Investment will overhaul telephony and other systems leading to faster customer service. More services to be available 24/7, with voice biometrics improving security and efficiency.

Bank of Ireland has revealed a €34m investment in the transformation of its telephony and customer relationship management (CRM) systems.

This investment in technology will lead to faster resolution of customer calls, enhanced self-service options (change account address, order duplicate statements, request a new card), allow more transactions to take place 24/7 via phone, and improved customer security.

“This is the largest single investment in enhanced systems and technology for our frontline colleagues in branches and contact centres that the Bank has ever made”

The Bank says this will provide 2,800 colleagues in branches and contact centres with ‘single view of customer’ data for faster call resolutions.

The bank of tomorrow

It will also use voice biometrics to improve customer authentication for better fraud protection and reduce call waiting times.

The new system will enable more streamlined phone-based transactions that can be done 24/7, including improved customer verification methods and removal of complex menus.

Bank of Ireland’s latest tech investments follow the news of €60m spent on ATMs and its branch network and €50m on fraud protections and bring the total being spent by the Bank on customer service improvements to close to €150m by the end of 2025.

“This is the largest single investment in enhanced systems and technology for our frontline colleagues in branches and contact centres that the Bank has ever made,” said Susan Russell, CEO of Bank of Ireland’s Retail Ireland division.

“We receive more than 11,000 calls on average each day and when customers call us they want speed, expertise and security. This investment equips colleagues with the latest technology to provide better and faster resolution of calls, and colleagues will now have a ‘single view’ of the customer at the touch of a button providing them with instant access to all their information without having to talk to another part of the bank. This investment will make things faster and better for customers and for colleagues, it’s a win-win.”

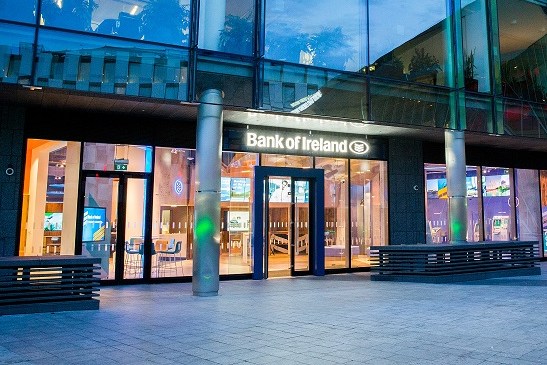

Main image at top: Newstalk presenter Joe Lynam with Susan Russell, CEO of Bank of Ireland’s Retail Ireland division, announcing the investment

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here