After the first full year of post-pandemic trade, hotel operators are more optimistic about the future of the sector, notes Bank of Ireland head of Hospitality Sector Gerardo Larios Rizo.

“However, businesses owners and managers are concerned about a few issues, including the anticipated increase in the hospitality VAT rate, inflation (including energy costs), the slowdown in the Tech sector, and fears of recession”

2022 H2 Insights

Despite the many challenges that the hospitality and tourism sector faced during 2022, most accommodation providers reported a very strong year. Record average room rates and a bounce-back in demand/occupancy delivered encouraging turnover figures for many service providers. However, inflationary pressures including a gargantuan increase in energy expenses kept EBITDA margins at bay.

An estimated 23% of Fáilte Ireland registered accommodation (16.9% of registered hotel beds) is currently contracted for International Protection IP (Refugees) and Beneficiaries of Temporary Protection BOTP (Displaced Ukrainian citizens).

This anomaly continues to distort Key Performance Indicators across all locations with a heavier influence in those areas with a higher concentration of contracted beds like Clare, Laois and Tipperary where over 30% of beds are currently under contract.

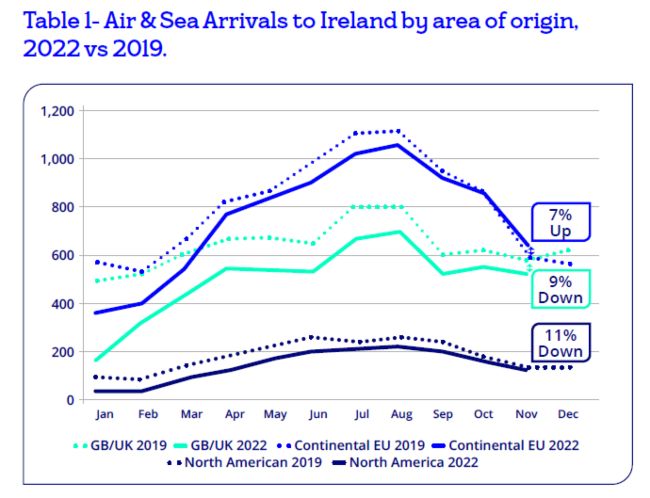

Overseas arrivals into Ireland surged back to 85% of 2019 levels by the end of November 2022 as per CSO reports, and domestic demand levels remain robust supported by low unemployment levels reported at 4.3% for December 2022. Demand for hotel assets also recovered for the period, with Jones Lang LaSalle (JLL) reporting 19 transactions amounting to €400m during the year, almost double the 2021 figure.

Hotel sector key activity and trends H2 2022

- Record average room rates reported by hotel properties across Ireland. Performance was supported by a surge in demand from both domestic and overseas visitors. It is worth noting that some of the average room rate increases relate to the heavy investment and upgrades to hotel assets in Ireland over the last couple of years.

- Large number of hotel properties (115) have upgraded to 4 star status since 2009. The segment now accounts for 44% of registered hotel properties in Ireland. Almost 50% of the bedroom stock in the country is now “upmarket”.

- Direct Provision. Approximately 17% of registered hotel beds in Ireland were contracted for direct provision purposes at the end of November 2022.

- Exponential increase in energy expenses reported by many properties across the country (100%+ increases).

- Arrivals into Ireland back to pre-pandemic levels for November 2022 (less than 1% down on 2019 arrivals for the month). At the end of November, EU arrivals have showed the highest level of recovery at 92% of 2019 levels (8% down).

- Robust Balance Sheets. Strong deposit balances in the hotel sector supporting capital investment projects across many hotel properties.

- Staffing. Difficulties with recruitment and retention remain a top concern for hotel operators.

Hotel investment and development

- Republic of Ireland Hotel bedroom supply increased marginally over the last year from 62,665 bedrooms to 63,488 (823 additional rooms) despite the opening of around 2,200 new bedrooms in Dublin during year-end December 2022, and some minor regional openings. The difference comes from a number of hotels taken off the register as they are currently being used for direct provision purposes. Some of these properties are anticipated to come back to the register when a more permanent solution can be provided by the government.

- Within the Republic of Ireland Dublin continues to lead the way in the development of new hotel bedrooms with just under 2,000 rooms expected by the end of 2024 and a further 11,180 bedrooms currently considered speculative/unconfirmed as per latest data from CoStar (Nov 2022). Additional hotel bedroom developments are also expected in Cork (2,040 in the pipeline), no material numbers anticiapted in Galway at this stage.

Business & Consumer sentiment

- 68% of businesses in the tourism sector reported more visitors in 2022 compared to last year, 11% have had the same level; 21% report being In Dublin it was 91% of businesses that reported an increase (due to the fact that recovery was a little slower in the capital).

- Accommodation sales are reporting a stronger trend than non-accommodation sales in the sector with some operators expressing concerns about profit margins.

- Consumer sentiment remains strong supported by record level of personal savings. Household deposits in Irish banks reached a level of €147 billion in August. This is up from €139 billion in August 2021 and a pre-pandemic level of €109 billion. Positive employment trends reported during the year provide further confidence about discretionary spending patterns in the coming year.

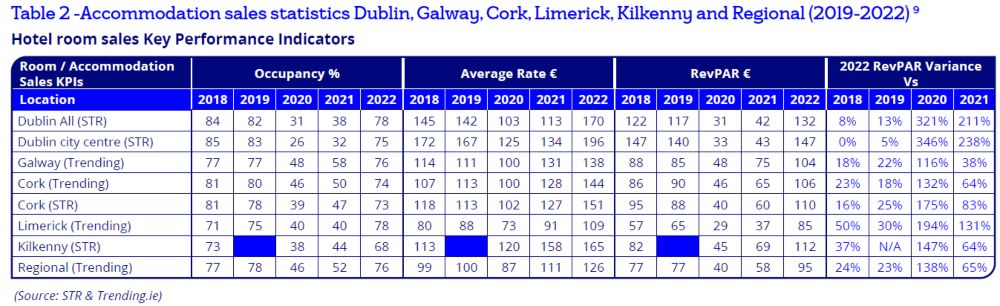

Accommodation sales key performance metrics H2 2022

- Galway City. Average room rate growth of €27 (24%) reported for year-end December 2022 vs 2019 with an average occupancy of 75.5% (1.2% down on 2019). Overall, a great result for the city with RevPAR up 22% on 2019.

- Limerick City reported outstanding performance during year-end December 2022 with both average occupancy and average rate exceeding pre-pandemic (2019) levels. Year-end RevPAR for December 2022 was 30% up on 2019.

- Cork City reported a €31.2 (28%) increase in average rate for year-ending December 2022 vs same period 2019, although slightly softer occupancy diluted the RevPAR increase to 18% for the period.

- Dublin. Both Dublin City and the wider Dublin area reported a sharp rebound in demand over the second half of last year.

- Dublin Region – Record average room rate of €170 reported for year-end 2022 (20% up on 2019) but 6% down in occupancy vs the same period.

- Dublin City – Dublin City finished year-end December 2022 with an average room rate of €196, 15% ahead of Dublin region and 17% ahead of the same period in 2019.

N.B. VAT Rate was higher in 2019 (13.5% in 2019 vs 9% in 2022) so comparisons are not exactly like for like.

Food and Beverage sales

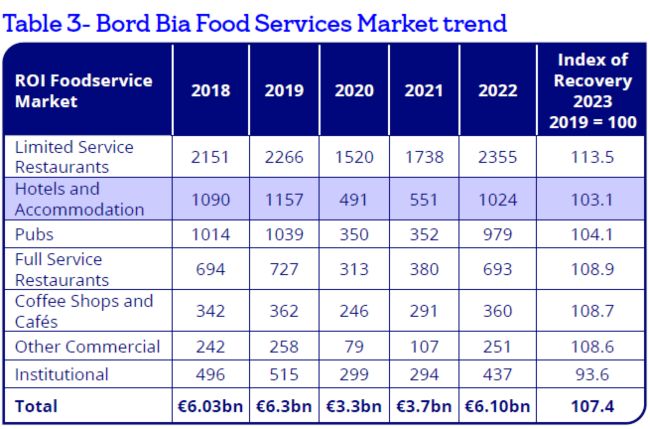

- Food sales showed strong recovery for the for the Hotel and Accommodation sector during 2022. Sales volumes, estimated at €1.024bn represent 88% of those delivered during year end 2019 by the sector.

- Limited Service restaurants, coffee shops and cafés reported stronger bounceback in trade and are already trading at similar levels.

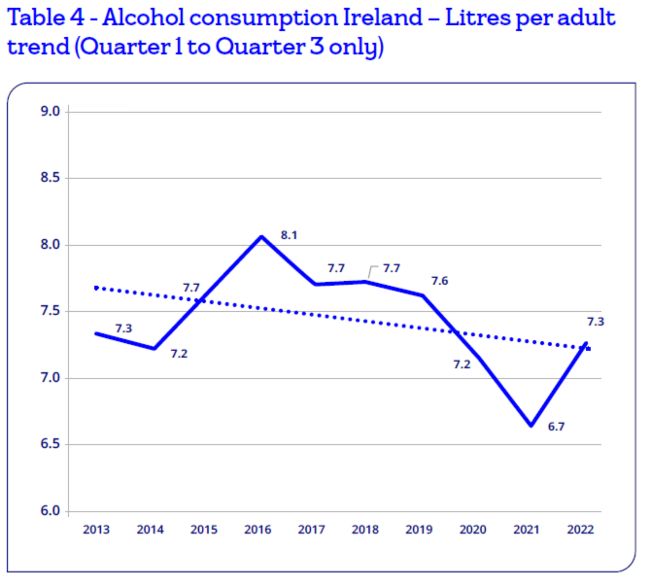

- Alcohol consumption in Ireland resurged in 2022 after a decline in the two previous years. This is no big surprise as licensed premises were unable to trade for a prolonged period of time.

- On December 7th, 2022, the government announced the approval of the priority drafting of the Registration of Short-Term Tourist Letting Bill and publication of the General Scheme of the Bill. It is estimated that up to 12,000 rooms may come back to the long-term rental market (out of the short-term) as a result of this initiative. Some of the provisions included in the bill are:

- Valid registration number provided by Fáilte Ireland required by properties advertised for short-term letting (including through online platforms).

- Suppliers offering accommodation for periods of up to and including 21 nights will need to be registered with Fáilte Ireland.

- Fáilte Ireland, for the first time, to have a full picture of tourist accommodation across the State, significantly enhancing their ability to promote and drive tourism investment.

2023 H1 Outlook

After the first full year of post-pandemic trade, hotel operators are more optimistic about the future of the sector. Businesses are reporting strong levels of bookings and sustained average room rates for the first quarter of this year which is driving business sentiment on an upward trend, as evidenced by the latest Fáilte Ireland Tourism Barometer (December 2022 update).

However, businesses owners and managers are concerned about a few issues, including the anticipated increase in the hospitality VAT rate, inflation (including energy costs), the slowdown in the Tech sector, and fears of recession expressed by leading economists at the World Economic Forum in Davos. The VAT increase from 9% to 13.5% could have an immediate negative impact in profit margins across the sector, particularly detrimental for businesses with a higher dependency on food sales as the margins on these have been under increased pressure in recent times.

Trends

- After two years of strong profits recorded by leading operators, a substantial number of refurbishments and extensions as well as equipment upgrades (focusing on energy efficiency) are on the cards for several hotel properties across Ireland for 2023.

- An increasing number of hotels will focus on securing Green credentials and wider “ESG” certifications in the coming year as sustainability continues to ascend in the customers ‘decision making matrix’.

- Sourcing of accommodation for people seeking International Protection (IP) and for those fleeing the war in Ukraine (BOTP) is becoming increasingly difficult for the government of Ireland. A number of longer-term viable solutions are currently under consideration by the government to reduce the over reliance on the sector.

- Talent recruitment, and development and retention strategies continue to evolve. Employers are increasingly offering more flexible working conditions, incentives and benefits like staff accommodation to attract staff.

- Inflationary fears are negatively impacting on forecasted profit margins for the coming year. Many hotel properties have budgeted a marginal decline in EBITDA margins reflecting the impact of increases in energy, wages and cost of food and drink.

- Numerous wedding venue operators have reported a softening of average wedding party numbers. The trend might become a legacy after the restrictions imposed on the sector during the intermittent lockdowns of the pandemic.

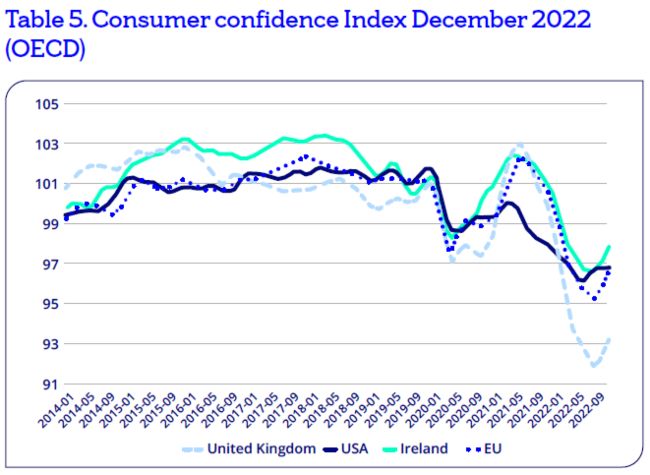

- Consumer confidence index appears to have turned a corner during the last quarter of 2022 with the US, the UK, Ireland and the EU all reporting a positive shift which should provide further confidence to the sector for the year ahead.

- Bord Bia estimates food services in the Hotel and Accommodation services sector will return to pre-pandemic (2019) levels by the end of this year.