It is a time of optimism and investment for Irish healthcare, says Bank of Ireland’s head of Health Sector Grainne Henson.

In recent years, headwinds associated with COVID-19, Brexit and the Ukrainian invasion have heavily impacted the healthcare sector. In the face of these headwinds, private operators continue to face challenges in the delivery of services within Ireland.

That said, the sector remains resilient and H1 has been a time of optimism and investment for many. Whilst some operators continue to experience static revenue returns, the 2023 health service budget allocation of €23.4 bn provides opportunities for community pharmacy, private nursing home and primary care centre businesses.

“The sector has proven itself to be extremely resilient in the face of multiple and compounded international crises and is emerging with optimism which looks set to continue”

The healthcare landscape is changing as players embrace commitments to ESG principles. Operators are investing in modernising existing building stock, bringing in energy efficient initiatives, which carry associated financial savings in the medium to long term. New buildings are adhering to the mandatory Energy Performance of Buildings Directive (EPBD).

Environmental factors are now central to strategy and planning decisions. As the sector aims for a decarbonised nearly zero energy buildings (NZEB) stock by 2050, greenfield developments are incorporating such things as bicycle parking and Electric Vehicle charging points as standard. Data released from the CSO for H1 noted that nursing homes were the second most energy efficient buildings with 12% rated BER rated A.

Sector Activity Insights H1 2023

Funding Activity: H1 credit applications reflect a busy period for the sector. These included going concern pharmacy purchases, consolidation through acquisition of further pharmacies, nursing homes extensions, capital expenditure to meet HIQA premises compliance and refinancing, as well as further working capital requests. A focus on the green agenda is also noted with credit approvals for investment in energy efficient technologies.

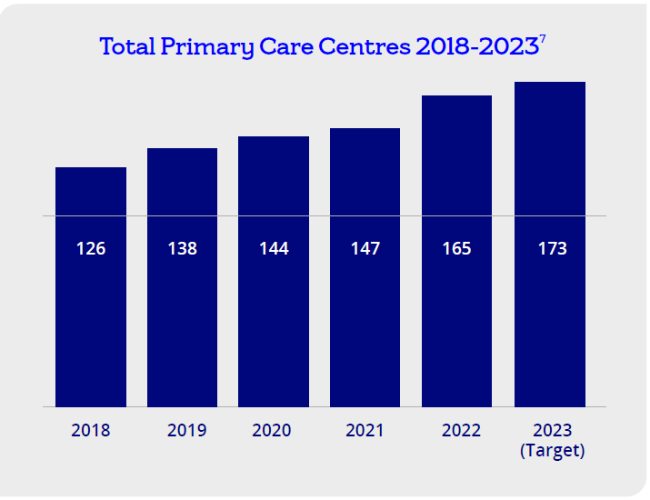

Primary Care Centres: A recently published HSE 2023 Service Plan emphasises ‘enhanced community care’ with the Primary Care Centre (PCC) model central to prioritising early interventions and person-centred community/home-based services. The Primary Care budget was increased by €414m (+8.1%) to €1.247b reflecting this aim.

Although some of the PCC developments have been led by the HSE, the capital development has largely been made possible by the private sector through lease agreements with developers or GPs and through Public Private Partnerships. A requirement to double current capacity presents strong investment opportunities and, with the HSE as tenant, it brings secure long term income streams for private businesses.

Nationwide there have been c.350 locations identified for PCC facilities, with 167 centres currently operating and there are a further six expected to be completed by the end of 2023. Capital funding of €34.15m has been allocated to Primary Care for new developments. Projects expected to complete in 2023 include one each in Monaghan, Meath, Louth, Galway, Tipperary and a two further in Dublin.

We note that that the pace of progression has slowed, due to construction inflation and developers are requesting rental increases to offset these costs.

Nursing Homes: Despite solid demand and insufficient supply, the sector has been challenged by rising operational costs, a fraught labour market and a higher dependency profile.

H1 has seen welcome increases in Fair Deal Rates (FDR), with a national average increase of 4.69%, to €1,109 per week (range €935 p.w. in Limerick to €1,380 p.w. in Dublin). However, it is argued that the FDR rate increases are not aligned with increasing operational costs and, according to a recent PwC report, commissioned by Nursing Homes Ireland, cost for care per resident has increased by 36% since 2017 while there have only been marginal increases to the FDR in this period. One large group operator has threatened to leave the scheme entirely, citing this mismatch as the reason.

Government financial supports in place since 2020 are currently being withdrawn.

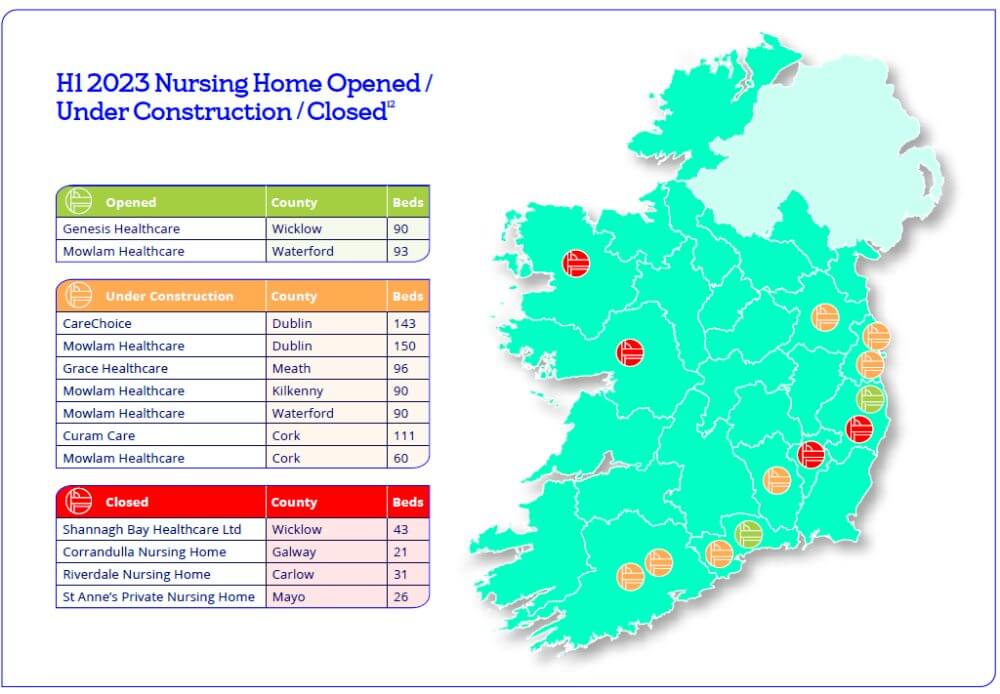

There are numerous projects underway with two new nursing homes opening in H1: Carnew Nursing Home, operated by Genesis Healthcare, with 90 beds opened in Wicklow, and Tramore Nursing Home, part of the Mowlam Group, with 93 beds, opened in Waterford. There are seven green site developments under construction scheduled to open in Q3 and Q4.

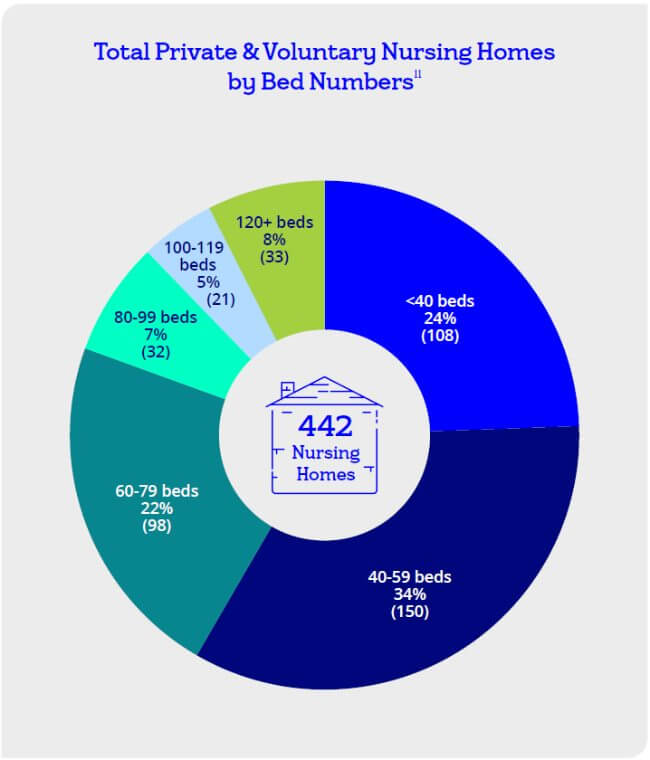

Four smaller independent nursing homes closed in H1 with the loss of 121 beds (range 21- 43; ave=30 beds). Three further homes, in Dublin, Kildare and Louth, have notified HIQA of their intention to close. Nearly a quarter of current nursing home stock (N=108) have less than 40 beds.

With data showing the requirement for an additional c.13k beds by 2031, analysis of the updated 2022 Census figures by CBRE show that Galway, Leitrim, Laois, South Dublin, Sligo, Dublin & Donegal have below the average number of required nursing home bed numbers per older population. The current new builds due to come on stream in Laois, South Dublin & Sligo will go some way to meeting the county demand.

With an overburdened HSE, and in a continuing bid to alleviate pressure on the acute hospitals, the government has relied on private nursing home operators both for traditional elderly nursing home care and for contracted egress/transitional beds which carry enhanced weekly rates. Up to now these contracts have been piecemeal, but the HSE is currently looking to formalise the process and invite tenders from nursing home operators.

Workforce challenges: The current unemployment rate of 3.8% puts pressure on the labour market and increases average wage expenditure. With 86% of healthcare companies now reportedly ‘struggling to attract talent’, the sector faces significant workforce challenges with a reliance on agency and overseas recruitment. It is reported that that only 30% of new nurse registrants in 2021-2022 qualified in Ireland, with over 60% qualified from outside of the EU. The three main countries for non-EU registrants were India (2,364), Philippines (391) and the United Kingdom (250). Ireland is also seeing a significant cohort of nurses choosing to move abroad, predominantly to Canada and Australia. Recruitment from overseas is costly and often necessitates accommodation being provided by the employer. Nursing home operators are increasingly looking to purchase property or modular housing, often becoming ‘reluctant landlords’. Particularly in rural locations, many operators are also having to provide staff transport.

Senior living: Increased activity is being seen in the development of senior living units, for example the recent completion of 12 Independent Living Units at The Grove, Marymount Care Centre, in Dublin. This model provides ‘front door access’ whilst also being connected to the existing nursing home, incorporating advanced and integrated technology to support care, and combining enhanced levels of automation, environmental control, and communication functionality. There are several similar developments underway, reflecting the need for a wider range of nursing home alternatives, and a desire to care for our elderly population in modern and less institutionalised ways. Currently, there is no government subvention to incentivise developments.

Pharmacy: With an estimated 430,000 additional people now eligible for free GP care and a government strategy to increase free access to contraception, the demand on community pharmacy services looks set to continue. The sector has experienced a year-on-year rise in dispensing volumes, though no increase in fee income from government schemes. Increased operational costs, particularly those relating to staff (due to a shortage of pharmacists) and increased rental costs have resulted in trading conditions which have been challenging for many within the sector.

A recent report from the Irish Pharmacy Union (IPU) indicates that the average total revenue of community pharmacies in Ireland has increased since 2017 but remains 24.12% lower than in 2009, with core income from community drug schemes reduced by 29% (from €1,277,120 in 2009 to €906,651 in 2022).

Covid-19 vaccinations generated a little under €26m in revenue in 2022, which partly offset the decrease in community drug scheme payments, but income from vaccines is now reduced from the 2022 levels. During the same period, pharmacy wages and salaries have continued to rise and, with many operators agreeing to new pay rates in January, employment costs will likely continue to rise throughout the rest of 2023. The IPU are currently campaigning for an increase to the dispensing fee paid to Pharmacists and linking it to public sector pay.

Minor Ailment Scheme: To expand the role of community pharmacists the Department of Health is actively pursuing the introduction of a Minor Ailment Scheme (MAS). This scheme would allow individuals with medical cards to visit their local pharmacist for assessment and treatment of specific ailments, rather than having to initially go to their GP to obtain a prescription. The main objective of this scheme is to eliminate barriers to access and increase capacity in the healthcare service.

The implementation of the MAS is expected to have a comparable cost to the current expenditure for those conditions covered under the General Medical Services (GMS) scheme. However, it is likely that the expenditure will include a combination of both transferred and new activity. In 2022, the expenditure under GMS for the conditions being considered for inclusion in the MAS was approximately €15.1 million.

Sector Outlook H2

Looking forward to the rest of this year and the beginning of 2024:

- The sector has proven itself to be extremely resilient in the face of multiple and compounded international crises and is emerging with optimism which looks set to continue.

- Successful providers will be those that are customer focused and choose to innovate and engage in technological solutions.

- Government bodies, regulators, investors, and healthcare users will have increased expectations for responsible business practices. An increased focus on ESG will become a fundamental part of all healthcare business strategies.

- Many health sector businesses, as price takers from the government, will continue to be challenged with static revenue compressing profit margins.

- Opportunities to collaborate and engage with the HSE will remain strong, particularly in providing services that meet Sláintecare objectives and align with the PCC model.

- Growth in development activity will continue to be limited by increased construction costs and higher interest rates.

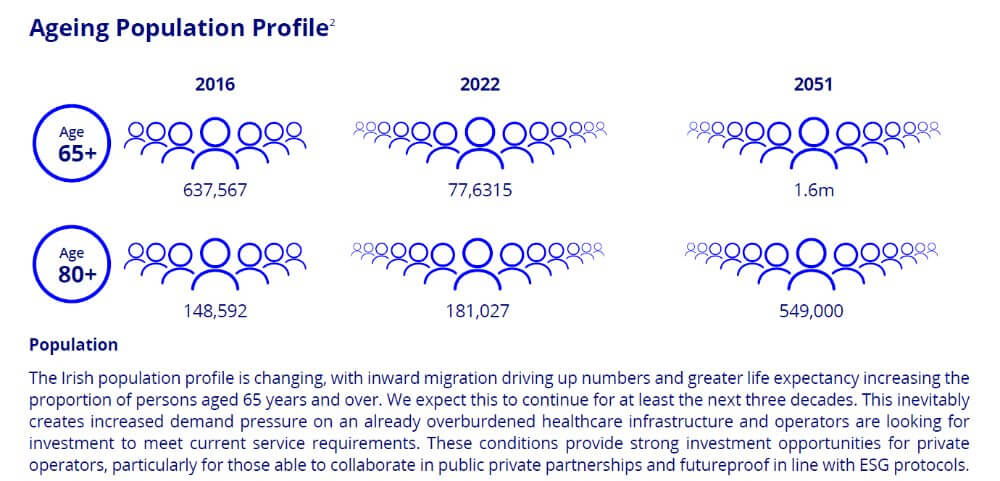

- An increasing and ageing demographic will ensure demand for healthcare services remains high.

Main image at top: Photo by JESHOOTS.COM on Unsplash