While recession clouds linger, Ireland’s manufacturing sector weathered the storm well says Conor Magee, Bank of Ireland’s head of Manufacturing Sector.

“The fundamentals of Irish manufacturing continue strong”

2023 – H1 Lookback

A cautious start as inflation eases, supply chain predictability improves, ESG goes mainstream, but global demand softens as recession clouds linger.

Irish Manufacturing started 2023 on an asymmetric mix of optimism and caution. Optimism on the back of record performance in 2022, but caution as demand slowed and manufacturing entered contraction waters in Q4/2022, which has persisted through H2 2023. Ongoing interest rate hikes across EU, US, and UK have had to a limited degree the desired effect of constraining demand and slowing inflation and with that comes a correction and slowdown in manufacturing output.

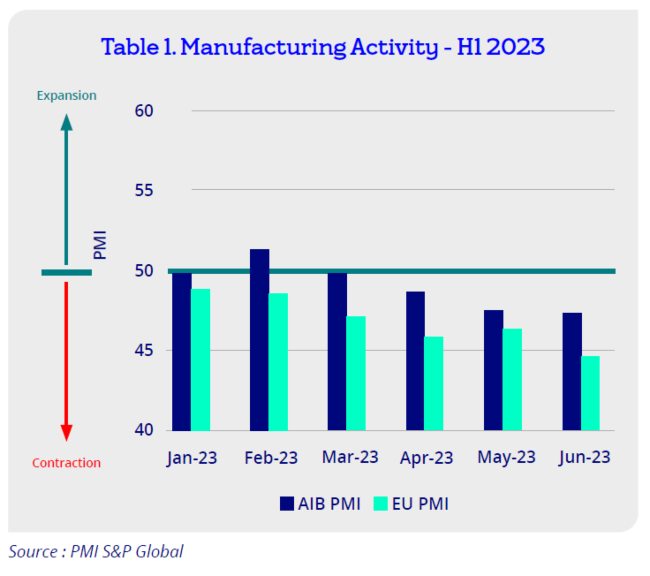

Ireland’s rate of contraction has been slower and lagging that of its peers with Purchasing Managers’ Index (PMI) dropping from 50 to 47.5 compared to from 48.8 to 44.8 for the EU. These numbers however tell a composite story and as such different sectors will feel the pain differently. Capital goods & Modular construction remain resilient, Automotive EU registrations were up 18.5% in May but global Q1 PC sales were 30% down YOY.

Caution is driven by a number of factors:

- Drop in demand and order books in certain sectors as interest rate and inflation environment reduces spend

- Manufacturing Capacity adjustments are likely with corresponding impacts on employment

- Geopolitics and rise in protectionism and the norm of VUCA, Volatility, Caution, Unpredictability, Uncertainty

- Purchasing Manager’s Index (PMI) is in contraction territory across all major economies

- Recession clouds linger

Optimism is underpinned by many positives

- A record year in 2022 translating into Ireland moving from 11 to 2 in IMD World Competitive Index

- Full employment and a record 323,000 working in Irish Manufacturing

- Supply Chain easing in part by receding demand

- Inflation of inputs is easing but prices are not back to pre-Covid levels

- Manufacturing is embracing the opportunity of the green agenda and managing the energy security risk 2023 will see a correction to flat and best case moderate growth but very much depending on subsector. Employment while strong, is a lagging indicator, and as capacity reductions aligned to lower demand kick in, a downward impact in employment can be expected. The 4% Q1 drop in exports and more dramatic drop in April of 12% underlines this risk. Already June PMI data has signalled a drop in employment levels as firms adjust capacity to true needs. However manufacturing are used to navigating economic cycles and will act early with an eye on the longer picture, keeping in mind the resources they have invested in growth.

Opportunities will remain strong in the sector and the green agenda is one of those opportunities. This will continue to gain momentum as businesses move from plans to action to align with regulations, MNC demands and customer expectations.

Investment in automation and digitalisation will gain ground. Irish manufacturing SMEs will continue to benefit from both recent positive FDI news (AMD, Lilly, Analog devices, Dexcom) and reality that MNCs continue to de-risk and reconfigure their supply chains to something more regional and resilient.

In summary, 2023 is a mixed picture for manufacturing characterised by a kaleidoscope of slower growth, moderating orders, solid business confidence, macroeconomic uncertainty, the impact of all of which are all dependent on subsector health and the economic performance of our trading partners.

H2 will need to deliver a strong performance in orders and production output to offset the slowdown in H1. Time is running tight to deliver on targets and so it may well be 2024 before growth returns.

Summary of Key Impacts

- Geopolitics, Rise in Protectionism and Strategic Autonomy: Perhaps one of the lasting impacts of COVID-19 and accelerated by Russia Ukraine conflict has been the desire for major economies to have greater Strategic Autonomy and less reliance on global supply chains. It is a complex picture of economies moving away from mutual benefit to national gain and impossible to predict how it will play out. Irish manufacturing is in a strong position to navigate the impacts given the deep roots of both the MNC and SME manufacturing community.

- Brexit: Exposed Irish Manufacturing has adjusted and there is of late no negative noise from players specifically in connection with Brexit. Many have benefited from new EU customers, technology transfers and unexpected higher sales volumes with the UK.

- Russia Ukraine Conflict: Sadly the Russia Ukraine conflict continues. It has highlighted risks of:

- Key commodity bottlenecks – concentration risk

- Risk of trading with autocracies – 109K EU firms have tier 3 suppliers in Russia Ukraine

- Accelerated Strategic Autonomy and rise in protectionism e.g. chip manufacturing expansion plans in US and EU

- Factory Operations: With the headwinds of energy inflation and labour shortages, Manufacturing response has been twofold. Behavioural and shift pattern changes to optimise energy usage (see more under ESG section) and an acceleration of the digital agenda and higher levels of automation

- Unpredictable volatility has become the new normal

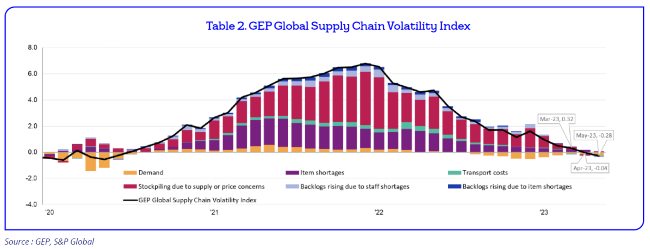

- Supply Chain Resilience continues a top priority for manufacturing to maintain business continuity and protect reputation. The good news is that Supply Chain constraints are easing with Global Supply Chain Volatility Index GSCVI at -0.28, which has dropped to less than 1 from peak “bottleneck” values in 2021 of >6. GSCVI = -0.28 is interpreted as “slightly underutilised”

- Inflation (HICP) has eased to 4.8% in June 2023 but will remain elevated in 2023: SMEs are passing on costs but not without pushback; given long lead times, higher price tags, lower spending capacity, consumers are delaying purchases or switching to service offerings e.g. holidays and leisure.

- 2022 Irish GDP of which Manufacturing contributes 39% grew by 9.4% and forecast for 2023 ranges from +0.1% (ESRI June 2023) to +5.5% (EU Commission May 2023). Q1 2023 GDP fell by 2.8% compared to Q4 2022.

- Manufacturing exports up 26% in 2022. However Q1 2023 exports while high are -4% YOY.

- IDA FDI growth with 242 investments won in 2022

Purchasing Managers, Index (PMI) data

2023 has been a year of contraction so far with latest June PMI at 47.3 driven by falling orders and lower production output. Higher risk adversity, tighter spending, interest rates hikes and lower business confidence all serve to amplify fears of an economic downturn.

- Labour market shortages. Economy is at full employment and shortages of key technical skillsets are still the case. These are being partly addressed with increased levels of automation and in-house employee networks. However availability of affordable accommodation remains a key barrier to attracting key talent.

- ESG, Digital and AI agendas gain momentum in 2023. All driven by a combination of digital transformation, supply chain reconfiguration, ESG metrics, regulatory compliance and higher fuel costs improving payback periods for electrification and renewable sources.

Key Trends and Metrics for Irish Manufacturing Sector

Irish Manufacturing PMI

PMI is a survey of 250 manufacturing companies, and a result greater than 50 represents expansion. From a high of 59.4 in 2022, the measure has seen a downward trend and now four months of contraction with June PMI at a 3 year low of 47.3 for Ireland and 44.6 for EU as orders decline and demand weakens. The concern is that this scenario drags on into H2 and will impact employment.

Global Supply Chain Volatility Index (GSCVI)

The GEP Global Supply Chain Volatility Index, based on data derived from a monthly survey of 27,000 businesses, has fallen from the dizzy heights of 6 to below zero in May at -0.28, or, its lowest level since May 2020. The difference compared to a year ago, when the index recorded 4.72 — one of the highest levels of stress on global supply chains in two decades of data — is remarkable. This dramatic fall points to:

- Weaker demand for raw materials, commodities and components

- A lower inventory requirement to buffer above.

- Reduced material shortages

- Easing of labour demands and risk of unemployment in sector rising

- Transport costs return to normal

- Downward price pressure

In summary the latest data signals economic weakness as we head into the second half of 2023. To avoid gluts, companies are running down inventories driven by weaker demand and reduced supply bottlenecks.

We are now seeing in part the other side of bullwhip effect i.e. gluts.

During the supply chain constraint period in 2021 to 2022, the tendency was to overstock and amplify needs to safeguard customer fulfilment. It was difficult to predict the numbers, there was high variability and for the sake of reputation and keeping promises, businesses often erred on the high side. As a consequence stocks end up higher than needed, and then as demand drops, gluts in materials can appear.

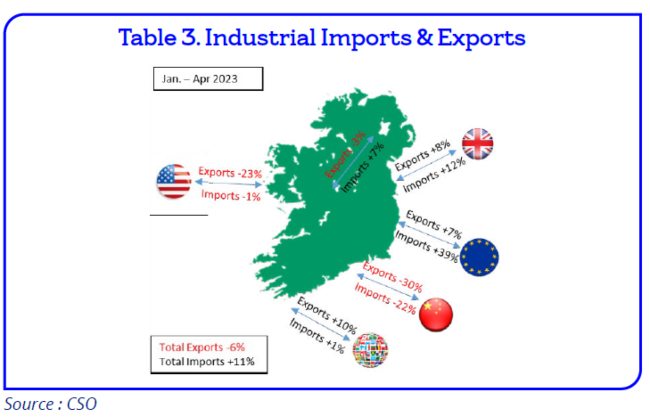

Imports and exports performance are summarised in graphic (Table 4) for period Jan – Apr 2023. In totality imports were up YOY by 11% while exports are down by 6%. Given that 2022 was an exceptional year driven by volume, inflation and spill over from 2021, this drop in exports is not entirely surprising. It is concentrated in the Pharma sectors down 6% and Machinery down 14%. Markets impacted are US down 23% and China down 22%.

What perhaps is more worrying is that month of April recorded a monthly drop of 12% with 14% in the Pharma sector.

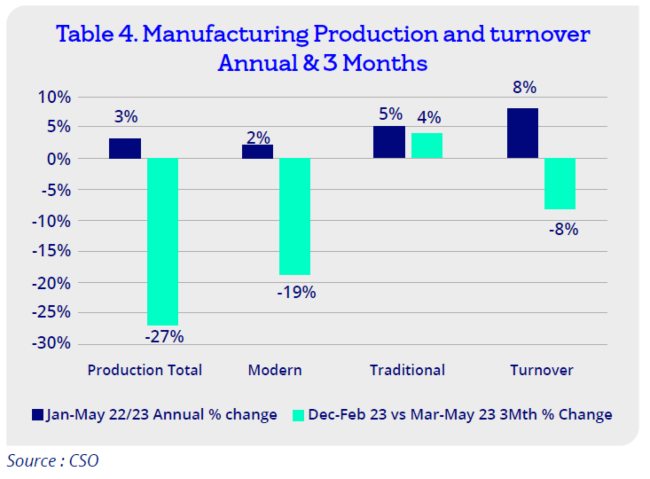

A similar picture emerges for Manufacturing production and turnover. Annual comparison January to May is positive reflecting less supply bottlenecks and manufacturers running down backlogs.

However rolling 3 month comparison is negative with production down 27% of which Modern (Including Pharma) is down 19%.

Manufacturing Input Price Inflation

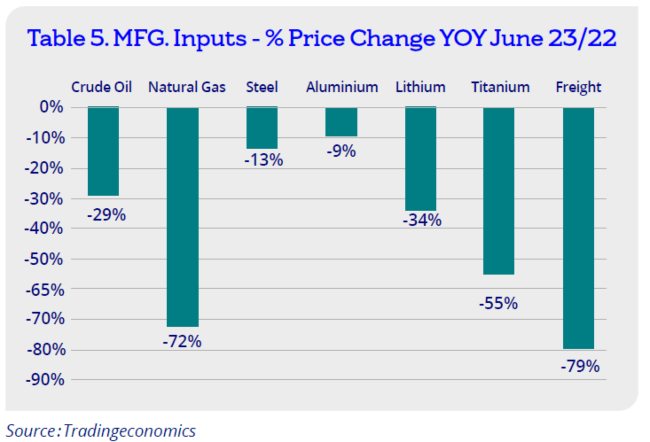

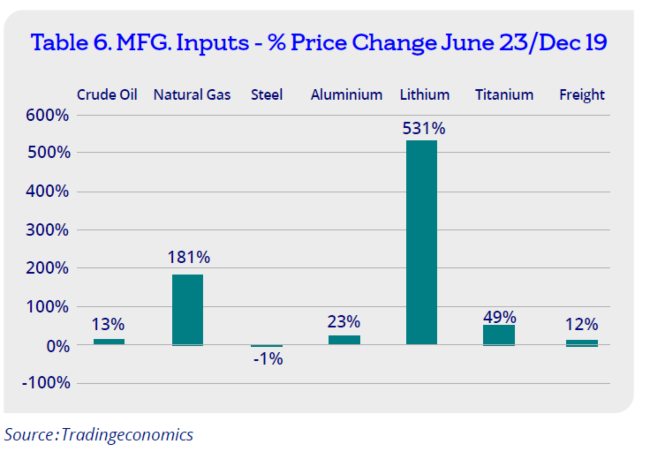

Last edition I wrote that inflation was easing, down to 8.2% in December. Thankfully this downward trend has continued with latest June 2023 figure at 4.8%. This is good news but the reality is that prices continue elevated when compared to pre Covid-19 levels. See tables 5 and 6.

Lithium pricing is attributed to growing electrification demands, Natural Gas pricing is contingent on mild winters and robust storage strategies. Freight and steel are back to more normal levels. Wage inflation is likely to continue given shortages while forecasted tax reliefs may only serve to reverse the downward inflation trend given that the Irish economy is operating at full capacity. The implication of these softening of inputs costs is that SME customers, MNCs and OEMs are likely to want to crawl back some of the pricing increases given. If the inflation downward trend continues then expect inflation to return to target EU levels of 2% as the comparison time window evolves.

ESG: 2023 the year when Carbon targets are mandated

2023 is the year when compliance with carbon targets is no longer optional as it becomes a legal and regulatory requirement.

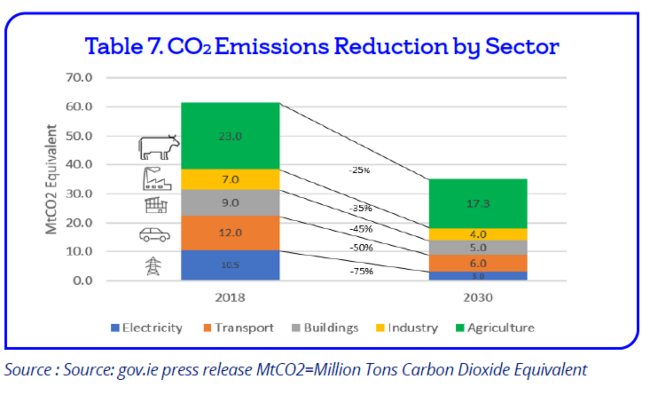

Carbon targets published on 28th July 2022 for Ireland are shown in Table 7. Manufacturing accounts for about 12% or 7 MtC02e of total emissions and the 2030 target is a reduction of 35% to 4 MtC02e.

This will be achieved by a combination of carbon reducing activities including:

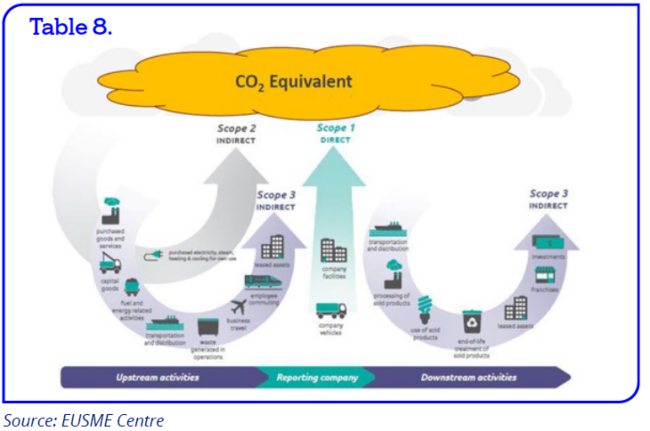

- Carbon neutral heating and energy sources (Scope 1, 2 emissions) – See Table 8

- Zero polluting emissions

- Electrification of internal logistics

- High energy efficient capital equipment

- Low carbon footprint supply chain (Scope 3 emissions)

- Waste management strategy

- Circular Economy strategy including a transition to 9Rs

In its recent publication, “Climate Action – A Toolkit for Business, IBEC together with Accenture have provided a practical Climate Action Toolkit which outlines five steps:

- Calculate Carbon Footprint

- Mobilise and prioritise actions

- Commit and set targets

- Implement

- Measure and Communicate

Step 1 involves the identification of Scope 1, 2 and 3 emissions shown in table 9. The requires a number of key steps:

- Choose a base year

- Set the business boundaries

- Categorise the emissions

- Data collection

- Apply Emission factors (SEAI)

- Calculate GHG emissions

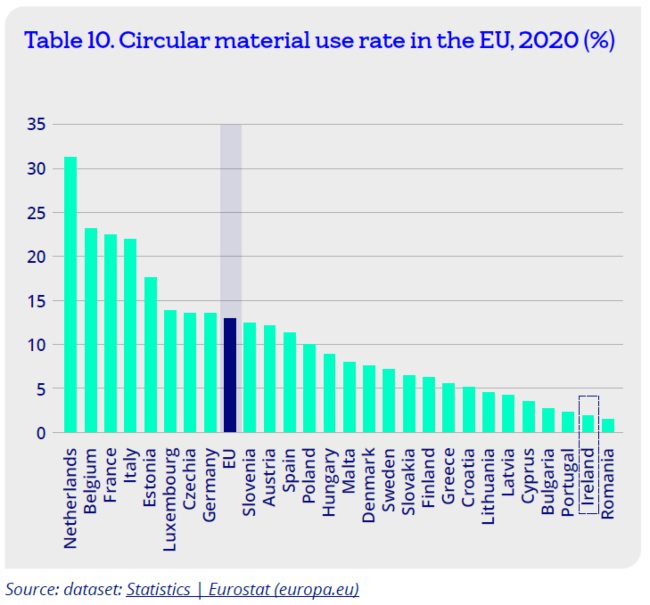

In addition to above, a key opportunity for Irish Manufacturing to reduce its carbon footprint is to maximise their circularity. Move from the linear take, make waste to embracing the 9R’s as per table 9 which shows that maximum Green benefit is achieved when material is designed out of a product while minimum benefit is achieved from recycle and recover, as carbon effort for both is high relative to the gain.

Currently at a global level the value of circular business is less than 10% of a typical linear business model. According to research paper “Financing in an inclusive circular economy”, Schröder & Raes, Chatham House, the value of the electronics industry is estimated at $2,000bn, whereas the E-waste market is valued at $42bn or just 2% of the linear model.

There are many challenges to transition to circular economy, including awareness of benefits, funding availability, return convenience at end of first life and perhaps what feels like “selfcannibalisation” of existing linear models. The good news is that Irish Circular Economy Act became law in July 2022 providing for the development of a Circular Economy (CE) strategy, a Fund, targets to increase current level sixfold and a levy on certain single use items e.g. Paper Coffee Cups. As awareness grows and consumers vote with their wallets, more and more players will become active and raise their profile in this space. Apple offer trade in for older devices and Nokia have just offered a new smart phone with a repair kit Table 11.

Looking at the ESG/CE challenge through a lens of optimism and opportunity, it is important to note many positive developments to accelerate the Green Agenda.

- Over 5521 Companies are signed up to the Science Based Targets Initiative (SBTi): 1/3 of Global Market Capitalisation and this number has doubled since start of 2023

- Companies with SBTs are empowering their peers, customers and suppliers to take action

- Bank of Ireland joined this cohort in Dec. 2022 with its ESG goals validated by the SBTi

The economics of renewable energy fuels continues to improve with grants for Solar conversion recently increased to up to €162,500 for businesses Home – Sustainable Energy Authority Of Ireland | SEAI

- Wind energy electricity accounted for 34% of needs in 2022, a saving of €2Bn for gas and will continue to scale subject to planning and grid constraints

- Market share for Electric cars (EVs) in EU continues to increase from 9.6% to 13.8% in May. Ireland has experienced over 65% growth for EVs YOY for H1 2023

- Triggered in part by energy inflation and security of supply, H1 2023 saw a noticeable uptick in Manufacturing embracing the Green Agenda:

- Behavioural Changes – shift planning, switching off, energy cost awareness

- CapEx projects in renewable energy sources – heat pumps and solar panels

- Price increases to customers where possible

- Avail of Government supports

- Marketing their “Green credentials” with customers

In summary, while the targets remain daunting and challenging, and pace is still too slow, a lot is happening to move the needle.

More and more businesses recognise ESG as a strategic imperative for value creation and survival. Under the new Corporate Sustainability Reporting Directive (CSRD) obligated companies must disclose detailed information annually. While this kicks in from 2026 for SMEs, many will bring this forward to meet the demands of their customers and to be “report ready” when legally required.

Funding activity in the sector

- Bank of Ireland Business Banking H1 2023 drawdowns are at a similar level to H1 2022 but Q2 are behind YOY reflecting:

- Caution in the sector given the uncertain macro-economic environment and ongoing geo political risks

- High and significantly increased deposit balances driven by a bumper year in 2022

- High interest rate environment

- Relief from higher working capital needs given improved supply chain dynamics

- Demand for funding continues to fall and is down 4 points (20% to 16% of firms) YOY according to a survey of 1,500

SMEs that was released in September 2022.

- M&A deal volumes are down YOY overall from 226 to 198 (Renatus 9/7/23)

- Funding was dominated by working capital followed by M&A, MBO transactions and capital expenditure.

- BOI continue to support clients with stocking loans which act as an insurance policy against supply interruptions and

inflation. However this need is reducing as noted earlier, with supply chain dynamic returning to more certainty.

- There is a wait and see element on interest rates and for funding options which offer lower fixed rates and are green related.

Manufacturing 2023 Outlook and Beyond – Optimism despite macroeconomic clouds with focus on costs and margins

Tailwinds 2023

- Irish Manufacturing is hugely resilient with enormous positive dividends gained by shocks of COVID-19, Brexit and Ukraine serving it well to navigate the uncertainty of 2023.

- SMEs continue to benefit from MNCs reconfiguring their supply chains to local and more secure partners

- SMEs have benefited from vertical integration changes in response to supply chain headwinds.

- The shocks of energy inflation and shortages are accelerating conversion to Greener alternatives.

- Latest PMI June survey indicates rising confidence around the future

- Inflation impacts are receding but customers are seeking to reverse increases.

- FDI activity remains buoyant and will support growth

- Manufacturing is embracing ESG and rate of adoption is increasing as funding grants increase

- EU GDP growth has been revised upwards to 1%. EU view on Ireland remains at 5.5% but more recently the ESRI has forecasted just 0.1% but returning to 3.5% in 2024. However Q1 2023 GDP fell 2.8% with MNCs contracting by 9%.

Headwinds 2022

- Negative PMI, Exports, Industrial output and GDP data all point to slower demand and recessionary caution

- Given the downward H1 data, it may prove difficult for businesses to catchup in H2 and hit 2023 growth targets

- Supply chain pain has moderated but requires continuous resilience improvements

- Input costs remain high, margins are under pressure and customers seeking reverse of increases

- Labour shortages and competition for certain talent in a tight market continues

The fundamentals of Irish manufacturing continue strong. However given the H1 global demand slowdown, manufacturing overall will find itself navigating a downward adjustment in capacity and employment levels until customer orders start to rise in the medium term. The short term focus will be cost and margin management and more bandwidth to spend on important Green and digital agendas.