The Irish Health Sector is experiencing stabilisation following a sustained period of volatility, writes Bank of Ireland head of Health Sector Gráinne Henson.

“The sector is currently experiencing a dynamic period, with a strong emphasis on providing universal care that is accessible to all. The private sector plays a crucial role in this process”

Summary

Following a sustained period of volatility, a degree of stabilisation has seen an interesting blend of consolidation and change, with associated challenges and opportunities across the Health Sector. The HSE has reported improved performance in H2 2023, with the number of patients on trolleys down by 20% in comparison with the same six months in 2022 (Gov.ie).

Some cautious optimism and positivity are also reported in the private sector, albeit tempered by a critical focus on cost containment, which has proven to be challenging. Two keys to success in 2024 will be understanding the importance of staff retention and a commitment to improving green credentials.

Nursing Homes

Market Dynamics

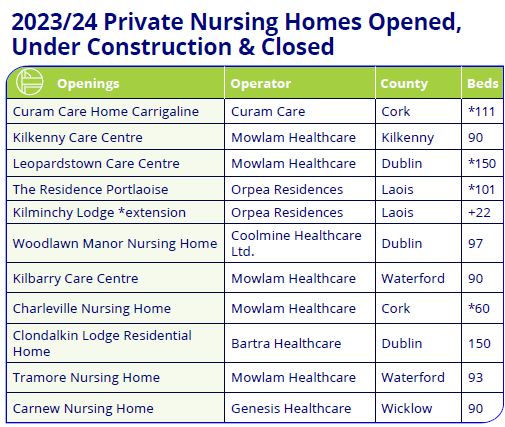

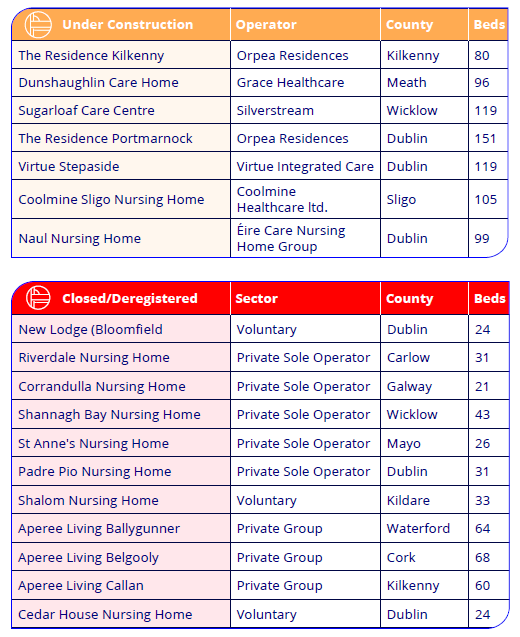

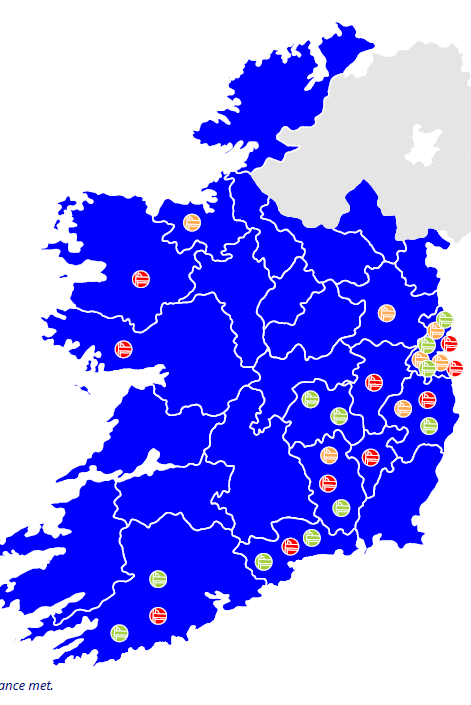

The private nursing home sector, across the whole size spectrum, is undergoing a turbulent period marked by economic, operational, and regulatory challenges. Staffing costs, interest rates, and related macroeconomic factors continue to impact the sector, squeezing margins. This has resulted in a general decrease in nursing home valuations with EBITDA multiples being paid ranging from 6x-13x depending on the quality and location of the asset (Irish Nursing Home Sector Annual Report, JPA Brenson-Lawlor). That said, H2 2023 also saw some positive developments, including a move towards equalisation of the Fair Deal Rate (FDR) (particularly beneficial for smaller rural operators), improved bed occupancy levels, and a small degree of staff stabilisation. Following the large number of smaller nursing home closures in 2022 (14 homes, avg size=30 beds), fewer closures occurred in 2023 (11 homes, avg size=42 beds), with three of those (Aperee Living Group) deregistered as a result of governance concerns rather than financial viability. The decrease in closures between 2022 and 2023 has been attributed to post pandemic stabilisation in the sector and the higher FDR. H2 2023 saw annualised FDR increases of 7.3%, up from 5.5% in H1, with Donegal and Tipperary seeing the highest average increases, and Dublin and Carlow the lowest. Dublin continues to have the highest average FDR at €1,296 (NHI) with Leitrim having the lowest at €1,041 (differential €250 per week/€13,260 per year, per resident).

The Aperee Living Group closures lend weight to concerns expressed by the ESRI about the risks associated with any further consolidation leading to a nursing home sector dominated by bigger group operators (ESRI). The 192 bed closures in a short space of time necessitated HSE intervention. The consolidation trend is set to continue with group operators including Mowlam Healthcare and Orpea adding to their portfolio, with a number of new home openings. An established UK real estate developer, Simply UK, has started its first development in Ireland with a site currently under construction for a 99 bedded ‘luxury’ nursing home at The Naul, Co. Dublin. The group currently own/operate 18 care homes in the UK under the brand ‘Éire Care Nursing Home Group’. The French based Emera group are seeking an exit from the Irish market. The group has a 70% stake in Virtue Integrated Care, with 13 nursing homes and three home care services.

The HSE recently registered 60 new beds at new facility, Ballyshannon Community Hospital, based at the old Sheil hospital site in Donegal.

There are a further seven HSE facilities under construction with 530 beds due to come on stream this year in counties Cork (x2), Kilkenny, Kerry, Louth, Tipperary, Meath.

The Department of Health (DoH) launches the RSI scheme

The new Nursing Home Resident Safety Improvement (RSI) Scheme, administered through the National Treatment Purchase Fund (NTPF), was launched on 1 January 2024. This scheme provides financial support for structural improvements associated with resident safety, in accordance with HIQA Regulation 27 (Protection against infection) and Regulation 28 (Fire precautions), (S.I. No. 415/2013 – Health Act 2007).

It is available to all HIQA and NTPF registered private and voluntary nursing homes. Work covered by the scheme and undertaken since January 2020 can be claimed retrospectively. The €10m fund allocated for Budget 2024 will allow all eligible nursing homes to claim a maximum of €25k.

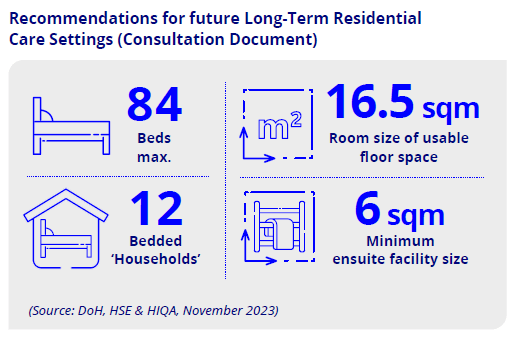

Design Guide for Long Term Residential Care

A public consultation document, ‘Design Guide for Long Term Residential Care’ (Draft Design Guide for Long-Term Residential Care Settings for Older People, Department of Health, HSE), is currently seeking submissions. Jointly produced by the Department of Health, HSE and HIQA, the document sets out expected minimum standards for all future new builds, extensions to existing nursing homes and conversions of an existing building into a nursing home. The point to note is that, in addition to National Building Regulations and EU Energy Directives, the guide requires providers to comply with minimum elderly and dementia specific care quality standards in both building design and location. For example, it recommends a maximum size nursing home of 84 beds, configured into smaller 12 bedded units or households, incorporating the Teaghlach, or ‘Household’ model of care. It also requires a minimum bedroom size of 16.5 sqm of ‘usable floor space’, an increase from the current 12.5 sqm, with an adjoining ensuite at minimum 6sqm in size. The report also highlights the Climate Action Plan 2019 and emphasizes the importance of energy efficiency, energy conservation and smart technology.

It will be interesting to see how enforceable the guide will be when the document comes into effect, but it seems likely that future HIQA registration will be tied to the expected standards being met. It is proposed that applicants should consult with the office of the Chief Inspector prior to any planning permission, with HIQA able to highlight any areas that do not meet relevant design guide regulation standards. The design guide will also inevitably have cost implications which might further impact the development of new builds and renovations. With the cost of nursing home construction currently estimated at between €250k-€300k per bed (up from €111k in 2017, and €162k in 2022 in rural locations and €128k in 2017 and €191k in 2022 in urban locations) (PwC) the stipulations included in the design guide might prove challenging for investors and providers.

Workforce Challenges

The 12% increase to the national minimum wage to €12.70 per hour, combined with the Statutory Sick Pay entitlement of 5 days is positive news for staff such as Health Care Assistants (HCAs) but rising employment costs continue to put pressure on providers, particularly smaller nursing home operators with tighter margins.

The imminent public sector pay deal, 10.25% over 2.5 years, is likely to further increase pressure in the private sector, exacerbating the cycle in which nursing home staff recruited and trained by private operators transfer to the public sector following expiration of their initial fixed-term contract.

The Irish health sector remains heavily reliant upon staff recruited from outside of the EEA via the work permit system.

Recommendations that the minimum remuneration threshold for HCAs and home care workers from this demographic, which was due to increase from €27k pa to €30k pa in January 2024 and to €34k pa in January 2025, have been deferred for an unspecified period following intervention by Nursing Homes Ireland (Department of Enterprise, Trade & Employment).

The provision of accommodation for staff is a growing trend that aims to address the needs and challenges faced by both staff and healthcare providers.

Senior Living

H2 saw CBRE Healthcare publish a document: The Market for Senior Living in Ireland (CBRE), encouraging a revisiting and re-imagining of the retirement village initiatives developed in Ireland between 2005–2010. The report advocates the development of ‘Senior Living’ schemes, which break from the assumption that retirement communities go hand in hand with nursing homes, towards more independent living away from the care associated with residential services. Pointing to success in other countries, including the UK, the report cites dual beneficial intentions: 1) to enable older people to ‘right size’ their living environment in communities with other retirees, and 2) to free up some of the estimated 1.2m unoccupied rooms in family houses. The report concludes that that there is a clear requirement and a demand for Senior Living solutions in Ireland and suggests ways, including the exploration of government incentives, to stimulate development.

Home Care

The proposed new statutory scheme for the financing and regulation of home care is now at an advanced stage. The regulatory framework consists of primary legislation for licensing home care providers, regulations outlining minimum requirements for obtaining a license and HIQA national standards. HIQA and the Chief Inspector will have legal authority to grant, amend or revoke a license, not dissimilar to the nursing home sector. Platinum Home Care, a new Irish home care provider, is planning to provide national home care services in six new HSE Regional Health Areas.

An enhanced HSE Home Support Tender rate was introduced in 2023, allowing for payment to home carers for travel time, payment of or above the National Living Wage, and the legacy rate being brought in line with the new revised rates of funding (Gov.ie).

Anecdotally, a positive impact is reported regarding reduced staff attrition.

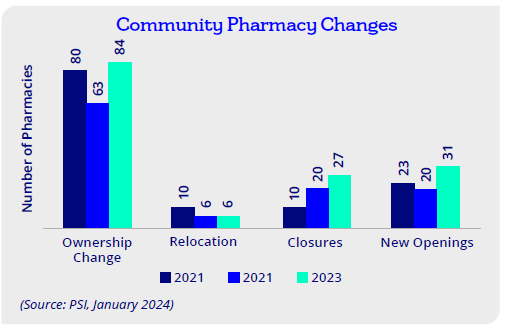

Pharmacy

The consolidation trend in the pharmacy sector, which saw Uniphar’s acquisition of the McCauley Pharmacy group in H1 2023, continued in H2 2023, with the acquisition of McCabes Pharmacy by the LloydsPharmacy chain, under the PHOENIX healthcare group. This union, 32 pharmacies from the former and 82 from the latter, will operate under the McCabes brand (conditional on approval by the Competition and Consumer Protection Commission). There are currently 1,907 Community Pharmacies registered and data reflects a dynamic market in 2023 with an uptick in new openings, closures, and ownership change.

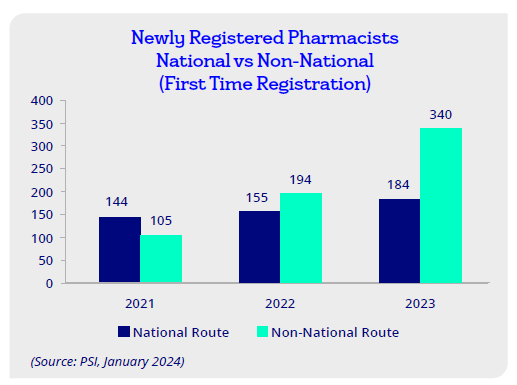

Whilst shortage of qualified pharmacists has been a key challenge over recent years, data from the Pharmaceutical Society of Ireland (PSI) shows a 6% increase in registered pharmacists since 2022 (current N=7480), with a marked rise in EU, UK and other third country route registrations compared to recent years (Thepsi.ie).

Policy

In November 2023, the Expert Taskforce to Support the Expansion of the Role of Pharmacy published its first interim Phase 1 report and recommendations.13 These were accepted by the Minister for Health and with effect from 1 March 2024, the legal validity period of certain prescriptions will be extended from 6 months to a maximum of 12 months.

This will give pharmacists the autonomy, where appropriate in line with the person-centred care ethos, to extend the dispensing period of prescribed medications, improving patient access to medication, expanding the scope of pharmacists, and reducing the workload of GPs. The Irish Pharmacy Union’s response to this development has been guarded on the basis that ‘pharmacists are already stretched and would find it difficult to safely deliver prescription extension services’, but this development nevertheless represents ‘a potential key step in the empowering of the profession for the future’.14

Phase 2 of the taskforce, Empowering Pharmacists to Prescribe within their scope of Practice, is currently in progress, exploring the possibility of pharmacists being given autonomy to substitute alternative medications where appropriate. This would bring Irish pharmacy more in line with the independent prescribing practices currently operating in the UK and would assist in managing supply chain issues.

Funding Activity

- Credit applications reflected a busy period for the sector.

- We have continued to finance going-concern pharmacy purchases, including both single unit businesses and further consolidation within established groups.

- Nursing home approved applications have included extensions, regulatory compliance CapEx and refinancing, together with working capital requests.

- Funding has been approved for Home Care companies.

- A continued focus on the green agenda is also noted with credit approvals for investment in energy efficient technologies.

Sector Outlook H1

Looking forward to 2024:

- An increasing and ageing demographic will ensure demand for private healthcare services remains high.

- Significant regulatory changes, including pharmacy scope and nursing home design, will present both opportunities and challenges.

- Effective retention strategies will be key to managing changing staff demographics, reducing costs associated with staff attrition and providing consistent and effective care.

- ESG will be in even sharper focus, with 2024 representing a turning point for health sector businesses engaging with environmental and social responsibilities, to comply with regulations and futureproof long term financial performance.

- The coming year will also see a focus on technology strategies that prioritise data accuracy and innovative solutions to challenges, as businesses evolve to meet changing demands.

- The use of AI generative applications will gain momentum in 2024 enhancing systems, easing administrative burdens, breaking down silos, and scaling tailored patient communication.

- It is expected that the Home Care sector will develop at pace in the coming months and years.

- Consolidation within bigger groups and cooperation between smaller businesses will continue to develop, helping to maximise revenues through stronger negotiating positions and increased ability to avail of government grants.

In the coming months and years, the healthcare system will need to strengthen collaborative working across partner organisations.

Strong leadership will be required to deliver sustainability changes, drive improvement, and encourage innovation. Bank of Ireland understands the challenges faced by private health companies across the sector. We are a strong supporter of innovative change and will continue to work closely with our customers and communities to enable them to thrive in the current headwinds.

ESG

2024 will undoubtedly mark a turning point for Irish health sector businesses, with an increased focus on ESG coming into practice. Whilst most health businesses will fall outside the scope of the reporting obligations under the Corporate Sustainability Reporting Directive (CSRD), the old adage ‘what gets measured, gets done’ remains pertinent, with businesses expected to prioritise sustainability KPIs. Green credentials will be increasingly linked to business valuations and transactions.

Bank of Ireland will continue to champion the transition to environmental sustainability.

The Sectors Team is a differentiator for Bank of Ireland in that the sector heads are recruited directly from industry and bring perspective that only first-hand experience can provide. To learn more about Bank of Ireland’s sectoral expertise, click here