The outlook for the Irish Food & Drink sector remains positive for the coming year, writes Lucy Ryan, head of Food & Drink Sector at Bank of Ireland.

“In 2024, profit margins will continue to be tight as the minimum wage increase comes in and input costs remain high”

“2023 yielded a solid performance for the sector despite very high food inflation,” said Lucy Ryan, head of Food & Drink Sector at Bank of Ireland in her 2023 Insights and 2024 Outlook sectoral analysis. “The geopolitical backdrop continues to bring uncertainty, such as for global shipping.

February sees post-Brexit changes to import rules for goods entering Great Britain, bringing extra cost and complexity for exporters. Windsor Framework: regarding this week’s news in Northern Ireland, this will see some operational elements of the framework altered to help restore the Stormont assembly and executive.

“In 2024, profit margins will continue to be tight as the minimum wage increase comes in and input costs remain high. Nonetheless, the outlook remains positive for the coming year with operators remaining optimistic about future opportunity.”

Summary

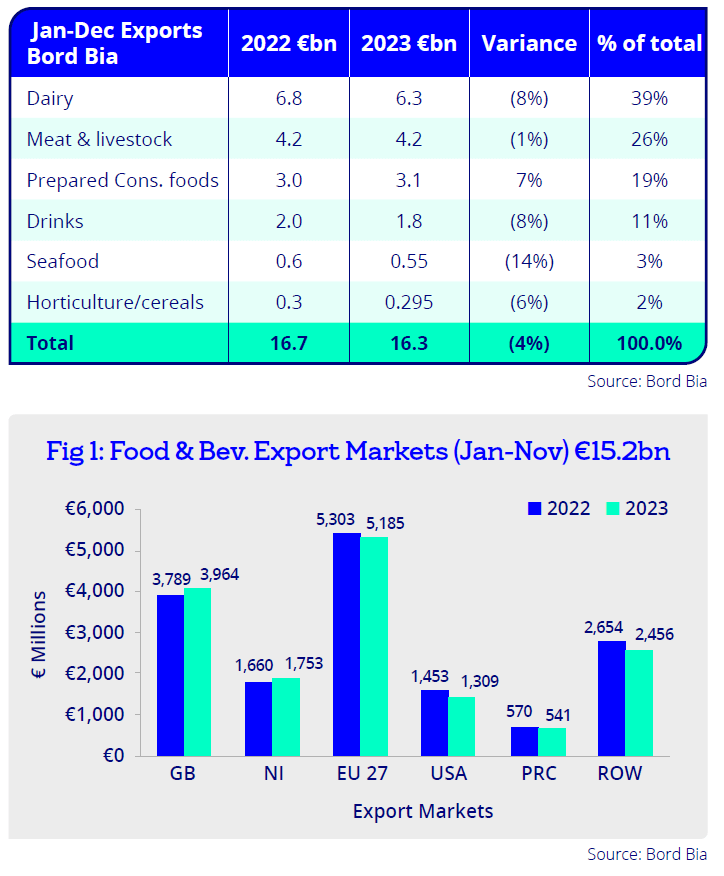

Whilst 2023 saw some reprieve for food and beverage companies from further input cost hikes, very high food inflation, 13.1% in spring 2023 (Trading Economics), weakened consumer spending power. Nonetheless the sector had a solid year’s performance with exports remaining strong at €16.3bn (-4%) compared to a record 2022 (Bord Bia) and the Irish grocery market ended the year very strongly with Kantar reporting the highest-ever recorded December spend of €1.4bn (Kantar) with inflation playing its part.

Heading into 2024, geopolitical uncertainties continue to create an ambiguous global backdrop. Whilst industry has learned to adapt to an ever-evolving global situation, the war in the Middle East has led to commercial shipping attacks in the Red Sea. Looking ahead, Bord Bia recently reported that 73% of food and drink exporters remain optimistic in the year ahead (Bord Bia).

Sector activity and update for 2023/2024

- Export value of food and drink slowed by 4% to €16.3bn compared to a bumper 2022 (Bord Bia).

- Input costs eased in 2023 but global volatility remains with shipping and supply chains complex and container prices increasing (World Container Index).

- The after-effects of high input costs resulted in high food inflation, at 13.1% (YoY) in Ireland in April ‘23, dropping to 5.6% in December (TradingEconomics).

- Staffing remains an industry challenge with very low unemployment rate of 4.8% in Nov 2023 (CSO). The minimum wage change in 2024 and the increased salary threshold for foreign work permit holders adds further cost pressures.

- The Board of newly-created Agri-food regulator – An Rialálaí Agraibhia- was completed in Dec 2023 and is now operational, promoting fairness and transparency in the agri-food supply chain (Agri Food Regulator).

- Brexit continues to feature as importation rules for certain goods into GB change in 2024.

Key Sector Trends Jan-Dec 2023

Food & Beverage Exports:

- The value of Irish food and drink exports fell back 4% to €16.3bn albeit after a very strong 2022.

- Whilst most sub sectors experienced some decline in 2023, after 22% value growth in 2022, prepared consumer foods showed strong growth growing 7% to €3.1bn (Bord Bia).

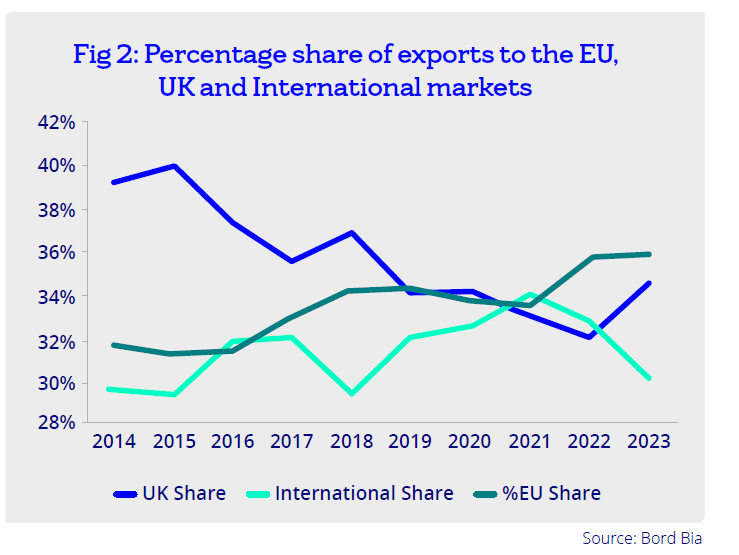

- January-November sector exports to Great Britain and Northern Ireland grew 5% YoY with other markets in decline.

- In the 12 week period to 26th November, Kantar reported the UK grocery market grew +7.5% vs 2022 with Lidl continuing strongly at +14.1% to gain highest ever share of 7.8%, Aldi +11.1% and Sainsburys +10.1%. Aldi is firmly the fourth largest retailer in the market with 9.6% market share and Morrisons now in fifth place (Kantar).

Food Inflation:

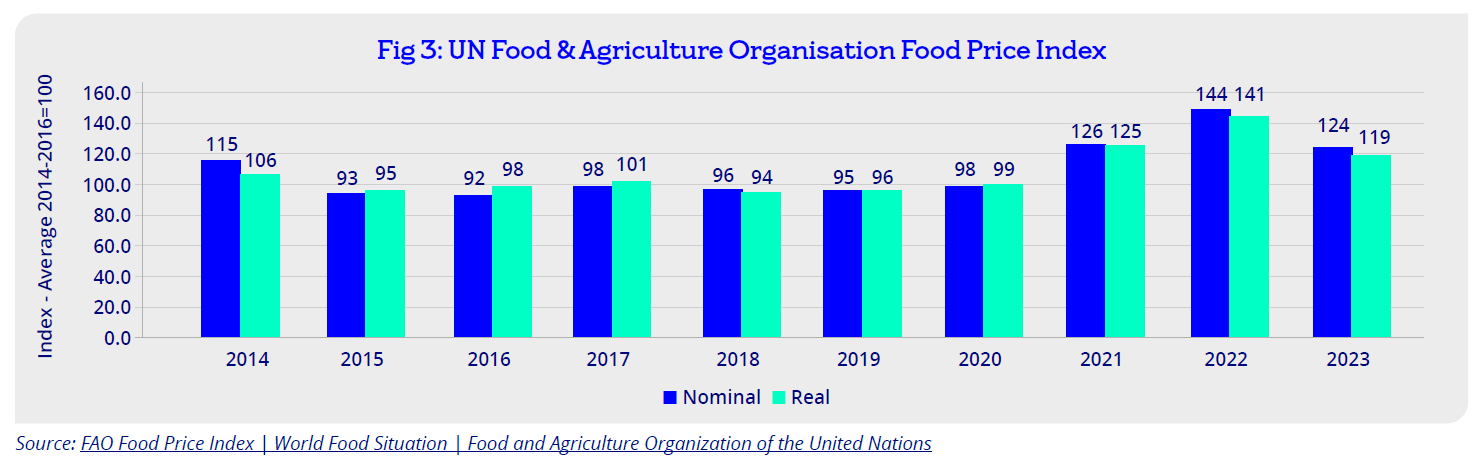

Significant input cost increases in the last few years led to very high food inflation in 2023. There was a time lag in consumer price inflation, as producers grappled with cost increases, trying to find ways to manage the higher cost base and maintain margins. In 2023 the Food and Agricultural Organisation (FAO) basket of commodities dropped (Fig 3) with all commodities except for sugar, lower than in late 2022 (Food and Agriculture Organization of the United States). Kantar reported food inflation continuing to fall to 7.1% in the last three months of 2023 (RTE.ie).

However with higher wage costs in 2024, and supply chain cost challenges back in the mix, inflationary pressures remain for the sector.

The Windsor Framework:

The Windsor Framework brought changes for goods entering Northern Ireland from GB in 2023 with the latest changes from October 2023. The green/red lane system means goods for circulation in N.I. pass easily through the green channel with ‘Not for EU’ labels. Goods intended for the EU go through the red lane with customs declarations and some checks.

Post-Brexit changes:

Whilst no longer in the headlines, further Brexit changes will take place in 2024, adding complexity and cost for exporters. The Border Target Operating Model requires exporters of animal and plant-based products to the UK to classify exports based on the UK’s new classification as low, medium or high risk. Products include live animals, meat/fish-based and germinal products, animal by-products, plants, fruit and vegetables.

- From 31 January Export Health Certificates and Phytosanitary Certificates will be required for medium-risk animal products, plants and plant products moving from EU & Ireland to the UK.

- Prenotification of imports of Sanitary and Phytosanitary (SPS) goods from Ireland on the UK’s SPS import system (IPAFFS) will be required, something already in place for other EU countries exporting to the UK.

- From October 2024, there will be documentary and physical identity checks for medium-risk animal products, plants and plant products imported to the UK from Ireland.

Further afield, Hungary, with the highest food inflation in the EU at 46.9% in January ’23 (Trading Economics), dropping to 4.6% in December 2023, has taken drastic measures to tackle shrinkflation. From March 2024, it requires large food retailers to display price warnings on products that have shrunk in size (RTE.ie).

There is continued consumer price sensitivity and consumers are very focused on cutting food costs through reduced higher-value purchases and more private label purchases. Shoppers continue to make more frequent and smaller shopping trips to avoid unnecessary purchases.

Supply Chain:

Geopolitical events including the war in Ukraine, the discontinued Black Sea grain deal, extreme weather, the lingering effects of the Covid pandemic, and more recently the disruption to commercial shipping in the Red Sea, continue to impact supply chains. The Red Sea conflict has put further strain on already fragile supply chains with shipping companies forced to avoid the Suez canal and take an alternative longer route. The unknown nature and timelines of this disruption has led to a significant rise in container costs.

ESG and sustainable food production:

Whilst food and beverage producers in Ireland recognise the urgency to produce sustainably, there are varying degrees of action. Energy-saving initiatives remain to the fore of activity. Operators have been keen to avail of green transition supports, such as from Enterprise Ireland, to advance their green transition. SMEs do cite lack of expertise or bandwidth in their operations and cost constraints as being factors in delaying their green transition.

B Corp certification:

B Corp certification has gained traction with a small number of Irish food & beverage operators now B-Corp certified. B Corp Certification is a designation that a business is meeting high standards of verified performance, accountability, and transparency on various factors from employee benefits and charitable donations to supply chain practices and input materials.

This is very positive from an ESG perspective. B Corp set up an office in Ireland in late 2023 which will encourage further participation.

Approval activity:

Transactions include approvals for stock management, loans for enhanced production capacity and for heightened seasonal activity. There are operators looking to increase production and to increase automation. Loans for green initiatives are being employed for the introduction of green technologies such as solar panels, heat pumps, CO2 recovery and more sustainable food production methods.

2024 Outlook

- The outlook for the sector in 2024 remains optimistic despite global uncertainty. Food and beverage producers continue to show remarkable strength and flexibility weathering the shocks of recent years.

- Inflationary challenges remain with increased staffing costs a key concern.

- Food inflation will continue to feature but to a lesser extent than 2023.

- It is likely that consumer food shopping and consumption patterns will remain cautious.

- ESG – Sustainable /local food production and reduction of food waste will become increasingly important to the sector.

- The UK’s Border Target Operating Model will introduce new controls for products entering GB, Ireland’s largest food and beverage export market.

- Producers are increasingly focussed on innovation in response to evolving food trends.

The Sectors Team is a differentiator for Bank of Ireland in that the sector heads are recruited directly from industry and bring perspective that only first-hand experience can provide. To learn more about Bank of Ireland’s sectoral expertise, click here