again in 2023 but hopefully with more bandwidth to spend on important green and digital agendas.

Main image at top: Photo by Clayton Cardinalli on Unsplash