Countries are beginning to struggle with food commodity prices and inflation, notes head of Food & Drink Sector at Bank of Ireland Roisin O’Shea.

Managing swings in commodity prices continues to be the main focus for food companies.

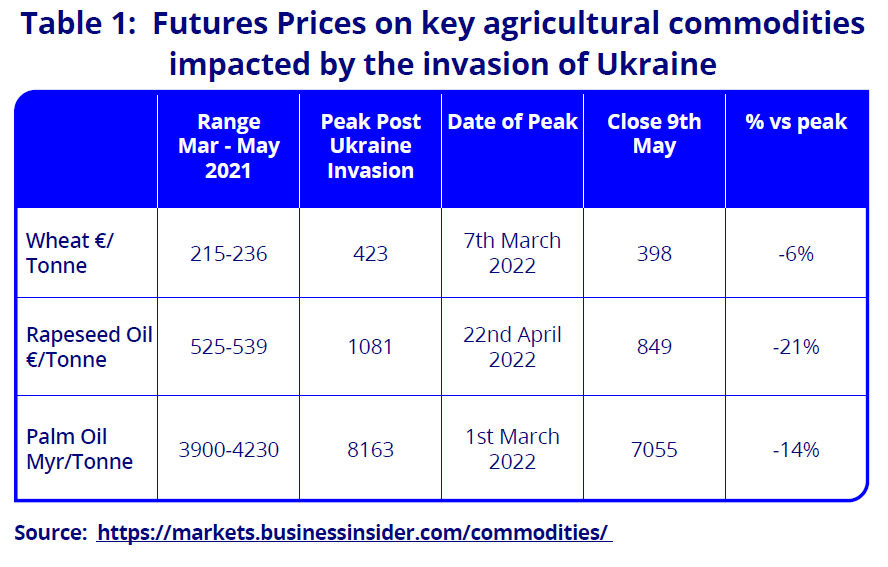

While recent futures prices on key food commodities indicate a fall back from the post Ukraine invasion peak, they continue to remain at a significantly elevated level to last year.

“As developing countries struggle with the impact of food inflation, increasingly we are seeing protectionist actions to retain supply for domestic populations”

With the exception of sunflower oil, availability has not been an issue, albeit with delays continuing due to ongoing supply chain issues.

As developing countries struggle with the impact of food inflation, increasingly we are seeing protectionist actions to retain supply for domestic populations.

The number of countries with export restrictions has climbed from 3 to 16. Indonesia, the largest producer of palm oil recently imposed an export ban on palm oil. While this is only likely to be temporary in nature, it increases volatility and price and causes further delays to supply chains.

While futures prices are yet to make their way to bills of material, they indicate the direction of travel.

From industry discussions, it looks like the main focus of price increases from business to retail and foodservice customers will be September 2022 on, whereas consumers are still seeing 2021’s and Q1 2022 price increases filter through to shopping bills now.

While wholesale industrial producer prices of food were up by 6% in March year on year, consumer inflation on food and drink in Ireland was 3% in March (Eurostat Harmonised Index of Consumer Prices), significantly lower than the 6.7% registered in the EU 27 for the same period, suggesting a lag in passing price increases to consumers.

However, despite the challenges on commodity pricing, the industry is performing strongly.

Recently released CSO figures on industrial production suggest a 22% volume increase in industrial production of food in Q1 2022. Much of this is due to ongoing import substitution due to Brexit, as well as the continued opening up of global markets.

Brexit tensions remain

Food exporters to Britain welcomed the well anticipated announcement from the UK government that border checks would once again be delayed for EU food and drink arriving into Britain.

However, it leaves UK food exporters at a disadvantage to manufacturers in the EU.

This is reflected in the recently published report from the UK Food & Drink Federation showing that exports of food and drink from the UK fell by 9% in 2021 versus the previous year, with exports to Ireland, the UK’s largest export market falling by 25%.

Focus continues on the impact of the elections in Northern Ireland and the UK’s overall political climate, on the implementation of the Northern Irish protocol.

For now, UK retailers continue to move products from Britain to Northern Ireland under an extended grace period implemented by the UK last September.