Head of Hospitality Sector at Bank of Ireland Gerardo Larios Rizo analyses recent Budget 2022 measures, staffing shortages and the outlook for the sector.

Demand recovery

Whilst domestic leisure demand supported strong trade and rates this summer, hospitality businesses are now dealing with pronounced drops in demand mid-week which would normally be filled by overseas visitors and corporate activity particularly around city centre locations.

Overseas visitor figures were encouraging for the month of August but demand for traditional corporate events remains suppressed as many companies are still not ‘fully’ back to their offices.

“A number of business in the hospitality sector continue to curtail their services due to the lack of staff”

The Republic of Ireland reported 822,000 passenger arrivals in August 2021, up 127pc on August 2020, but down 64pc on August 2019, when 2.3 million passengers arrived in Ireland. Continental routes at 508,000 were up by 122pc on August last year – this stands at 45pc of the arrivals for August 2019 and is the route showing the strongest recovery compared with 2019.

Overseas arrivals by Route (‘000’) August 2021

More and more flight routes continue to be restored by different airlines such as the Dublin to San Francisco route set to be restored next month by Aer Lingus. The increased air capacity will not only provide opportunity for overseas visitors but also to Irish residents to travel abroad, leading to a drop in demand unless international travel follows similar trends.

The short lead in time for bookings means a lot of businesses are still unsure about demand for the Christmas season with many businesses still reporting plenty of availability only two months out.

Government supports

Budget 2022 included a number of measures that were welcomed by the hospitality sector including the extension of EWSS supports to April 2022 and the moratorium on council rates to December 2021. However, the hospitality VAT rate is expected to return to 13.5pc by August 2022 with industry bodies expressing disappointment at this measure.

New EWSS subsidy rates will kick in from December 2021 and stay in place to the end of February 2022 (two rate structure €151.50 and €203). For March and April 2022 a flat rate subsidy of €100 will be in place and the reduced employers PRSI will no longer apply.

The Budget included some additional measures to support the wider tourism industry:

- €50m for further Tourism Business Continuity Schemes

- €36.5m in Capital Funding for tourism product developmen

- €35m increase in Tourism marketing Fund

- €90m for an aviation package

Staffing

A number of business in the hospitality sector continue to curtail their services due to the lack of staff which has become a very serious issue particularly for full time kitchen staff; part time staff to support weekend trade is not really a problem for the majority of businesses.

Solutions implemented by many businesses to address staffing issues include overseas recruitment (a number recruiting from Eastern Europe and Italy) and the upwards revision of pay scales; some of these measures could impact profit margins in the coming year.

Recovery at a ‘Net Profit’ level

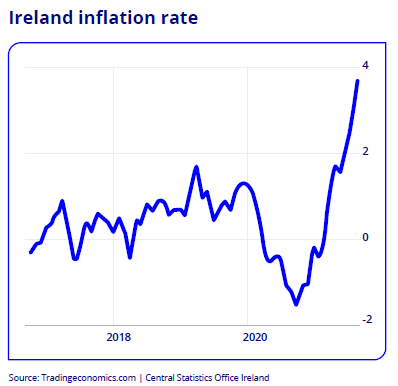

Ireland’s consumer price inflation rate increased to 3.7 percent in September 2021, from a 2.8 percent increase in August which presents many challenges for a sector that operates under tight margins. The sector is already facing pressure from the rising cost of wages and the introduction of mandatory paid sick leave starting next year, so businesses are now having to review their prices to compensate for an increased cost base.

A large number of hotels, bars and restaurants are positive about a bounce back in trade which may bring turnover back to 2019 levels by the end of 2023, however the increased cost base may a take a little longer to settle and delay the bottom line recovery by another 12 months or so.

Warehoused revenue liabilities

Businesses across the sector continue to take advantage of the warehousing of liabilities offered by Revenue which is set to expire at the end of this year. The accumulated (qualifying) debt will incur no penalties or surcharges during 2022, however it does need to be repaid starting 2023 with an interest rate of 3pc being currently advised. Businesses can already make arrangements with Revenue to organise their repayment schedule although many are waiting to see how Q1 2022 pans out before making commitments.

Sector Development Insights October 2021 report:

-

Bank of Ireland is welcoming new customers every day – funding investments, working capital and expansions across multiple sectors. To learn more, click here

-

Listen to the ThinkBusiness Podcast for business insights and inspiration. All episodes are here. You can also listen to the Podcast on:

-

Spotify

-

SoundCloud

-

Apple