Whilst food inflation has started to fall, consumer prices remain high and inflationary pressures remain, writes Lucy Ryan, head of Food and Drink Sector at Bank of Ireland.

“Producers are increasingly looking at ways to innovate, which brings new opportunity, as producers look to satisfy evolving consumer demands”

Food and Drink Review and Outlook – H1 2023

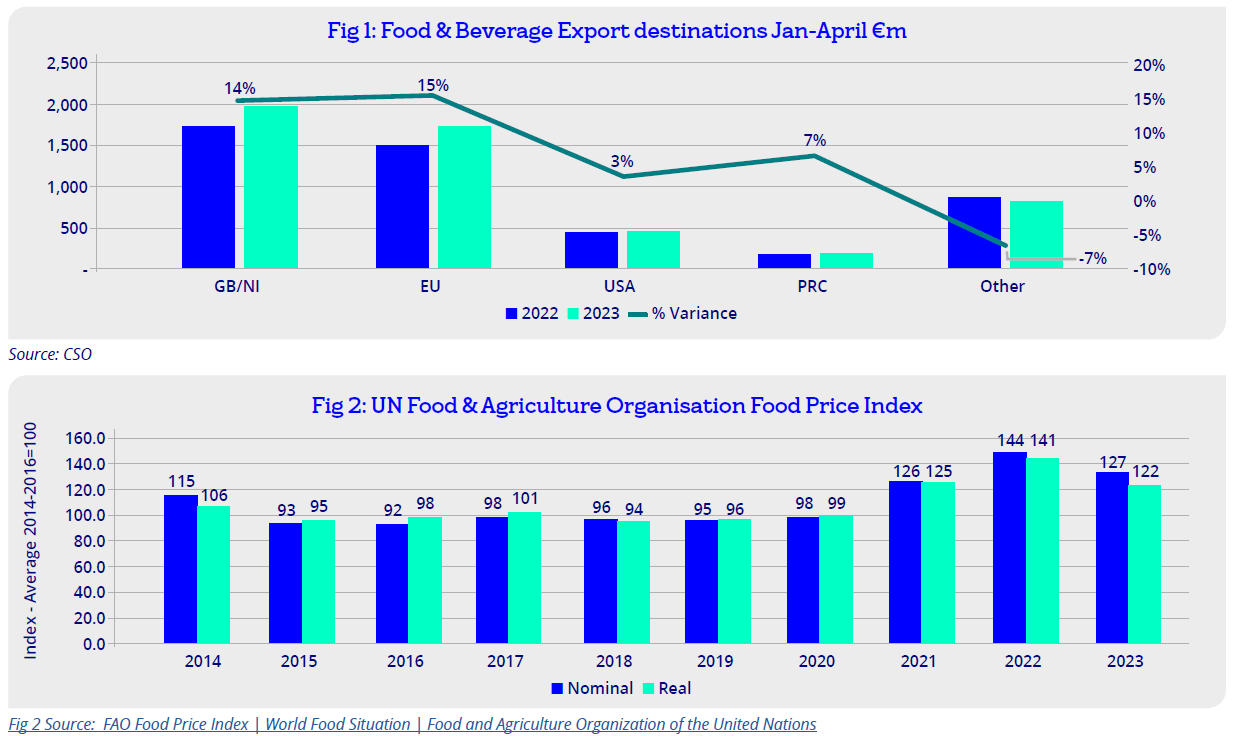

There was positive sentiment in H1 of 2023 on the back of strong exports of Food & Drink in 2022, some easing of input costs for producers and improvements in supply chain. However high food inflation, which became an all-too-frequent headline, has proved stubborn and impacted food affordability for consumers. Nonetheless, the majority of Irish food companies are confident about growth prospects (Love Irish Food/PwC). The value of food and beverage exports from Ireland grew 9% in Jan-April 2023 compared to 2022.

Food volumes in industrial processing grew modestly annually to April 2023 but saw a slight drop month on month in April 2023. Sector activity & update H1 2023

- Input costs eased in H1 of 2023, alleviating some of the margin pressures. However, high input costs impacted the sector since 2021 and food inflation reached 13.1% (YoY) in Ireland in April, dropping to 12.7% in May. In May, food and energy inflation continued to slow significantly in OECD countries.

- Export of food and drink showed 9% growth in Jan-April to €5.2bn compared to 2022.

- Supply chains remain complex due to geo-political factors. Certain producers have sourced alternative supply or adapted to use substitute products. The ongoing war in Ukraine, and Russia’s recent withdrawal from the Black Sea grain deal, brings further uncertainty to supply chains, affecting the flow of exports from Ukraine and grain prices.

- Labour shortages continue to impact the sector as unemployment remains very low.

- In May 2023 a new government agri-food regulator was established – An Rialalai Agraibhia – its remit being to increase transparency of the agricultural and food supply chain in an effort to boost the position of farmers, fishers and other food providers.

Approval activity

From a transaction perspective, some customers are taking out loans to ensure stock levels are optimal to service customers.

Some operators are looking to increase production efficiencies and to increase automation, enabling a reduction in staff numbers.

Loans for green initiatives are being employed for the introduction of green technologies such as solar panels, heat pumps, and more sustainable food production methods.

Key Sector Trends H1 2023

Food Exports growth

Overall the value of Irish food and drink exports grew in Q1 of ‘23. Jan to April showed value growth of 9% in food and drink exports versus 2022. Growth in exports to the EU and UK/NI have contributed the greatest uplift at +15% and +14% value growth respectively. Exports to international markets grew 7% whilst exports to the US were just 3% ahead of 2022.

Dairy exports continued to perform particularly strongly with butter, cheese and infant food contributing most to this growth.

Prepared consumer foods had a solid performance matching 2022. Meanwhile, alcoholic beverages fell back 9% in Jan-April.

Seafood exports had a slower start to the year compared to 2022 (Table 1). Exports to some African markets, such as Nigeria and Egypt, reported a softening in orders in early ’23 due to limited availability of foreign currency, and local inflation, impacting purchases.

In the Irish grocery market, grocery sales value grew by almost 11% in 12 weeks to June 11th, with inflation accounting for much of the value growth. During that period, Kantar reported grocery inflation as being at its lowest level so far in 2023.

In the 12 week period to 14th May, the UK grocery market showed +10% sales growth with Aldi and Lidl growing at the fastest rate with sales at +24% and +23.2% respectively compared to 2022.

Post-Brexit trends

Although GB remains the largest export market for food and beverage, with CSO reporting 38% value of exports for Jan-April 2023, the longer term trend for exports is shifting towards international markets, as producers look to diversify to other markets post-Brexit.

The Windsor Framework

After protracted negotiations, the EU and UK jointly announced the Windsor Framework on 27th February, adopting it formally on 24th March, in a bid to resolve post-Brexit disputes. This will amend the NI Protocol and significantly, it will mean no hard border on the island of Ireland. Extensive preparations are underway to develop the new arrangements. There will be a Green lane system for all goods going from GB into NI and a Red lane system for goods ultimately intended for the EU. Controls for certain products, including agrifood, will be much simpler enabling smoother transit of goods. The new system will take some time to be introduced: its implementation is expected to be on a phased basis from Autumn 2023 and into early 2024.

Inflation

Significant input cost increases led to very high food inflation, impacting consumer spending power. There was a time lag in consumer price inflation, as producers grappled with cost increases over the last 24 months, trying to find ways to manage the higher cost base.

There has been some reprieve in input costs in recent months.

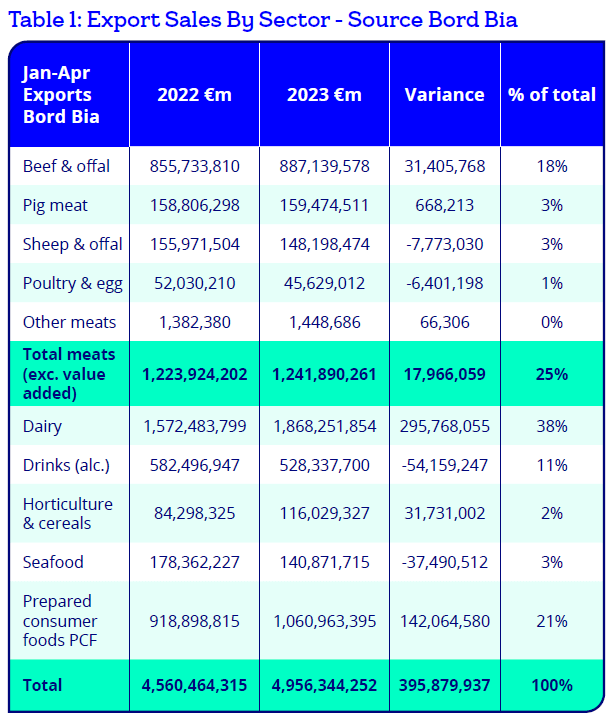

The Food and Agricultural Organisation basket of commodities reached a peak in March 2022, after a sustained upward trend, and dropped to 122.3 points in June, a 23% drop since the peak. Recent drops reflects lower prices for sugar, vegetable oils, cereals and dairy products whilst meat prices remain unchanged.

Wholesale energy prices have also dropped in recent months.

Food and non-alcoholic beverage inflation dropped to 12.6% in 12 months to May 2023. Food inflation in the UK slowed to 18.3%14 year-on-year in May from a 45-year-high of 19.1% in March.

Trading Economics reported EU food inflation at 15.04% in May having reached 19.19% in March.

There is growing consumer price sensitivity and consumers are very focused on cutting food costs through reduced premium brand purchases, more private labels purchases, more frequent and smaller shopping trips to avoid unnecessary purchases, and attempts to cut down food waste.

Price negotiations between suppliers and retailers remained challenging for a sustained period but has largely settled with most suppliers having secured price increases.

Supply chain and sporadic shortages

Global supply chains continue to be challenged, but the situation has improved in 2023. Container costs eased in recent months helping the global transport of ingredients and finished goods.

European road freight rates dropped in H1 of 2023 and fuel prices have eased; driver shortages in the industry are still a concern for hauliers.

Nonetheless, geopolitical risks, ingredient shortages and natural resources are all factors that need careful monitoring and will continue to feature in Food & beverage supply chain considerations.

Whilst supply of foods has improved since the pandemic, there have been some shortages. Fresh produce was impacted in 2023 due to climatic conditions, affecting some vegetables, and some producers saved costs by reducing greenhouse energy usage during the colder winter months.

2023 H2 Outlook

The outlook for H2 of 2023 is moderately optimistic. Food and beverage producers have shown great resilience adapting to the impacts of the pandemic, the war in Ukraine and inflationary pressures. However, Russia’s recent withdrawal from the Black Sea grain deal has created a very challenging situation for exports from Ukraine.

Food inflation will continue but at a slower pace

Whilst food inflation has started to fall, consumer prices remain high and inflationary pressures remain.

There is uncertainty regarding inflationary effects and rising interest rates on consumer behaviour regarding food purchases and consumption patterns, which will evolve in coming months.

The continuing positive employment situation does allow some confidence regarding household expenditure.

From 31st October, exporters of meats, dairy, table eggs and animal by-products to GB will need to include an export health certificate generated on TRACES (EU Trade Control system) to accompany their exports.

Producers are increasingly looking at ways to innovate, which brings new opportunity, as producers look to satisfy evolving consumer demands.

Longer term, there is a rising global demand for nutritionally-rich foods and plant-based foods which will further shape the future of Irish food.

ESG and sustainable food production

Food and beverage producers in Ireland are acutely aware of the need for ESG initiatives, especially plans to reduce their carbon footprint. Proposals and plans are being frequently debated along the supply chain and SMEs recognise the need for a comprehensive ESG plan to future-proof their business. Retailers are requesting sustainability action plans from suppliers regarding scope 3 initiatives as the retailers set their own carbon targets.

Many operators have embarked on the green transition investing in solar panels, reducing packaging and plastic, reduced energy usage and enhancing energy rating of buildings, with some operators availing of various government and EU sustainability support funds.

This will accelerate and with increased government supports and climate toolkits to help guide industry, operators will take more measures to create ESG plans and develop more sustainable food and drink production methods.

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple