The hotel sector in Ireland had a phenomenal 2023, but profit margins could come under pressure in 2024, warns Bank of Ireland head of Hospitality Sector Gerardo Larios Rizo.

“The hotel sector in Ireland had a phenomenal 2023. Robust demand supported healthy occupancy levels and record average room rates across all locations in the Republic of Ireland. Profit margins could come under pressure this year with a higher rate of VAT and an increase to minimum wage putting a squeeze on the bottom line”

2023 H2 Insights

2023 was a record year for many (if not most) hotels in the Republic of Ireland (ROI). A combination of healthy occupancy levels, strong average room rates, and a softening of energy expenses, delivered record turnover and profits across all asset classes and locations.

The beneficial cash flows that followed, have allowed many hotel owners and managers to invest in their assets, their staff and ultimately their customers’ experience. Investment in ESG initiatives was also top of the agenda across the tourism and hospitality sector as more hoteliers look to further improve on their sustainability credentials.

Air access to ROI was 3% ahead of 2019 levels (Failte Ireland) and supported strong inbound travel; GB visitors accounted for 37% of inbound travel (volume) for the period of March to November 2023 (CSO), although it was North American visitors that spent the most money contributing to 37% of the overall overseas travel expenditure in ROI for the same period. Domestic leisure demand continued to support the performance of accommodation, food and beverage sales during the year further enhanced by robust wedding figures reported by multiple venues. Increase spend was shaped by inflation with the CSO reporting a 6.6% increase in the Restaurant and Hotel sector for 2023, a slightly lower figure than the 8.1% reported for 2022.

The Government contracts continue to distort accommodation statistics, as an estimated 12% (Government Contracted Accommodation Stock) of registered hotel bedrooms in Ireland are currently dedicated for direct provision purposes with no definite end date in sight.

Accommodation Statistics

A positive supply and demand dynamic delivered high occupancy and double digit RevPAR growth across all reported ROI locations5.

The last quarter of 2023 showed a visible slowdown of demand in Dublin with both occupancy and rate falling behind 2022 for the months of November and December (the return of the 13.5% rate of hospitality VAT impacted stats from September to December).

Dublin; despite reporting a soft last quarter, the city centre reported a 5.4% average increase in occupancy in the 12 months to December 2023, and an €8 (4%) increase in average room rate. The opening of about 1,700 additional hotel bedrooms in the city during the year influenced occupancy and average room rate performance.

Galway finished 2023 with an average occupancy of 79% and a rate of €155 (average room rates for August exceeded the €200 mark) this represents a rise of 14% in RevPAR for 2023 vs last year.

Cork reported occupancy of around 90% and an average room rate of circa €156 for year ending December 2023. Hotel bedroom supply will increase by almost 400 new hotel bedrooms in Cork city next year.

Limerick hotels continued to lead the way in RevPAR growth during 2023 with a 22% increase reported vs 2022. The increase was primarily driven by a 15% increase in average room rate which finished the year at €126.

Transaction activity

Whilst only a handful of hotel sale transactions completed during the year, there was plenty of activity with bids considered for a number of additional assets, and some large transactions pending to completion, including the sale of the Shelbourne hotel (Archer Capital reportedly closing on a deal to acquire, The Sunday Times), and the sale of the majority stake in the Dean Hotel group being acquired by Lifestyle Hospitality Capital and Elliott Investment Management (JLL Research).

The strong financial performance reported by the sector during 2022 and 2023 may deliver healthy sales premiums for hotels as these are generally valued on EBITDA multiples, on a per room basis we can expect the Shelbourne to break the record of c€700k per room set by the sale of the Marker Hotel in 2019.

Inbound visitors

Tourism and travel statistics made available by the CSO for 2023 are no longer comparable to historical reports due to changes in the collection and processing of the data. However some of the overarching trends indicate that little has changed in terms of the basic makeup of inbound

travel. The North American market maintains its position as the most profitable one for the hotel sector (CSO);

- GB Market; 1.7m trips delivering a spend of €861m; 37% share by volume and 20% by value – Avg spend €528 (30% of this was spent on accommodation and 60% in day to day expenses)

- North America; 1.1m trips delivering a spend of €1,570m; 23% share by volume and 37% by value – Avg spend €1,479 (51% of this was spent on accommodation and 42% in day to day expenses)

- Other Europe; 1.6m trips delivering a spend of €1,457m; 35% share by volume and 34% by value – Avg spend €894 (45% of this was spent on accommodation and 51% in day to day expenses)

Hotel bedroom development

Dublin city saw an increase of about 6% in the number of hotel bedrooms during 2023 dominated by branded properties in the economy segment including Motel One, Easy Hotel, Clink Hostel,

Travelodge Plus and Premier Inn. Around the country new hotel bedrooms were developed through extensions of existing hotels but this will change in 2024 with new hotel openings in Dublin, Cork and Galway as brands strengthen their presence outside the capital.

Food & Beverage sales

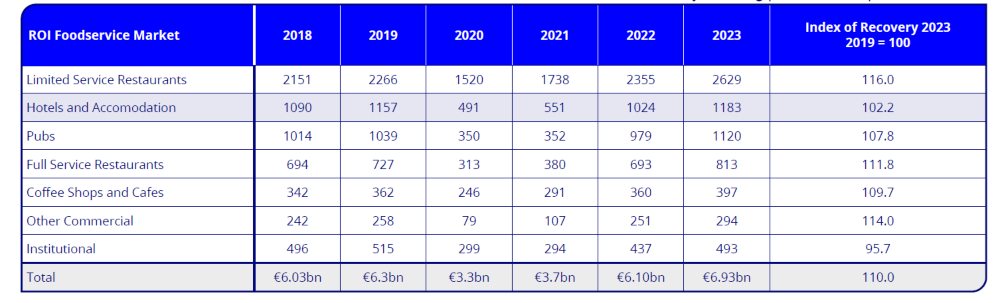

- The foodservices sector performed remarkably well last year, although part of the reported growth/bounce was led by inflation rather than volume. Overall, the market increased by 14% from year end 2022 to year end 2023; the “Hotel and Accommodation” sub-sector was slightly ahead of the average with a 16% increase for the same period as reported by Bord Bia.

- Alcohol consumption (Revenue.ie) declined marginally in the 9 months to September 2023 (- 4%) compared to the same period in 2022.

However, a surge in the consumption of non-alcoholic beverages has compensated sales volumes across most premises.

- The dynamics of demand in the foodservices sector continue to change, and this has contributed to some extent to the surge in restaurant closures reported by the media during 2023.

- Sales prices have managed to keep up with the pace of inflation, but we are aware that the balance is delicate for food and drink sales in particular where the current headwinds could threaten the viability of some businesses. Some pubs and restaurants have reacted by reducing the number of trading days, reviewing their menus, and closely watching purchases and portions

Hotel sector 2023 H2 Insights and 2024 H1 Outlook

Profit margins could come under pressure this year with a higher rate of VAT, increases to minimum wage and paid sick leave entitlements as well as mandatory pensions all putting a squeeze on profits. However, owners and managers appear optimistic about trading prospects for 2024 after a strong end of year and healthy levels of business on the books for the year ahead as well as expectations for inflation to fall below 3% (Reuters) in the year ahead. Sustained employment statistics (unemployment rate of 4.9% reported by the CSO for December 2023) provide some comfort on discretionary spending patterns from the domestic market in the coming months.

Tourism Ireland has predicted a significant rise in US tourism in Ireland in 2024, with numerous new flights announced between Ireland and the US including a number of additional routes to Shannon Airport which reported a 29% increase in passenger numbers last year. Sustainability is frequently referenced in business plans these days and is likely to shape

the investment landscape in 2024. Reflecting this growing interest, “Tourism Ireland is to join with Failte Ireland and NI Tourism in launching a new standard for tourism stakeholders who offer a sustainable product or service” (Hospitality News). The scheme will be launched in 2024 will aim to support businesses committed to sustainability.

Most agents agree that 2024 could be a record year for the hotel transaction market in Ireland based on active transactions and a number of high profile properties currently on the market.

Trends

- Strong levels of transaction activity are expected in the Irish Hotel sector this year based on a number of live deals, including: sale of the Shelbourne Hotel, Hampton Hotel in Donnybrook, the sale of the majority stake of the Dean Hotel Group to Lifestyle Hospitality Capital and Elliott Investment Management and the recently announced sale of the Radisson St Helen’s Hotel in Stillorgan. The Slieve Russell Hotel in Cavan will come to the market later this year.

- Dublin hotels are set to benefit from an increase in the number of world class entertainment events during 2024 with scheduled performances from Bruce Springsteen, Coldplay, Taylor Swift, and Pink, among others. These high calibre events are highly profitable for hotels and the wider hospitality sector. However, the increase in hospitality VAT and additional bedroom stock hitting the market could negatively impact on average room rate and occupancy statistics for some locations in the coming year. STR forecasts a slight RevPAR drop for Dublin (c-7%) in 2024.

More hotel openings; in Dublin Accor will open the doors to the Hoxton Hotel (129 bedrooms) on Georges Street and the Press Up group will open “The Leinster” (55 bedrooms), while in Cork Whitbread will open its first Premier Inn outside Dublin (187 rooms) and JMK is expected to open its Moxy and Residence Inn by Marriott development; in Curracloe, the Neville Group is set to open the 50 bedroom Ravenport hotel this Spring.

- The question remains about the slowdown in development because of escalating construction costs, but the level of enquiries reviewed at Bank of Ireland last year would indicate many intend to press ahead. Hotel room occupancy and rate trends are the biggest enabler for projects, and Dublin retained the top position when it comes to Occupancy in 2024 across all major European capitals (CBRE).

- The phased repayment of warehoused tax obligations will begin May 2024 and may add to the cash flow pressures of those who have yet to settle their obligations. A sizeable portion of businesses have already been in discussions with revenue.

Staffing

Prevailing unemployment levels in Ireland, and the focus on moving towards a “living wage” continue to encourage hoteliers to improve efficiencies in their operations, which is not easy to deliver without impacting on the customer experience. Staff turnover represents a big expense to the sector, and so staff retention should remain a top priority in the coming year. In recent times there has been a noticeable increase in properties offering staff accommodation, personal development plans and flexible employment contracts aimed at improving staff wellbeing. Auto-enrolment, which kicks in next year could further align employment in the sector with other industries.

ESG

Bank of Ireland is a founding signatory of the UN Principles of Responsible Banking initiative on financial health and inclusion, and we are committed to support our customers and communities as they embark on their journeys for a more sustainable future.

As of today, we offer a wide range of products like the Growth & Sustainability Loan Scheme in conjunction with the Strategic Banking Corporation of Ireland (SBCI) as well as incentives from Sustainability linked targets in offer letters where we reward customers who deliver on their ESG ambitions to tailored supports and solutions for specific proposals. There is no one size fits all as everyone’s journey is completely different, and we understand that. There is limited pricing flexibility with interest rates at the moment, but we look at all options to ensure sustainability ambitions are rewarded with an adequate pricing model.

- The Sectors Team is a differentiator for Bank of Ireland, in that the sector heads are recruited directly from industry and bring perspective that only first-hand experience can provide. To learn more about Bank of Ireland’s sectoral expertise, click here