Despite various challenges, the sector remains positive in outlook, looking to future innovative opportunities for sustainable food and beverages, notes Lucy Ryan, head of Food & Beverage Sector at Bank of Ireland.

“H1 2024 saw a solid result for exports, matching 2023, yet producers endeavour to manage costs, whilst keeping sight of future opportunities, and staying relevant to consumers”

Development and Insights Autumn 2024

- Value of food and live animal exports in H1 2024 was €8.1 billion, matching 2023 exports (CSO).

- Exports were mixed with meat €2.3bn flat vs 2023 whilst dairy was €1.75bn or -11% YoY. Other sub sectors matched or were slightly ahead of 2023, whilst beverages made strong gains at +18% YoY to €1.04 Bn and seafood sales were €310m or +7% YoY (CSO).

- Food inflation remained low in June/July at +2.2% in ROI vs LY in Ireland (Trading Economics), 1.5% in GB and 1.5% in the European Union.

- Forecasts suggest circa 2% for H2 2024 (Trading Economics).

- Input costs remain high but varied across raw materials, energy and transport, with producers striving to gain efficiencies, reduce cost base and energy usage.

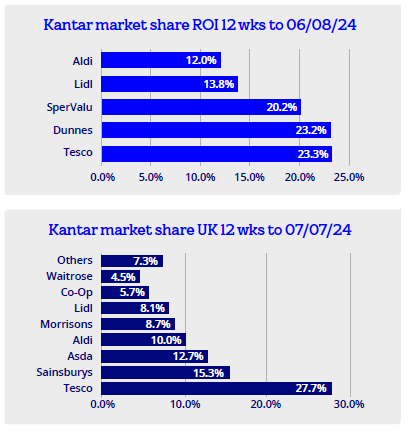

- In the ROI grocery market in 12 weeks to 6th August, Tesco took the lead with 23.3% share, Dunnes number 2 at 23.2%, Supervalu 20.2%, Lidl 13.8% and Aldi slipped to 12.0% (Kantar).

- In the UK, Kantar shows in 12 weeks to 7th July ’24 Tesco achieved its largest share gain since Nov 2021 taking 27.7% share, Sainsburys was +4.7% to 15.3%, Asda 12.7%, Aldi 10%, Morrisons 8.7% and Lidl grew to 8.1%; smaller retailers Co-Op has 5.7% and Waitrose 4.5% (Kantar).

Food & Beverage producers – a balancing act

Food and drink operators continue to juggle the balance between company, consumer and retailer requirements, with the balance more acute in an inflationary market. Producers aim to satisfy consumers, with innovative products, retailers with varied product ranges at keen prices, whilst satisfying their own shareholders and growing sustainably. As consumers become more sophisticated, producers and retailers need to increase their focus on analysing consumer behaviour and find ways to retain consumer loyalty and stay relevant with products. Brands and product ranges need to remain ‘front-of-mind’ and be in tune with evolving consumer preferences.

Private Label

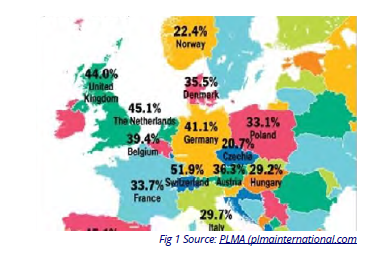

Gradually, as food prices increased, consumers have turned to own-label products. The Private Label Manufacturers Association (PLMA), which runs a trade show in Amsterdam every year, claims that in 2023, sales of own-label product hit a high of €340 Billion or 38.5% of total grocery market value in Europe. That is +13% growth compared to +6% for branded goods (PLMA). Figure 1 shows the percentage of private label market share in a number of European countries. Own-label market share in ROI is similar to the UK at c.44%.

Food Inflation

Food Inflation in Ireland was reported at 2.2% in July ’24 for food and non-alcoholic beverages, down from 2.3% in June, the lowest level in three years (Trading Economics). Whilst this was welcomed by consumers, who have managed high grocery prices by reducing basket size, switching brands or buying private label, cost challenges remain for producers. Kantar showed inflation of food and non-alcoholic beverages grew 2.8% in ROI in 12 weeks to 4th August ’24 vs 2023 (Kantar).

In the European Union food and non-alcoholic beverage inflation was +1.5% in June ’24 (1.8% in Euro area) vs. June ’23 (Trading Economics).

In the United Kingdom, food inflation was recorded as +1.5% in June ’24 (Trading Economics). However in recent weeks, food inflation has edged higher in the UK with Kantar reporting +1.8% in the 4 weeks to 13th August (Reuters).

Producers of premium brands and high-end products will be hopeful that food inflation stays low, and demand for their products picks up, but food inflation levels are not easy to predict.

Food Index

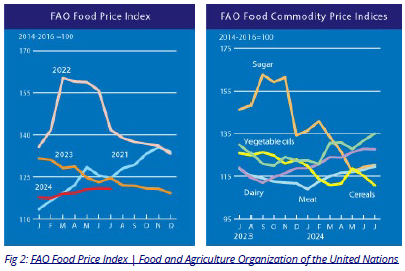

The Food and Agriculture Association of the United Nations (FAO) food price index that measures the change in the international basket of commodities (meat, dairy, vegetable oils, sugar and cereals) was 120.8 in July ’24 (UN), marginally below figure for June. A decrease in cereal prices outweighed increases in sugar, oils and meat products.

Cocoa prices continue to stay high since spiking in April of 2024

with cocoa futures trading at circa $9,000 per tonne (Trading Economics) an increase of 130% since the start of 2024. Stocks remain tight after a poor season in ‘23/24. Prices for the rest of 2024 are estimated to stay high and volatile, due to the extent of the poor crops in Ghana and Cote d’Ivoire, demand uncertainties, and early predictions from farmers in West Africa, biggest producers of cocoa, that the ‘24/25 harvest may look better (ICCO). Chocolate producers have needed to raise their prices to manage their cost base which adds to food inflation.

Deposit Return Scheme

The DRS scheme for plastic bottles & drinks cans reports 400m plastic bottles were returned since 1st February (Checkout), peaking at 90m in June. This is good progress in a short time. The incentive to collect and return containers (due to high deposit rate) is evident from cleaner streets and it’s encouraging to see schemes being set up for charities to benefit.

There are challenges with machines at capacity or out of order in some stores.

Looking to other European countries, some operating return schemes for decades, the DRS evolution can continue to improve.

In France, bottles are shredded in the machine, requiring less frequent emptying, and in Denmark & Sweden bottles can be dumped into the newer machines, making the return much faster.

The scheme here has the opportunity to further develop to help ROI reach its single use plastic reduction target. The inclusion of the Return logo seems unnecessary once the system has settled as it creates extra complexity /cost for producers and requires separate production runs for a small market like Ireland.

ESG

- Energy efficiency initiatives continue to be the number one sustainability action for most businesses with solar panels, heat pumps, heat recovery systems and production efficiencies also featuring.

- Whilst climate change is impacting crops and food security, one positive change in Ireland is grapes can now be grown and harvested as wine production moves northwards. One producer growing vines and making wine commercially is Old Roots vineyard in Co Wexford. A variety of grapes including Cabernet, Chardonnay, Pinot Noir and Pinot Blanc have grown there since 2015 and Old Roots now supplies some hotels with wines (RTE).

Sustainable Food and Beverage Production – Ireland and the EU

As we look to develop a more sustainable food system in Ireland, it is important to consider this as an integrated part of a sustainable food production system within the EU. The scale of food and drink production across the EU is vast, one of the largest manufacturing sectors in Europe (Food Drink Europe).

There are 4.6 million employed in food and drink production with a turnover of €1.1 Trillion (Food Drink Europe).

Approx 300,000 businesses in this space, with 90% of them employing fewer than 20 people (Food Drink Europe).

As sustainable food production evolves, and food circularity increases, it is important for Ireland’s food sector to tap into EU developments and supports, and be an integral part of the change.

Price Competition – Mondelez fined for contravention

The EU allows free movement of goods, and holds great commercial opportunity, with its 450m population. To keep tabs on single market activity, the European Commission acts as the EU watchdog. In May this year, it imposed a significant fine of €337.5m on Mondelez International for breaching EU law (Europa). Mondelez, one of the world’s largest producers of chocolate and biscuit products, distributes its products using traders, brokers and exclusive distributors, typical for fast moving consumer goods (FMCG).

Between 2015 and 2019 it was found to have hindered cross-border trading of products and ‘artificially partitioned the internal (EU) market’. The Commission found it engaged in various anticompetitive practices, abusing its dominant position, and restricted or ceased supply to maintain higher pricing in other markets (Food Drink Europe).

This ruling sets a precedent regarding cross-border trade. The substantial fine sends a strong signal to those operating in the EU regarding distribution agreements and how they operate.

Brexit and Border Target Operating Model

The Border Target Operating Model (BTOM), introduced post- Brexit, means products brought into Great Britain are subject to new UK controls. The National Audit Office estimates £4.7Bn has been spent to date implementing the BTOM as changes were introduced with the UK’s departure from the EU (Export.org.uk).

Since 30th April 2024, imports into GB are subject to non-routine checks; some shipments need documentary checks and identity seal checks on entry and exit. October 2024 will bring more documentary, identity and physical checks for live animals, an extra cost for those trading with GB.

Northern Ireland

Northern Ireland’s food and beverage sector is evolving and growing with an increased focus on locally- produced products.

The industry straddles a diverse range from fishing and agri-food production to brewing and distilling. It is worth £5.4 Bn, and is the largest producer of the region’s manufactured sales (37%) (InvestNI). It is the only market in the world that offers tariff-free market access to both Great Britain (GB) and the European Union (EU) putting NI in an enviable position (invest NI).

In July a new Agri-Food Investment Initiative of £46 million was launched to support the agri-food sector, including food and beverage processors (Manufacturing-supply-chain.com). This was developed by Invest NI to improve the sector’s competitiveness. It is anticipated funds will be used for innovation and to help operators adopt greener technologies.

Looking ahead

- The dairy sector in ROI, and indeed the wider EU, holds concerns that an anti-subsidy probe into EU dairy imports, recently opened in China, may affect Ireland’s dairy exports (c€45m)27. This was a day after the EU published higher tariffs for Chinese electric vehicles28.

- High costs and further planned increases to wages and employee benefits, will further challenge producers’ cost base yet retention of good staff remains a key focus.

- Food inflation estimates from Trading Economics are low single digit of 2.5-3.2% in Q3/Q4 ’24, 1.8-2.4% in the EU and 1.9-2.5% in the UK29.

- Supply Chain issues have largely settled yet transport costs remain high. The latest World Container Index (WCI) shows the average price of a 40ft container is $5,428, 48% below the pandemic peak of $10.3k (Sep 2021), but 282% higher than the pre-pandemic cost in 201930. Road transport costs also remain elevated with personnel & fuel costs high and new CO2 emissions-based tolls coming into effect31.

- Despite the various challenges outlined and geopolitical uncertainties, overall the sector remains positive in outlook for 2024, looking to future innovative opportunities for sustainable food and beverages.

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple