Grocery & Convenience sector continues to perform strongly with progressive operators proactively investing for the future. However, grocery inflation is on an upward trajectory, writes Owen Clifford, head of Retail Sector, Bank of Ireland.

“Market activity focused on store investment and consolidation within the sector. Margin preservation and environmentally friendly practices key linked to changes in consumer behaviour and rising cost base”

Summary

- Robust performance: Robust performance delivered by the sector in H1 2022. Shopping behaviour and frequency patterns returned to more normalised trends with sales continuing to surpass pre-pandemic levels.

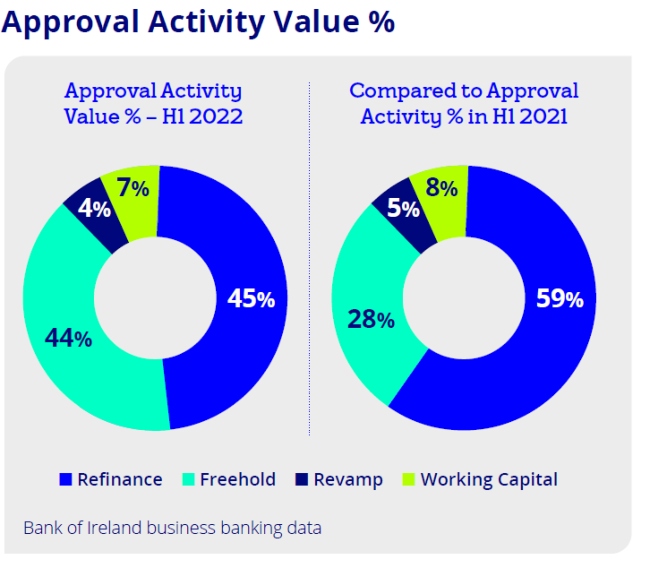

- Investment: Store purchase and revamp/refurbishment activity has been strong in H1 2022 and this trend is expected to continue with a particular focus on energy efficiency measures. Bank of Ireland continues to actively engage and support grocery retailers with their investment plans.

- Consolidation: Increased consolidation has become a feature of the market with larger grocery/fuel operators expanding their store network and diversifying their sales mix.

H1 2022 Key Trends

- Strong growth in take-home grocery sales continued. Growth of 7+% delivered in H1 2022 v pre-pandemic performance in 2019 per Kantar Grocery market share.

- Dunnes continues to hold the number 1 position in respect of grocery market share driven by a particularly strong performance in the wider Dublin region. Supervalu and Tesco have maintained strong market share with Tesco benefiting from increased frequency of consumer engagement – not just being used for the “big shop” in 2022. Aldi and Lidl continue to solidify their strong foothold in the Irish market.

- Grocery inflation in Ireland hit 5.5% in June 2022 reflecting the supply-chain issues and uncertain geo-political landscape – this represents the highest level of inflation since August 2013.[1] The large supermarket operators have been proactive in addressing cost of living concerns with targeted ad campaigns and voucher offers being strongly promoted in recent weeks. Given the prevailing inflation position across Europe, it is expected that we have not reached peak inflation and further increases are being forecast across the sector in the immediate future.

- Margin growth and preservation have become an imperative for retailers linked to an increased cost framework driven by personnel, insurance and energy overheads.

Key Activity in the Sector in H1 2022

- Whilst shopping patterns reverted to more normalised frequency trends in H1 2022 – the impact of increased grocery inflation (and associated cost of living) on consumer behaviour will be monitored closely in H2 2022.

- Retailers are continuing to implement pragmatic succession planning structures to ensure that appropriate long-term value is delivered from their business. Covid-19 has been a catalyst for some retailers to investigate future options in respect of both ownership and operational models.

- A strong pipeline of store purchase and associated revamp activity has been generated in H1 2022. Progressive retailers continue to recognise that in-store investment is necessary to maintain customer engagement and loyalty.

Sector Developments: Investment & Economic

- Supervalu, Lidl, Aldi, Tesco and Dunnes all outlined plans for new store openings/significant store revamps in H1 2022 across all regions with a noteworthy focus on satellite towns of Dublin, Cork and Galway.

- The increased cost and regulatory burden presented by the proposed living wage structure, pension auto-enrolment, spiraling energy overheads and insurance in a competitive environment has led to an up weighted focus on margin development/preservation from retailers, wholesalers and their advisors

- Tesco Ireland have appointed Natasha Adams as CEO – the purchase of the Joyce Group and recent store opening in Spencer Dock demonstrating their commitment to the Irish market.

- Consolidation remains a feature of the wider grocery/convenience/forecourt market. In the UK – Morrisons secured the future of 1,600 jobs by purchasing the McColl’s convenience group from Administrators. In Ireland/Northern Ireland, further consolidation is projected in 2022 linked to succession planning, prevailing economic conditions and the growth strategies of leading operators within the sector.

H2-2022 Retail Convenience Outlook

- Robust Outlook: Overall a resilient sector to economic shocks; Strong sales performance to continue but increased focus on margin preservation and cost management required linked to a continuing inflationary environment.

- Funding Activity: Strong active pipeline of store purchase and associated revamp proposals– retailers recognise that customer experience/excellent standards will be key to attract and retain market share.

- Investment/Consolidation: Increased investment in partnership agreements and further consolidation of the market (especially forecourt/wholesaler sub-sectors) expected in H2 2022.

Market

- In a competitive labour market – sourcing and retaining the best people is vital to sustain a retail business. A structured employee development plan that incorporates role variety, up-skill opportunities and competitive remuneration needs to be embedded within the culture of the business. The smart use of digital/automation tools can deliver efficiencies within the business which will support this employee focused model.

- Rising energy costs need to be addressed proactively by the wider sector; collective affinity schemes negotiated, investment in energy efficient equipment/processes and sector lobbying for Government support all expected/required in H2 2022.

- Significant revamp programme will continue to be rolled out in H2 2022 nationwide by leading grocery operators as the ever more discerning consumer seeks excellence in store standards. However, the volume/scale of activity expected tobe depressed linked to current building materials cost profile.

- Detailed analysis pre and post revamp will be an imperative to ensure that a maximum return on investment is delivered via sales mix improvement, margin growth and cost saving. The “localisation” trend will continue with store revamps taking a more bespoke, community focused approach.

- City centre stores will need to proactively assess all aspects of their business plan: target customer demographic, margin development, shrinkage, cost base, property costs etc. They will need to focus more on city centre dwellers as opposed to city centre employees – partner with foodservice/restaurants and provide effective delivery options etc to engage a new recurring customer base

- Corporate social responsibility linked to sustainable and environmentally friendly in-store activities will be a key area of focus for all retailers – energy efficient equipment, elimination of single-use plastic, improved recycling facilities and reduction of food waste. This will enable an improved cost base whilst meeting consumer expectations in respect of ethical trading. The proposed roll-out of the deposit return scheme and “latte levy” in H2 2022 will be monitored with interest.

- As consumers seek cheaper alternatives across some product lines, all leading operators recognise that a strong own-brand offering will be critical to maintain customer engagement as the inflationary cycle continues.

Funding Activity

- Store purchase strategies will continue to develop in H2-2022. Covid-19 has been the catalyst for increased levels of succession planning/retirement which is driving this activity.

- Revamp funding to continue with a particular focus on energy efficient equipment and processes.

- Robust refinance activity projected linked to exiting banks and loan book purchasers seeking to deleverage.