What is the most tax efficient way to extract large sums of cash from your business?

Having emerged from deep recession to now operating in one of the fastest growing economies in Europe, many companies are starting to make healthy profits and accumulate strong cash balances.

While company directors might want to extract some of the profits, we know that there are considerable tax implications in doing so.

“If your business is doing well and generating cash, now may the time to start extracting it from your business.”

One route we talk to our business customers about is what we call “wealth extraction.” In simple terms, this involves transferring money into your name tax free using an executive pension policy.

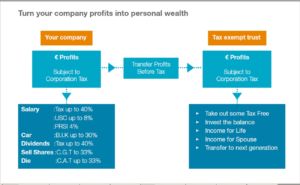

The chart below sets out how this works. On the left side, you can see conventional ways of taking your money from your business.

- If you take it by way of salary, you may have to pay income tax at up to 40%, USC up to 8% and PRSI up to 4%.

- If you take it as dividends, you would pay tax at up to 40%.

- If you use the money to buy a car for yourself, you pay Benefit in Kind at up to 30%.

- If you sell your company, you pay Capital Gains Tax at 33%.

- In the event of death, Capital Acquisitions Tax at up to 33% applies.

We use the words “up to“ as various allowances and reliefs may reduce the tax liability.

One of the most attractive is Retirement Relief which can reduce the taxable value of your business on liquidation or sale. This and other points in this article are, as always, subject to Revenue rules, requirements and restrictions.

“Many company directors pay themselves relatively low salaries, to avoid straying into the top rate tax band.”

The tax treatment is very attractive

Let’s take a look at the right hand side of the chart. We set up a trust and transfer the money into it. The amount that you can extract is a function of your salary and service. It is important that company directors plan in advance for this. Many pay themselves relatively low salaries, avoiding straying into the top rate tax band. However, this can severely limit how much you can extract from your company in a tax-efficient manner.

“When you reach your retirement age, you can draw down up to €200,000 tax free.”

The downside of this strategy is that you cannot access this money until your retirement age. However, how far away is this? Really, you are just deferring expenditure – rather than spending all of your money today, you might spend some of it in the future.

The upside of this strategy is that the tax treatment is very attractive.

- The company gets Corporation Tax relief on its contribution to your pension pot.

- While it is in the trust, it grows tax free.

- You can invest it in a myriad of different ways, reflecting your attitude to risk.

- No DIRT or exit taxes are deducted.

- When you reach your retirement age, you can draw down up to €200,000 tax free and up to another €300,000 at 20%.

You need to find the perfect balance

Once you have made the decision to put money into your pension pot, you need to consider how your money should be invested. At the current stage of the economic cycle, it is important to find the balance between achieving growth and managing the level of risk that you are comfortable with.

“Good quality advice is a vital ingredient in getting this right.”

When you draw down your benefits, you can choose to buy an income for life or to invest it and draw down when you need it.

If your business is doing well and generating cash, now may the time to start extracting it from your business, investing it wisely, benefiting from the tax advantages and taking care of the future for you and your family.

Good quality advice is a vital ingredient in getting this right.

This guide was written by Bernard Walsh.