Irish manufacturing remains upbeat about future growth and opportunities, notes Bank of Ireland’s head of Manufacturing Sector Conor Magee.

“Irish manufacturing is agile, well used to navigating economic cycles, and the optimistic view for 2024 is a return to modest growth”

2023 Insights

2023 was a year of of contraction, lower inflation, economies defying gravity, strong employment, growing conflicts, complex geopolitics, the hottest year on record, a growing realisation that ESG carbon targets are under serious threat and Artificial Intelligence

Contraction: Irish Manufacturing started 2023 on an asymmetric mix of optimism and caution. Optimism on the back of record performance in 2022, but caution as global demand slowed. EU manufacturing has been a full year in contraction, with sluggish demand and new orders, while Irish Manufacturing has fared much better with only moderate contraction coming off a record 2022 performance.

Lower Inflation: Interest rate hikes have had the desired effect with inflation falling back. The reality is though that input prices remain elevated and Manufacturing must have a laser focus on cost and margin improvement.

Economies Defying Gravity: Most commentators forecasted a global recession in 2023. Yet GDP growth was 3% (The Economist 17.12.23). Yes some economies like Germany did go into recession. However somehow US with high interest rates, defied the economic logic of high inflation reduces demand, which in turn increases unemployment. The opposite has been true.

Strong Employment: Employment has remained strong in 2023 in Ireland and US. However this is a lagging indicator and signs are that without a material upturn in demand, Manufacturing including Ireland will cut capacity. November 2023 EU PMI report noted that “Employment falls for first time in almost three years as eurozone downturn continues.”

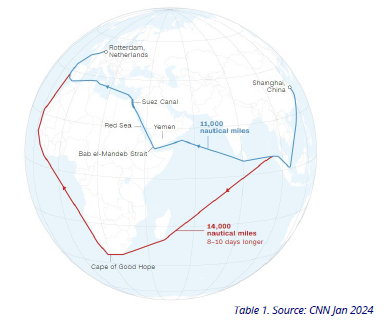

World Conflicts: Ongoing conflicts in Ukraine and The Middle East with no clear pathway to resolution create huge uncertainty and trigger a slowdown in consumption and demand for goods. The Middle East crisis has opened a whole new supply chain uncertainty for manufacturing with container ships rerouting away from the Red Sea adding significant time and cost to manufacturing inputs.

Complex Geopolitics: 2023 saw an increase in the risks and uncertainties for manufacturing associated with geopolitics. A growing move away from globalisation to protectionism because “business trust” is broken, creates tension between trading partners. VUCA – Volatility, Uncertainty, Complexity, Ambiguity, is the new norm.

ESG and Climate Change: 2023 will go down has the hottest year on record. The urgency of the crisis is not matched by the pace of change. Carbon Targets are not on track and Intent to address is not matched by action.

Artificial Intelligence: ChatGPT, Generative AI and Large Language Models entered our collective minds in 2023.

Despite the challenges above, Irish Manufacturing has delivered a solid performance in 2023:

- 2023 Value of Irish exports are down YOY by 5% but up on 2021 by 21% (CSO)

- Corporation tax receipts totalled €23.8BN overall, up 5.3% YOY (Gov.ie) with ca. €10BN attributable to Manufacturing

- MNC Employment stayed above 300K with 248 new investments (IDA Ireland)

- SME/Enterprise Ireland Employment grew 3% to 225K (Enterprise Ireland)

- Employment in Manufacturing stands at 271K+ up from 230K in 2018 (CSO)

- Manufacturing are embracing the Green Agenda driven by MNC demands, and strategic imperative

- SMEs proven to be the engine of MNCs and Manufacturing growth

The optimistic view, sentiment and ambition is that Manufacturing contraction has hit a turning point and that 2024 will see a return to at best moderate growth. However the turning point is recent, weak and vulnerable to ever more risky geopolitics. A prolonged contraction, may trigger capacity reductions and a drop in employment levels cannot be ruled out.

Summary of Key Impacts

Democracy: This will continue as a complex picture of economies moving away from mutual benefit of globalisation to national gain of protectionism. It is impossible to predict how it will play out. 2024 will test democracy as an estimated 4 billion people in more than 50 nations – 50% of the world’s population – will vote in national elections.7 The outcomes are likely to shape global politics for years to come. Irish manufacturing is in a strong position to navigate the potential impacts of above given the deep roots of both the MNC and SME manufacturing community.

Brexit: Exposed Irish Manufacturing has adjusted and there is no negative noise from enterprises specifically in connection with Brexit. The dominating narrative now is the impasse in NI and the “buyer’s remorse” wider acknowledgment that Brexit has not worked and according a report from Cambridge Econometrics has cost the UK economy £140Bn so far. According to a Dec. 2023 NCSR (National Centre for Social Research) poll a majority are now in favour of re-joining the EU. (Renatus)

Russia Ukraine & Middle East Conflicts: Sadly both conflicts show no sign of resolution. Supply Chain logistics has been disrupted again with the effective closure of the Red Sea route(Table 1). This accounts for 15% of global trade will add 10- 15 days to shipping routes cost driving up manufacturing input costs (CNN).

Factory Operations: With the headwinds of energy inflation and labour shortages, Manufacturing response has been twofold. Behavioural and shift pattern changes to optimise energy usage (see more under ESG section) and an acceleration of the digital agenda and higher levels of automation.

Predictable Unpredictability has become the new normal.

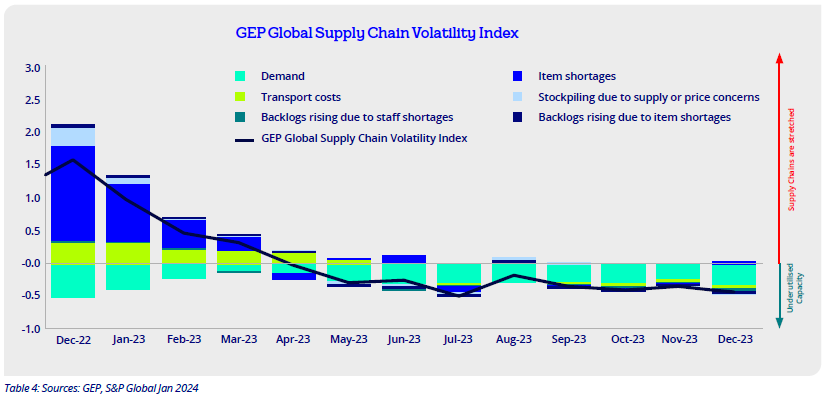

Supply Chain Resilience continues a top priority for manufacturing to maintain business continuity and protect reputation. The bittersweet news is that supply chain constraints are easing with Global Supply Chain Volatility Index GSCVI (GEP) at -0.44 down from peak “bottleneck” values in 2021 of >6. As noted above the latest body blow now playing out is the Red Sea blockage.

Inflation has eased from high of 7.5% to 2.5% in November 2023 but back to 3.2% in December (CSO):

- Pressure on SMEs to reverse earlier price increases

- Consumers are justifiably pausing consumption as some big ticket items like electric vehicles are falling in price

Labour market shortages: Economy is at full employment and shortages of key technical skillsets are still the case. These are being partly addressed with increased levels of automation, and in-house employee networks. Availability of affordable accommodation remains a key barrier to attracting talent and some business owners have become landlords. The “abundance” of manufacturing activity is not matched by infrastructure needs of housing, transport, grid capacity.

ESG, Digital and AI agendas gain momentum in 2023. All driven by a combination of digital transformation, supply chain reconfiguration, ESG metrics, regulatory compliance and higher fuel costs improving payback periods for electrification and renewable sources.

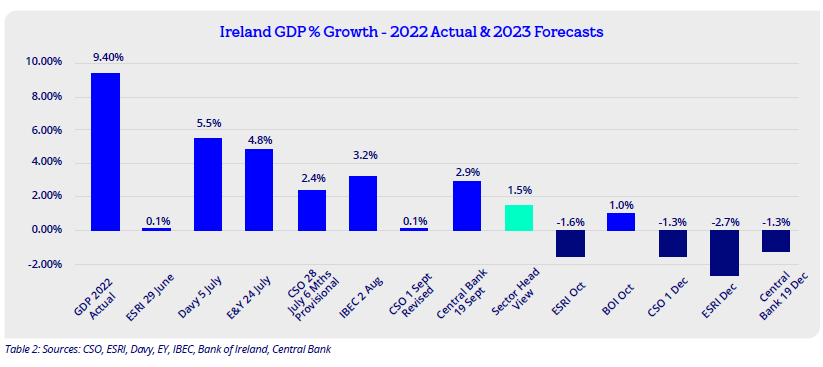

2023 Irish GDP Forecasts ranged from widely optimistic to more data driven results as commentators repeatedly downgraded their outlook. In 2022 Irish Manufacturing delivered export growth of 26% and close to 40% of total GDP. Ireland delivered 9.4% GDP growth in 2022 of which Manufacturing contributed about 4%. Given the above dependency of the economy on Manufacturing combined with 5% lower exports, it is likely that the 2023 year-end outcome will be in the red zone (Table 2).

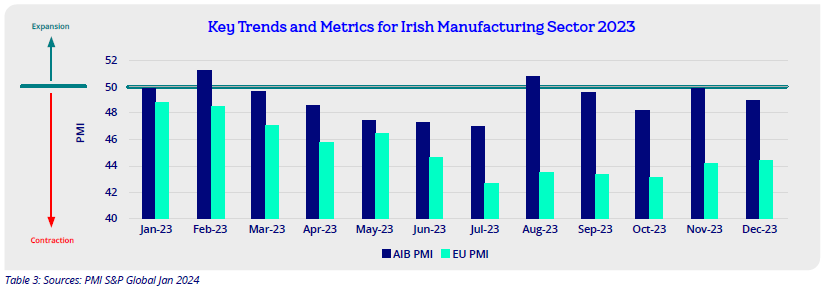

Purchasing Managers Index (PMI) data: 2023 has been a year of contraction with latest December PMI at 48.9 driven by falling orders and lower production output. Higher risk adversity, tighter spending, elevated interest rates and muted business confidence all serve to amplify fears of an economic downturn in 2024.

Artificial Intelligence went mainstream in 2023: ChatGPT, Generative AI and Large Language Models entered our collective minds and lexicons in 2023. It is the dominant theme of the 2024 World Economic Forum Annual Meeting at Davos. Global CEOs are excited about 20%+ productivity improvements, but that comes with heightened concerns around job losses, existential risk to humans and the pervasive increase in disinformation. The reality is that nobody can keep up with the pace of change but manufacturing must find ways of navigating the opportunities that AI presents which in the end are human centric and deliver Amplified Intelligence to their business.

Irish Manufacturing PMI

PMI is a survey of 250 manufacturing companies. A result greater than 50 represents expansion. Ireland has spent most of 2023 in mild contraction with an average score of 49. By comparison, our biggest market, the EU, has averaged much lower at 45 with significant new order decline and weaker demand. Latest data suggests a fragile upward turning point but this needs to be sustained into H1 2024 to avoid capacity adjustments and employment impacts (Table 3).

Global Supply Chain Volatility Index (GSCVI) (Table 4)

The GEP Global Supply Chain Volatility Index, based on data derived from a monthly survey of 27,000 businesses, has fallen from the dizzy heights of 6 to -0.44, or, its lowest level since May 2020.

This dramatic fall points to:

- Weaker demand for raw materials, commodities and components

- A lower inventory requirement to buffer above

- Reduced material shortages

- Easing of labour demands and risk of unemployment in sector rising

- Transport costs return to normal

- Downward price pressure

In summary the latest data signals persistent weakness in the global economy with recessionary conditions prevailing in Europe.

While sentiment going into 2024 may be positive as data indicators slowly improve, it continues to be overshadowed by geopolitical shocks which show no sign of abating.

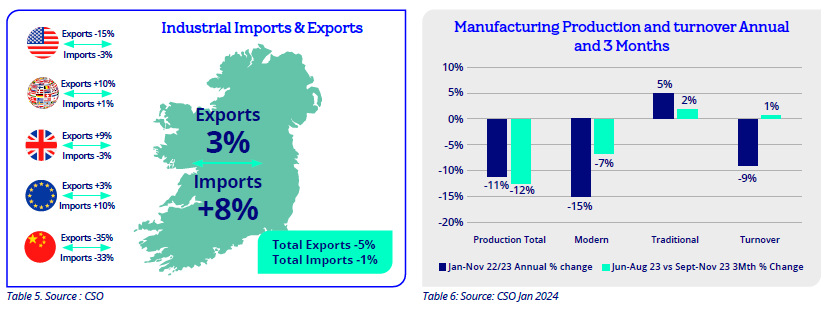

Imports and Exports, Industrial Output and Turnover (CSO)

Imports and exports performance are summarised in graphic (Table 5) for period Jan – Nov 2023. In totality imports were YOY unchanged while exports are down by 5%. Given that 2022 was an exceptional year driven by volume, inflation and spill over from 2021, this exports performance is actually very strong. It is up 21% when compared to 2021. The drop is concentrated in the Pharma sectors down 5% and Machinery down 14%. Markets impacted are US down 15% and China down 35%.

A similar picture emerges for Manufacturing production and turnover (Table 6). Total annual comparison January to November is negative reflecting the export profile. However traditional production output performed better than modern (including Pharma) at +5% production growth YOY.

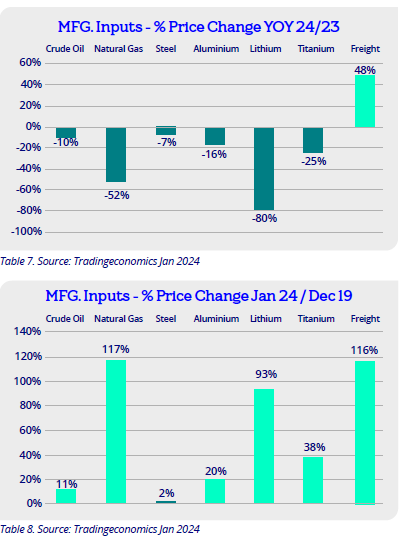

Manufacturing Input Price Inflation 13,14

Inflation (HICP) has eased in 2023 from 7.5% in January down to 2.5% in November but reversing upwards to 3.2% in December. While this is good news, the reality is that manufacturing input prices continue elevated when compared to pre Covid-19 levels. See tables 7 and 8 below.

Lithium pricing drop is welcome and driven by EVs gaining volume.

Natural gas is still double pre Covid 19 levels. Freight has spiked again in January due to Red Sea closure and there will be renewed upward pressure on oil which uses this route. Wage inflation is likely to continue in the short term given shortages and some of the 2024 tax reliefs taking effect may slow further downside in inflation. The implication of these softening of inputs costs is that SME customers, MNCs and OEMs will exert pressure to crawl back some of the earlier pricing increases given.

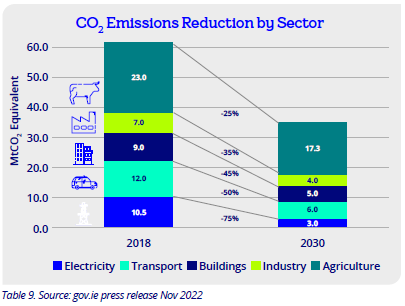

ESG – 2023 was the year when carbon targets were mandated for Ireland – intent needs action

2023 was the year when compliance with carbon targets was no longer optional as it became a legal and regulatory requirement.

Carbon targets published on 28th July 2022 for Ireland are shown in Table 9. Manufacturing accounts for about 12% or 7 MtC02e (Million Tons Carbon Dioxide Equivalent) of total emissions and the 2030 target is a reduction of 35% to 4 MtC02e (Gov.ie).

The reality is that progress in Ireland has followed a similar pattern to the global one and so it is imperative that intent now turns to action as the 2030 target hill to climb will only get steeper and more expensive as 2030 draws closer.

Key actions to reduce carbon footprint in manufacturing

In its recent publication, “Climate Action – A Toolkit for Business”, IBEC together with Accenture have provided a practical Climate Action Toolkit which outlines five steps:

- Calculate Carbon Footprint

- Mobilise and prioritise actions

- Commit and set targets

- Implement

- Measure and Communicate

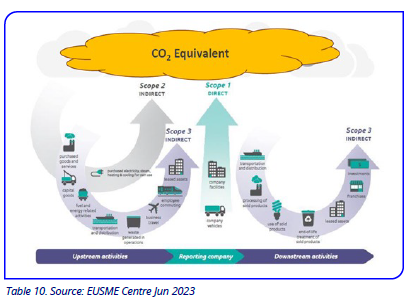

Step 1 involves the identification of Scope 1, 2 and 3 emissions shown in table 10 (EU SME Centre). The requires a number of key steps:

- Choose a base year

- Set the business boundaries

- Categorise the emissions

- Data collection

- Apply Emission factors (SEAI)

- Calculate GHG emissions

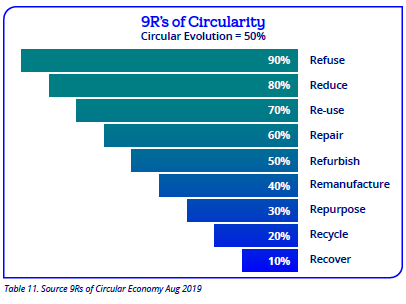

In addition to above, a key opportunity for Irish Manufacturing to reduce its carbon footprint, is to maximise their circularity. Move from the linear take, make waste to embracing the 9R’s as per table 11 which shows that maximum Green benefit is achieved when material is designed out of a product while minimum benefit is achieved from recycle and recover, as carbon effort for both is high, relative to the gain (Shweta Singh, Medium).

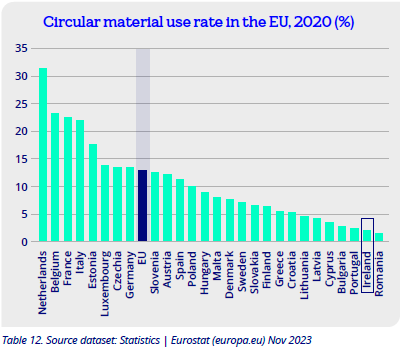

Table 12 shows that Circular Economy in Ireland accounts for less than 2% of materials consumed getting a second life when compared with the EU average of 12% (Eurostat). So the only way is up and represents a huge opportunity for Irish Manufacturing to pivot away from linear models. Currently at a global level the value of circular business is less than 10% of a typical linear business model. According to research paper “Financing in an inclusive circular economy”, Schröder & Raes, Chatham House, the value of the electronics industry is estimated at $2,000BN, whereas the E-waste market is valued at $42BN or just 2% of the linear model (Chatham House Think Tank).

There are many challenges to transition to circular economy, including awareness of benefits, funding availability, return convenience at end of first life and perhaps what feels like “self-cannibalisation” of existing linear models. The good news is that Irish Circular Economy Act became law in July 2022 providing for the development of a Circular Economy (CE) strategy, a Fund, targets to increase current level sixfold and a levy on certain single use items e.g. Paper Coffee Cups.

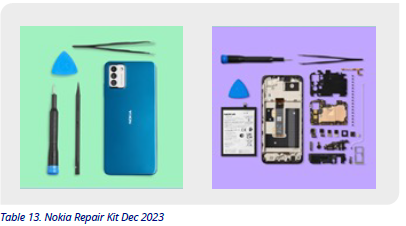

As awareness grows and consumers vote with their wallets, more and more players will become active and raise their profile in this space. Apple offer trade in for older devices and Nokia have just offered a new smart phone with a repair kit as per table 13 (Nokia).

In addition to all of above Manufacturing should also consider independent accreditation to validate their green credentials. Options include the B Corporation ESG standard22 or Excellence in Energy Efficiency Design (EXEED) certification in process with SEAI.

ESG Compliance Reporting Overview

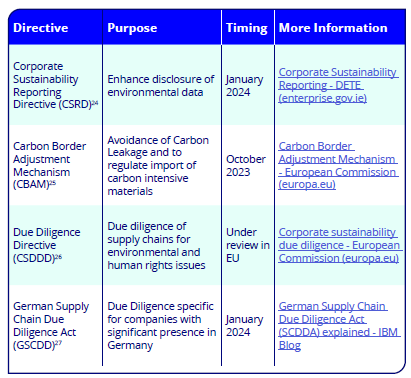

ESG Compliance reporting kicks into gear in 2024. The main directives are summarised below with links for more detailed information, which companies should review to determine scope and timing for reporting.

Reasons to be Optimistic about a Greener Future in Manufacturing

- More than 6,970 Companies including Bank of Ireland are signed up to the Science Based Targets Initiative (SBTi)

- The economics of renewable energy fuels continues to improve with grants for Solar conversion recently increased to up to €162,500 for businesses (SEAI)

- Wind energy electricity accounted for 35% of needs in 2022, a saving of €2Bn for gas and will continue to scale subject to planning and grid constraints.30

- Ireland has experienced over 45% growth for EVs YOY (Carzone)

- Triggered in part by energy inflation and security of supply, 2023 has seen a noticeable uptick in Manufacturing embracing the Green Agenda:

- Behavioural Changes – shift planning, switching off, energy cost awareness

- CapEx projects in renewable energy sources – heat pumps and solar panels

- Avail of Government supports

- Marketing their “Green credentials” with customers

In summary, while the targets remain daunting and challenging, and pace is still too slow, a lot is happening to move the needle.

More and more businesses recognise ESG as a strategic imperative for value creation and survival. Under the new Corporate Sustainability Reporting Directive (CSRD) obligated companies must disclose detailed information annually. While this kicks in from 2026 for SMEs, many will bring this forward to meet the demands of their customers and to be “report ready” when legally required.

Funding Activity in the Sector

Bank of Ireland Business Banking 2023 drawdowns are marginally behind level of 2022 reflecting:

- Caution in the sector given the uncertain macro-economic environment and ongoing geopolitical risks

- High and significantly increased deposit balances YOY

- High interest rate environment

- Relief from higher working capital needs given improved supply chain dynamics

- Demand for funding continues to fall and is down 4 points (20% to 16% of firms) YOY according to last credit survey of 1,500 SMEs that was released in September 2022 (Gov.ie)

- M&A deal volumes are down 7% YOY overall from 453 to 419

- Funding was dominated by terms loans, asset finance, green capex, followed by M&A and MBO transactions

- There is a wait and see element on interest rates and for funding options which offer lower fixed rates and are green related

Survey Roundup – Business Sentiment is higher for 2024 than 2023

Despite the complex and high risk geopolitical backdrop as we start 2024, many surveys show that CEOs and businesses are surprisingly more positive than this time last year. Perhaps a function of survey timing – before Middle East crisis and Red Sea blockage – shocks are never far away but here are four highlights:

KPMG 2023 CEO Survey: High Optimism

PWC 2024 27th CEO Survey: “CEOs are twice as likely to expect the global economy to improve this year compared to last year”

IBEC Manufacturing Survey: “Manufacturers are cautiously optimistic about the current business environment compared to last year”

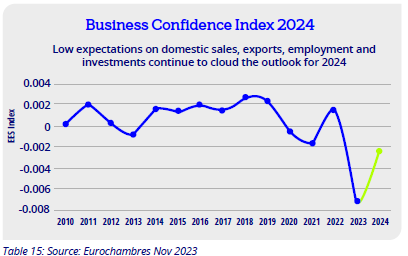

2024 Eurochambres Survey: Business Confidence up on 2023

Tailwinds 2024

- Irish Manufacturing is hugely resilient with enormous positive dividends gained by shocks of COVID-19, Brexit and Ukraine serving it well to navigate the uncertainties of 2024.

- SMEs continue to benefit from MNCs reconfiguring their supply chains to local and more secure partners

- SMEs have benefited from vertical integration changes in response to supply chain headwinds.

- The shocks of energy inflation and shortages are accelerating conversion to Greener alternatives.

- Latest PMI data indicates a fragile trend in direction of growth.

- Inflation impacts are receding but customers are seeking to reverse increases.

- FDI activity remains buoyant and will support growth.

- Manufacturing is embracing ESG and rate of adoption is increasing as funding grants increase

Headwinds 2024

- PMI, Exports, Industrial output and GDP data all point to slower demand and recessionary caution.

- The risks pf geopolitics complexity and 2024 election results will overshadow the macro-economic landscape.

- Supply chain pain is back on the agenda with logistic cost spiking upwards as a consequence of Red Sea blockage.

- Rising input costs, including materials, minimum wage, social costs will weaken competitive profile and must be countered with a laser focus on business costs and margins.

- Labour shortages and competition for certain talent in a tight market continues.

- Interest rates reduction forecasts for 2024 may be over optimistic, thereby stymying investment appetite.

- There may be capacity adjustments in certain sectors depending on how macroeconomics plays out.

- Infrastructure of transport, housing, utility grids need to match Manufacturing ambitions and not be a barrier to growth.

The fundamentals of Irish Manufacturing continue to be strong. The optimistic view, is that Manufacturing contraction here and in EU has hit a turning point and that 2024 will see a return to moderate growth. However the turning point is recent, weak and vulnerable to ever more risky geopolitics. Manufacturing may indeed find itself navigating a downward adjustment in capacity and employment levels until customer orders start to rise in the medium term. The short term will be sharp focus on cost and margin management.

The Sectors Team is a differentiator for Bank of Ireland in that the sector heads are recruited directly from industry and bring perspective that only first-hand experience can provide. To learn more about Bank of Ireland’s sectoral expertise, click here